Get your FREE 30-day trial.

Please complete all fields.

For marketers, the best part of the Super Bowl isn’t just watching the commercials — it’s watching how consumers interact with the commercials … and the game.

Since Super Bowl XLIX, we’ve seen smartphones continue to supplant computers, the continued rise of the second screen, and Snapchat’s evolution into a more serious social player. For Super Bowl 50, we expect smartphones and social will play an even bigger role in the game day experience than in the past.

To learn how Super Bowl 50 viewers plan to use their devices and social media during the game, Salesforce Research surveyed 1,082 consumers. Here’s what we discovered.

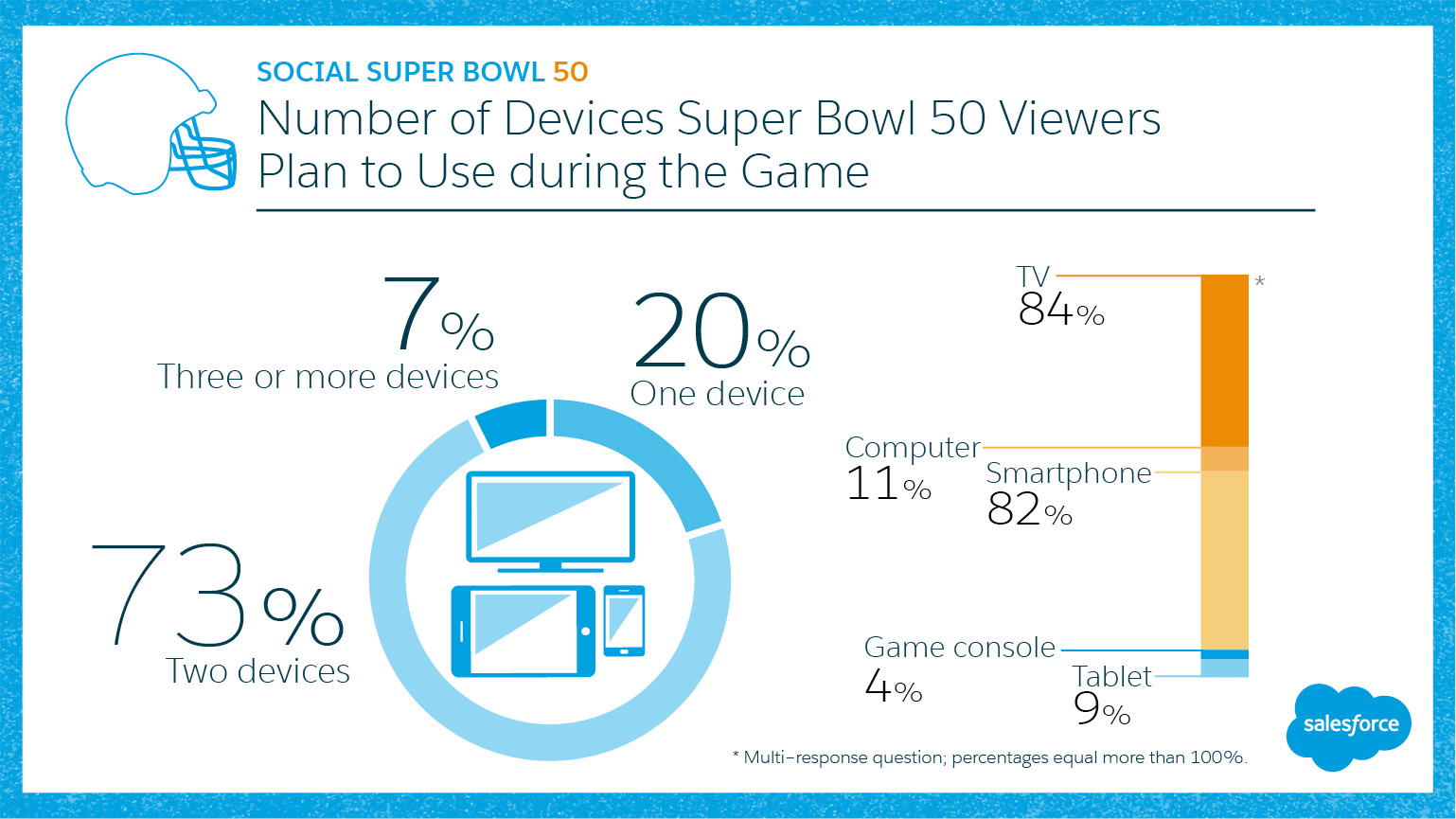

Seventy-three percent of Super Bowl 50 viewers plan to use at least two devices during the game — including televisions, smartphones, tablets, game consoles, and computers.

Equally interesting: smartphones will be almost as ubiquitous as TVs during the game, with nearly as many viewers planning to use their smartphones (82%) as TVs (84%).

This is good news for marketers whose budgets aren’t super-sized because they can still make an impact on almost as many consumers without spending millions of dollars on a TV advertisement.

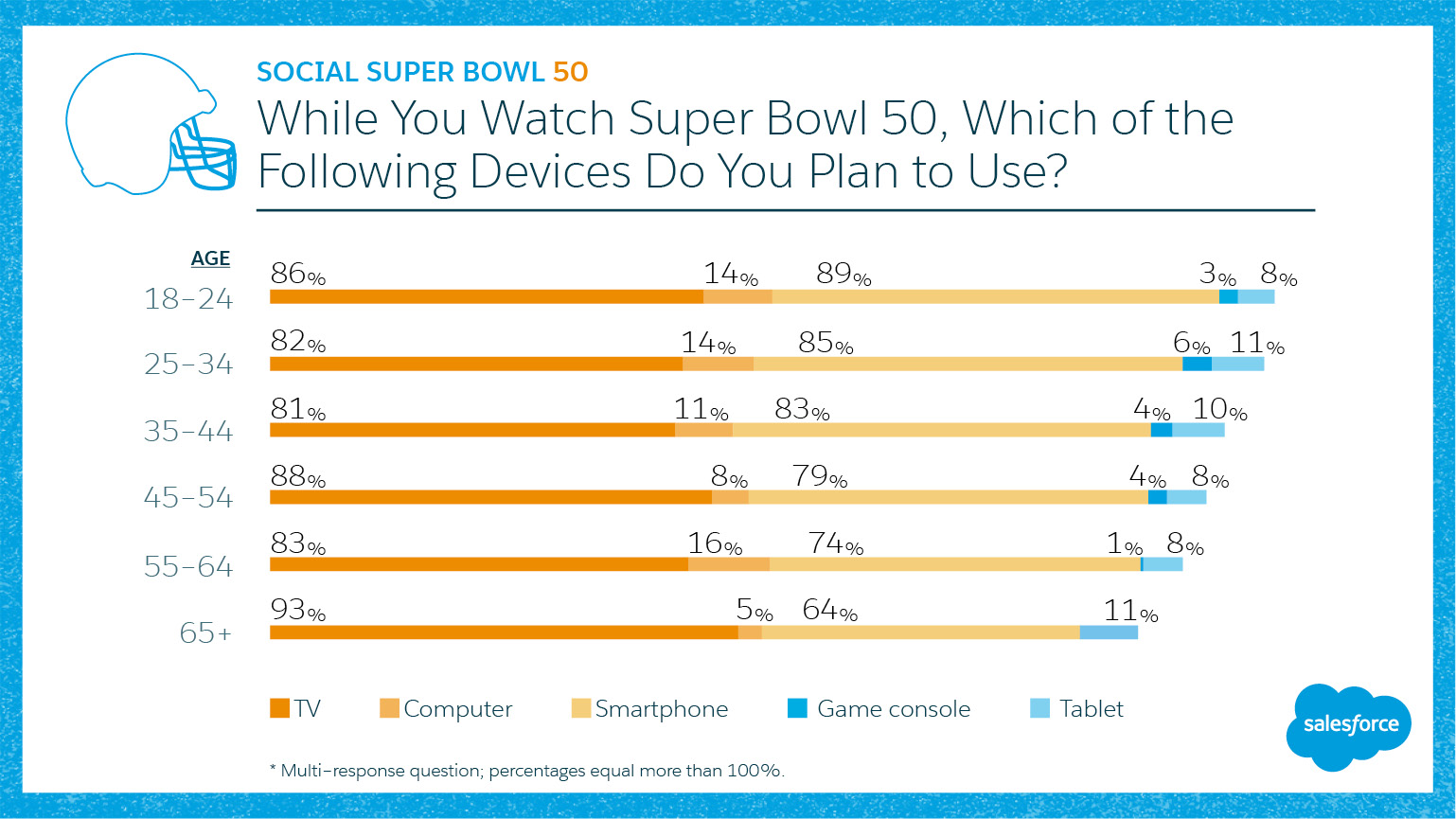

Super Bowl 50 viewers aged 18-44 are more likely to use their smartphones than a TV during the game. In fact, according to our research, the younger the viewer, the more present the smartphone, with 89% of viewers aged 18-24 planning to use a smartphone during the game, compared to 86% who will use a TV. That means there’s 3% of younger viewers who plan to enjoy the Super Bowl without a TV.

If they’re not using a TV, how are they watching the game? They’ll be streaming it directly onto their smartphones, tablets, or even computers, though at a much lesser rate (only 14% of viewers aged 18-34 plan to use a computer during the game). CBS is offering plenty of ways to stream the game beyond TV this year.

As consumers cut the cord and become more accustomed to streaming content on their computers, smartphones, and tablets, it’s a gut-check for marketers to make their events and conferences available via live-streaming options, as well.

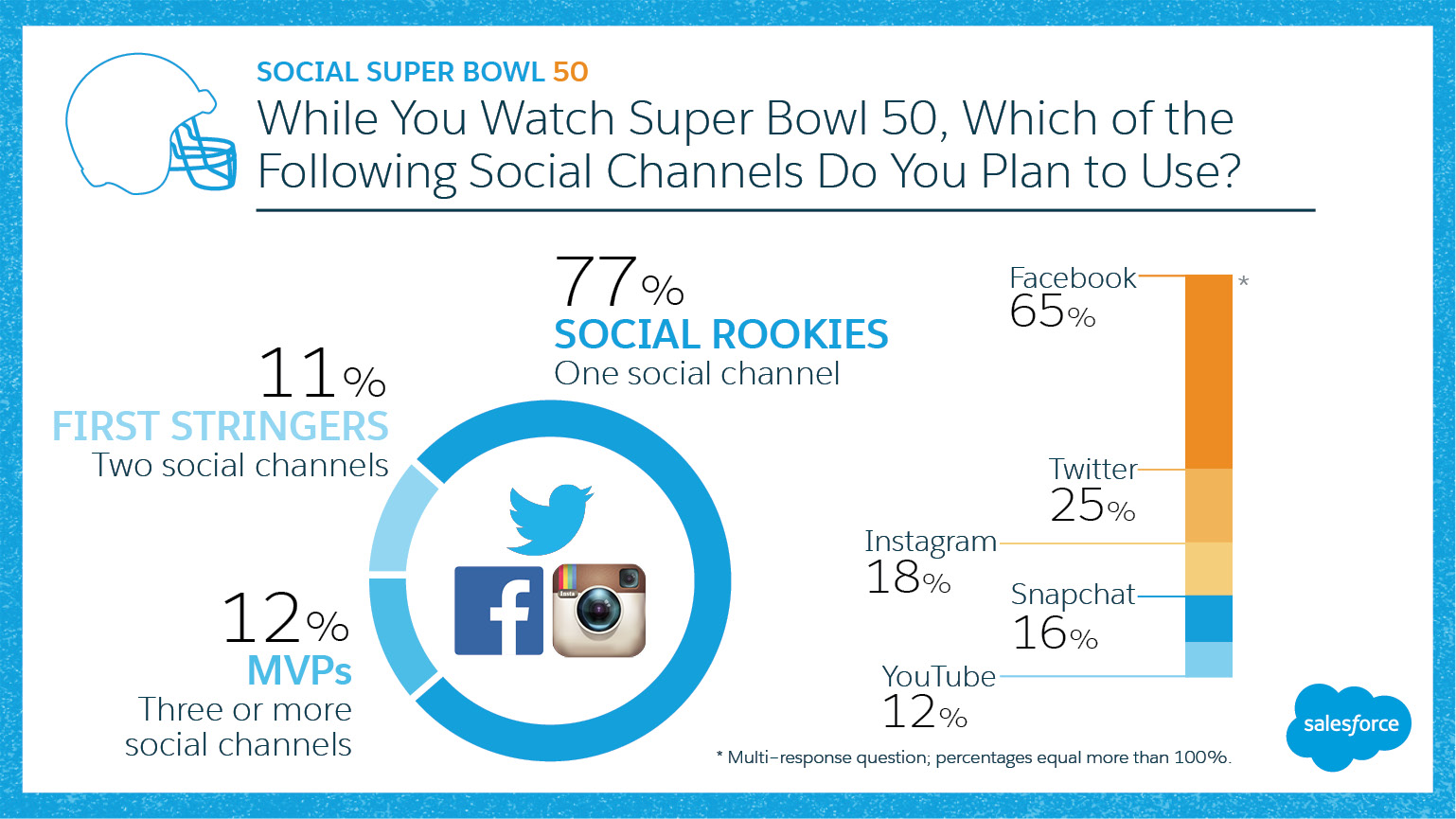

Most consumers surveyed plan to use two social media channels to stay up to date with the Super Bowl or interact with other viewers; however, the channel they’ll use varies widely based on age and gender.

Of those who plan to use only one social channel, nearly half will use Facebook (48%), a decline from last year when 66% of viewers surveyed said they’d use Facebook. After Facebook comes Twitter at 12% and YouTube at 8%.

When we dig deeper into the social media usage numbers by gender, we see a more complex story than simply Facebook wins again.

Female Super Bowl viewers are 1.3x more likely than male viewers to use Facebook while watching the game (72% vs. 58%, respectively). After Facebook, 29% of male viewers plan to use Twitter, while female viewers will split time between Twitter (21%), Instagram (20%), and Snapchat (17%).

The takeaway for marketers: Facebook is still on top, but the social landscape is growing more diverse. For male sports fans, Twitter is an important real-time sounding board. For female sports fans, newer channels like Instagram and Snapchat are right on Twitter’s heels.

Companies can no longer have a presence on Facebook and Twitter and call their social strategy complete as their audience may be fragmented across different channels at different times. Few brands can truly be everywhere on social — so they must be strategic about which channels they pick, based on where their audience spends the most time.

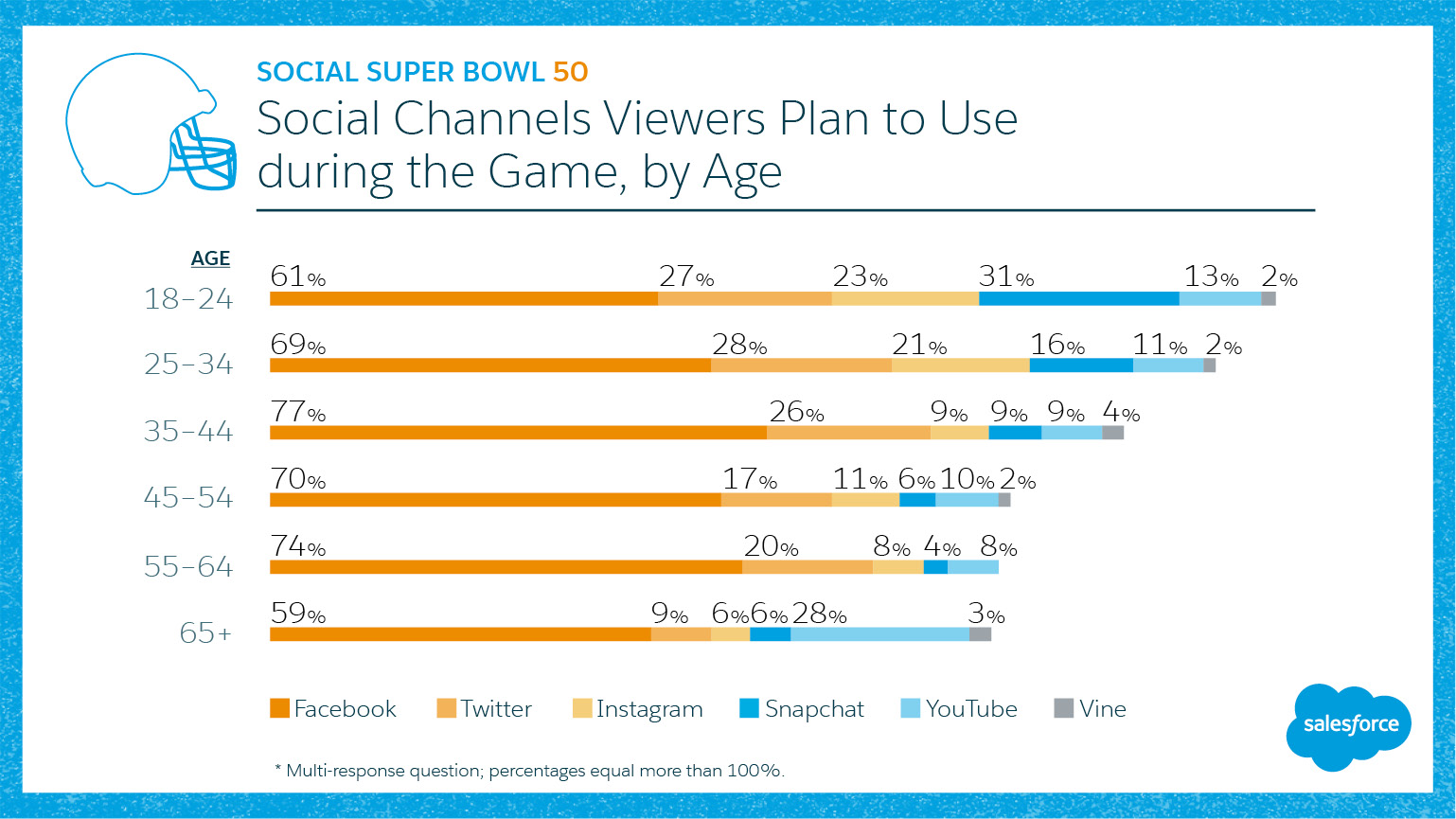

In 2015, with new ad offerings and more users than ever, Snapchat moved into social media’s center stage from the fringes. Our research shows that twice as many viewers aged 18-24 plan to use Snapchat during the Super Bowl compared to all other age groups. Snapchat is only second to Facebook among this age group, with 61% saying they’ll use Facebook during Super Bowl 50.

No surprise here: Instagram is also more popular among those aged 34 and younger with 21% of those 25-34 and 23% of those 18-24 saying they will use Instagram during the game, compared to just 9% of those 35-44 and 11% of those 45-54.

Just as marketers should pay close attention to target audience gender when devising a social strategy, they should also keep in mind that age plays a critical role, whether engaging with customers on social during the Super Bowl or the rest of the year.

No, I’m not advocating for every brand to create a Snapchat account on Feb. 7 because they hope some 18-24-year-olds will buy their product. But these numbers show the range of social behaviors by age — and also how much changes in social over the years. Five years ago, the only channels on this list would have been Facebook, Twitter, and YouTube. Next year, who knows what will be in a similar survey. For marketers who thrive on change, it’s all part of the fun.

We’ll be paying rapt attention to where Super Bowl fans share their favorite (and least favorite) ads, the most exciting touchdowns, and halftime show reactions on game night, as well as how digital streaming numbers compare to last year. We’re also be tracking social sentiment and engagement via our Big Game Social Tracker, which we’re updating in real-time. Access the tracker if you’d like to follow along.

Game-day results aside, brands that respond to consumers’ growing reliance on mobile devices and emerging social channels will win the biggest audience in the year ahead.