Get your FREE 30-day trial.

Please complete all fields.

The growth of digital has shaken up everything we thought we knew about retail. Giants have fallen. Major new players have emerged, seemingly from nowhere. Yet, despite the uncertainty, the retail industry is teeming with opportunity.

According to a recent report from Salesforce and Deloitte, brick-and-mortar sales are projected to grow by $36 billion through 2022, with ecommerce projected to grow by $50 billion in the same time frame. Consumers are ready to spend too; 44% say they spent more on retail in 2017 than the year before.

Brands should be ready to innovate internal operations and align around the customer to secure their piece of this growth. Fortunately, many successful brands are already doing just that. Keep reading for some of the top retail marketing insights from the report.

While some retail brands are struggling to find their way in this new growth landscape, others have hit their stride, harnessing new platforms, technologies, and data to transform the consumer experience.

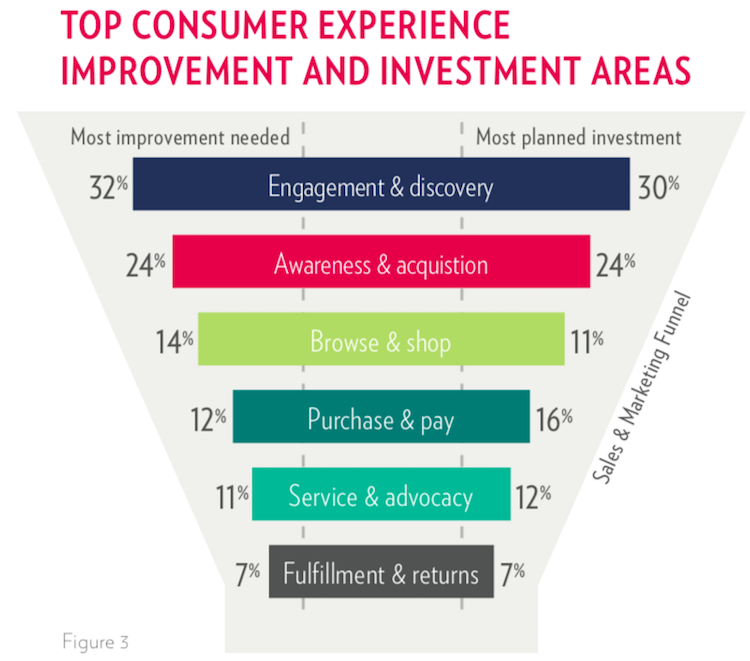

Where most brands face challenges is at the top of the consumer experience funnel—32% of brand leaders say their biggest consumer experience challenge is engagement and discovery. Awareness and acquisition is a close second for 24% of respondents.

This comes as no surprise when you consider that these same companies use an average of 39 different systems to manage consumer engagement. Consider how many different systems your company uses to track consumer interactions across mobile, social media, email marketing, content marketing, website, call center, point of sale, and so on, and you'll understand why this number is so high. But keep in mind that many brands are managing many more than that — 39 is just the average.

Inevitably, this excess of engagement tools leaves the consumer experience fragmented. Brands that can clarify who owns their consumer experience internally and can realign their teams, systems, and processes around the customer will be better prepared to eliminate dissonance and deliver seamless, meaningful experiences.

In fact, the vast majority of brands (99%) say they are doing just this by moving to unified customer engagement platforms that let them better align marketing, commerce, and service capabilities. Among elite performers (brands whose revenue has grown more than 10% in the past fiscal year), the move toward unifying is even more pronounced. Elite performers are 3.2x more likely to be investing in a single engagement platform.

Data is key to thriving in the retail renaissance. Whereas it’s always been important to collect data — whether from a first, second, or third-party sources, it’s just as important to be organized and prepared with a plan for how you’ll use it.

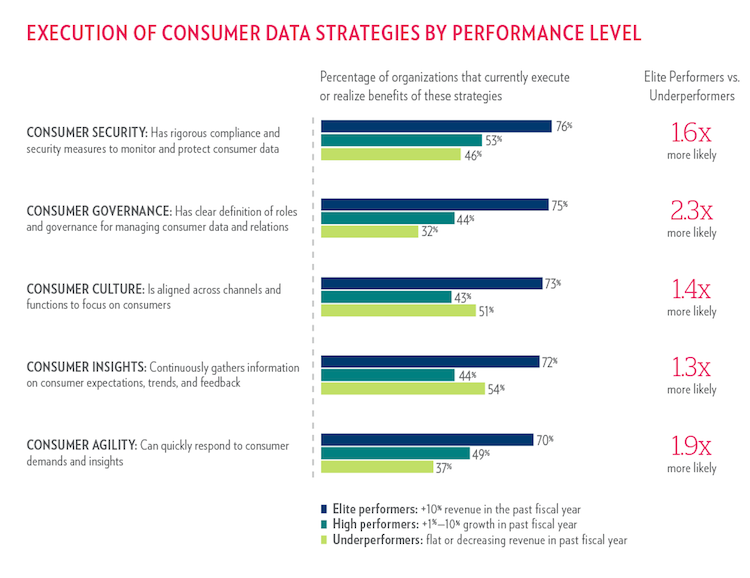

Seven out of 10 elite-performing brands are agile enough to quickly respond to consumer demands and insights due to a smart data strategy, versus only 37% of underperformers. This may have something to do with the fact that top performers are 2.3x more likely to have clearly defined roles for managing consumer data.

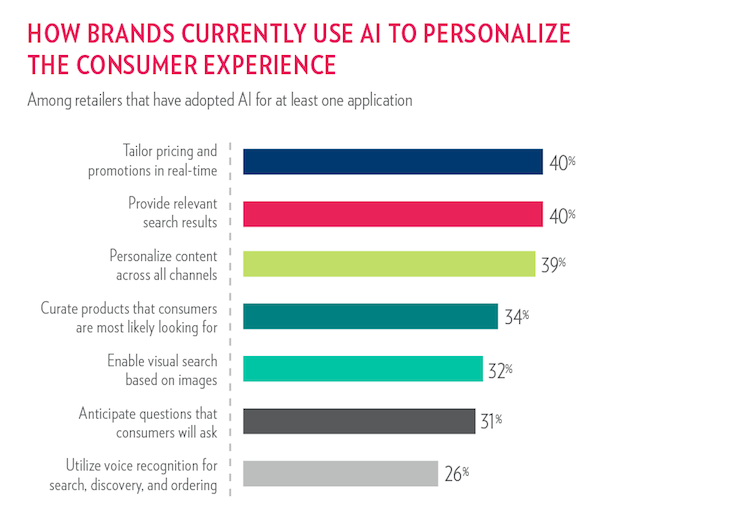

Clearly defined roles, governance, security protocols, and expectations will go a long way in helping brands organize around the consumer. AI can help brands make the consumer experience more seamless and meaningful. It is the key to linking product, customer, and transactional data to give marketers and all B2C leaders a clear picture of the customer, allowing for smarter pricing and promotions, personalized content, relevant search results and recommendations, and so much more.

Despite AI’s massive potential for businesses, adoption rates are still waiting to take off. On average, only 30% of brands surveyed are using AI for any particular use case, such as personalized content or voice recognition. In a sign of what's to come, major retail brands report that over the next several years they plan to grow their in-house data scientist ranks—these are the very professionals who create and manage AI technology—by 50%.

Elite performers have shown that the retail industry is moving toward more unified business structures that allow B2C leaders to organize around consumer needs — and now, the possibilities are real for data and AI to help make it happen.

Read the full report from Salesforce and Deloitte for more data and insights about what the renaissance means for your customers.