Get your FREE 30-day trial.

Please complete all fields.

What’s keeping retail leaders up at night? The growth, innovation, and ubiquity of online marketplaces might top that list. You could even say the retail industry is experiencing an outbreak of agoraphobia — or the fear of marketplaces.

This unique brand of agoraphobia isn’t without justification. On the positive side, the U.S. retail industry grew 5.7% year over year in the second quarter of 2018. Ecommerce especially showed strength across traffic and mobile orders, with the latter increasing 40% year over year. But when it comes to ecommerce growth, Amazon is expected to drive more than 80% of it.

Our new Shopper-First Retailing report reveals exactly why shoppers purchase from retailers vs. brands vs. marketplaces, including the specific instances in which they prefer each to do their shopping across these different channels. And you might be surprised to know that shoppers do see a distinction!

For an even deeper dive, be sure to check out this entertaining podcast from eMarketer, in which two experts discuss our Shopper-First findings and consumer behavior:

Shoppers see retail models differently

Over the past two decades, ecommerce has been responsible for the greatest amount of change within the retail industry. Need proof? Just walk around a mall, and you’ll find many stores look the same as they did in the 1980s. Meanwhile, consumers carry a supercomputer in their pockets, and digital innovation — from AI to social media — has transformed every aspect of online shopping.

The digital revolution in retail has led to the emergence of two new retail models: marketplaces and direct-to-consumer brands. As a result, the retail industry has quickly evolved into an increasingly competitive environment where brands, retailers, and marketplaces now all sell directly to consumers

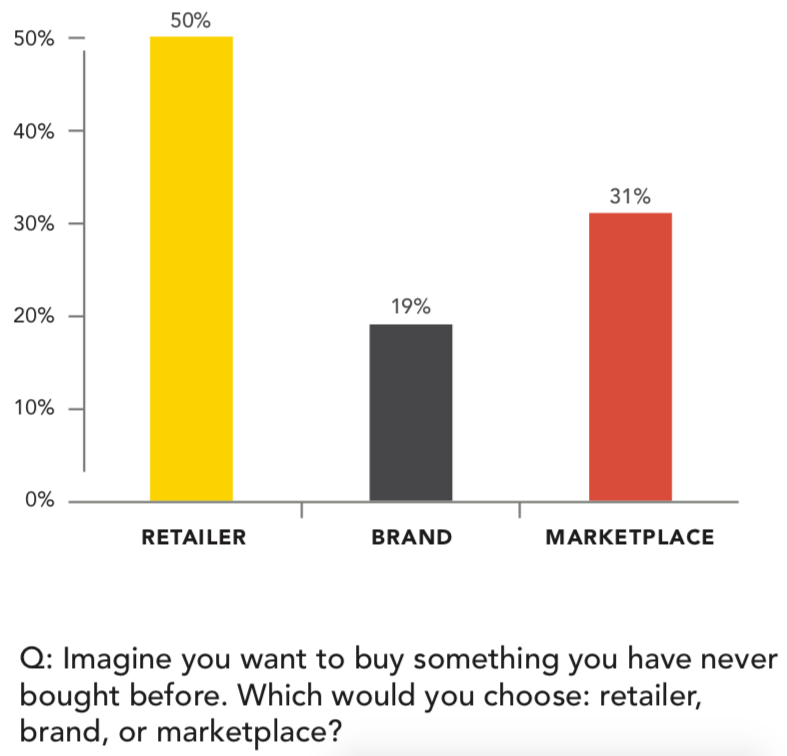

And even though each model is based on the premise of connecting shoppers with relevant products, our survey of 6,000 global consumers actually found that today’s shoppers choose to transact with each model for different reasons:

Shoppers choose to engage with brands directly to have direct access to unique, innovative, and quality products.

Shoppers choose to engage with marketplaces for the convenience, availability, variety, and even inspiration they bring to the overall shopping experience.

Traditional retailers only have a leg up when it comes to customer service.

Unfortunately, in order to stand out from the competition placed on them by brands and marketplaces, retailers have failed to emphasize and double down on their greatest differentiator: customer service. This has, in large part, contributed to the failure of many new retail ventures and a number of recent store closures. Think about the big-name retailers that you’ve seen close their doors in the past year. There’s a good chance “service” is not the first thing that comes to mind when you think about those retailers.

However, retailers synonymous with service — REI, Nordstrom, and Stitch Fix, to name a few — are maintaining their momentum and still enjoying a huge amount of success. They understand that service is their true one-to-one engagement opportunity. After all, the role of customer service is not simply to resolve issues, address complaints, and change orders. It’s also an opportunity to build lasting relationships with shoppers.

Service-driven experiences are critical for the survival of retailers, as retailers can no longer compete on the basis of product alone. This is further accentuated by the fact that marketplaces now offer a deep bench of convenient product options while brands offer the most unique and innovative products directly to consumers (think: limited-edition or customizable products from brands like Adidas, American Girl, and Stance).

The slipping second purchase

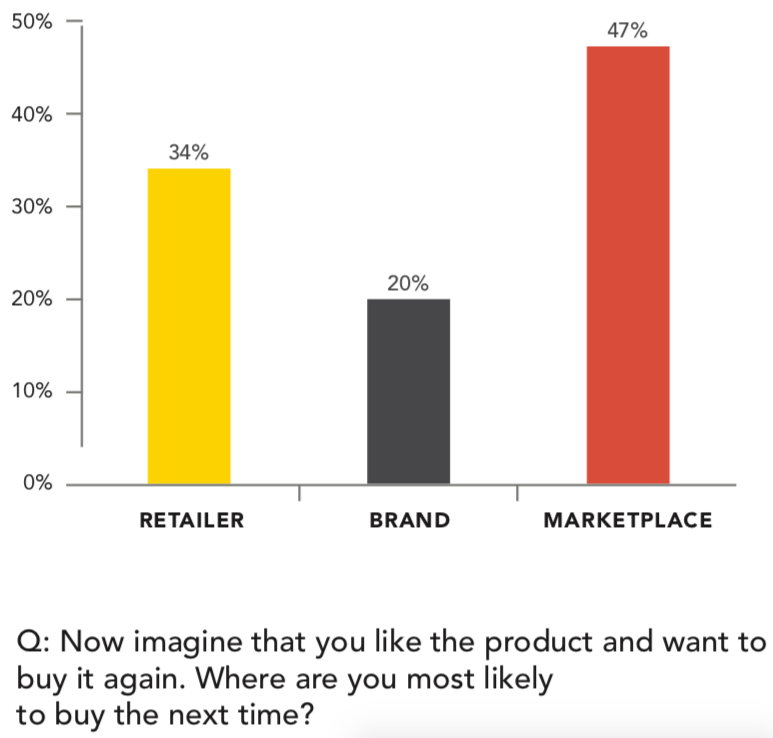

The challenge that both retailers and direct-to-consumer brands face is the slipping second purchase. Earning a shopper’s first purchase is one thing, but sustaining loyalty over the long-haul — starting with the second purchase — is the real challenge. While 69% of shoppers initially purchase directly from a retailer or brand, their second purchase is a different story. A surprising 47% of shoppers will go directly to a marketplace for their second purchase (vs. only 34% returning to a retailer).

The draw of both convenience and frictionless repeat purchasing from marketplaces is a massive obstacle for retailers and brands to overcome. The economic effects are serious — brands and retailers invest heavily in acquiring shoppers for that initial purchase, all in the hope that an initial purchase will lead to long-term customer loyalty. Unfortunately, the leaky bucket of repeat purchases pours out directly to marketplaces instead (and in growing numbers).

To reverse this trend, retailers and brands must act with urgency to further develop strategies that incorporate personalization, loyalty programs, and relevant brand messaging. Doing so will allow them to connect with customers at a deeper level and build the kind of loyalty that will ultimately lead to repeat on-domain or in-store purchases. Creating a more personal, service-oriented experience with customers is how brands and retailers can compete — and win — as marketplaces attempt to take a bigger chunk of both mind- and market-share.

The cure for "retail agoraphobia"

The cure for retail agoraphobia is out there. That is, if retailers and brands actually listen and respond to customer wants and needs. By analyzing the shopping activity of 500 million shoppers, engagement across 200 million service cases, the results of a survey administered to 6,000 global consumers, and a mystery shopping expedition among 70 different retail flagship stores, our researchers believe there’s still hope for both retailers and brands looking to win in today’s increasingly crowded online retail environment.

As a starting point, both retailers and brands should double down on these three shopper-first mandates as a blueprint for retail success:

Make It Fresh: Shoppers reward brands that connect them with unique products and experiences.

Be Where I Am: Shoppers reward brands that anticipate needs and can identify the moments when a need exists or when interest is piqued along the shopping journey.

Give It Meaning: Shoppers reward brands that go beyond the transaction and seek to create lasting relationships.

Be sure to download the Shopper-First Retailing report to learn more about these three shopper-first mandates and to get other useful tips around how brands and retailers can succeed like never before — even with the threat of marketplaces looming over them.