Get your FREE 30-day trial.

Please complete all fields.

Black Friday marks the official start of deep discounts and the holiday shopping period for U.S. consumers. A retail analyst predicted last week that “between Thanksgiving and Cyber Monday, $80 billion will be spent online as well as in stores”, and according to eMarketer, in 2014 Cyber Monday “was the biggest day in US online shopping history.” The holiday shopping period has been moving earlier and earlier as well, with some retailers opening their doors on Thanksgiving.

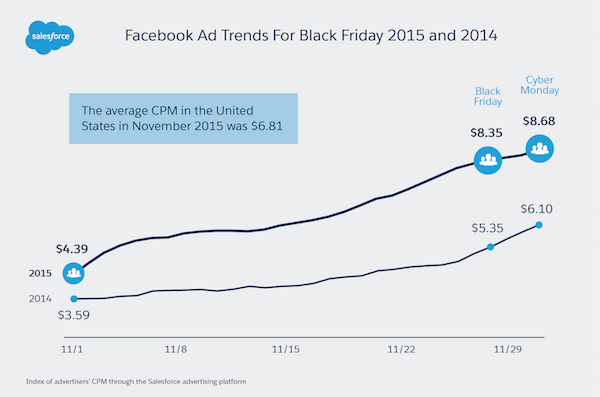

As part of a broader look at marketing for the holidays, we examined advertising trends for November. For advertisers looking to reach their audiences and market their products, holiday shopping historically results in increased media costs as more advertisers bid on a relatively fixed amount of inventory which is based on Facebook usage. Facebook in both 2014 and 2015 follows this trend, with U.S. media costs of an index of Social.com customers rising a full 98%, from $4.30 to $8.86 CPM, between the start of November and Cyber Monday. This sharp increase matches a similar 70% increase in 2014.

Advertisers are buying these ads because they work, and consumers are engaging. The average click through rate (CTR) was 1.20% for the month, as advertisers on Facebook had success targeting the right audiences using Facebook. Overall, for the month of November, we saw an overall CPM of Facebook advertisers targeting US consumers of $6.81.

As the holiday season gets into full swing, Facebook has historically had a large jump in advertising revenue. Last year, Facebook’s advertising revenue in the United States jumped from $1.51 billion in Q3 to $1.86 billion in Q4, an increase of 23%. This is common for digital advertising; in 2013, Facebook advertising rose 25% between Q3 and Q4. While Facebook doesn’t break out its monthly numbers, most of that increase probably came in the current holiday season, and we’ve seen a strong start to Q4 this year. Social.com looks forward to helping you with your holiday campaigns!

To see more benchmark data about Facebook advertising, check out our Q2 2015 Advertising Index report.