Get your FREE 30-day trial.

Please complete all fields.

Over the past two years, we’ve examined the shopping activity of hundreds of millions of global shoppers to identify trends and the pace of change in digital commerce.

Some trends have been crystal clear, like mobile’s march towards device dominance, and free shipping’s hold on digital shopping. We’ve also witnessed how shifting metrics have altered digital analytics; as mobile and cross- device shopping are pulling overall conversion rates down. An interesting side note – comparing Q2 year-over-year, conversion rate rose on each major device: computers, tablets and phones, but actually fell overall. #datadrop

But the most interesting perspective that the data provides, this ‘wisdom of the cloud,’ is centered on the shopper. This quarter, we wanted to learn more about the shoppers’ intention to buy. While conversion has been the value we in the digital commerce business have lived by since the inception of ecommerce, the ‘three percent’ of visitors who actually buy tell only part of the story. If we can better understand shopping intent, we can adjust and evolve the way we engage with consumers to increase the likelihood of a purchase.

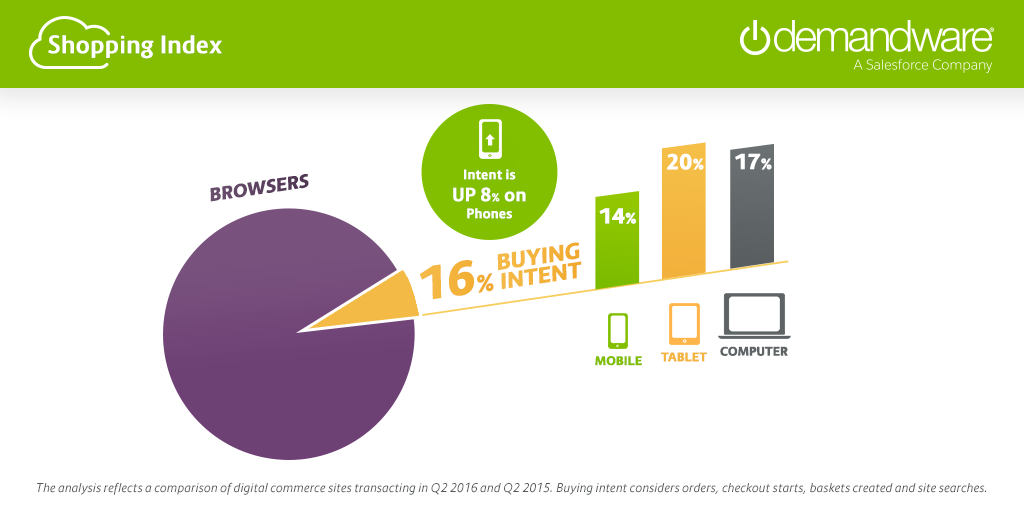

There are so many good and productive signals a shopper sends in digital, it cheapens the impact of digital when we focus only on the shoppers who placed an order in that particular session. So, we created a new metric – Buying Intent – that measures the clear and positive shopping signals that shoppers send in digital. We found that 16 percent of shoppers demonstrate buying intent, by either searching, starting a cart, beginning a checkout or placing an order. The value is lower on mobile, at 14 percent, but is up eight percent compared with the same quarter last year. Overall, buying intent is slightly up compared with last year.¹ To see how Buying Intent differs across countries, visit the Shopping Index.

Buying Intent is a very interesting metric to watch and, like similar metrics, the change and pace of that change is most interesting. We’ll report back on Buying Intent in subsequent quarters. Alongside Buying Intent, we measure the overall growth of digital with the Shopping Index, and we continue to see that shopping attraction – the change in number of digital shopping visits – remains the key ingredient in digital’s growth.

I hope you enjoy this latest edition of the Shopping Index, and if you are looking for a deeper dive into all things mobile, read the Mobile Shopping Focus.

¹ Buying Intent is measured per device, not across devices, and looks at the shopper’s activity over the full calendar quarter, not just a session.

The Shopping Index measures digital commerce growth and is based on an analysis of the shopping activity of over 400 million shoppers worldwide. The Shopping Index is not indicative of the operational performance of Demandware, a Salesforce company, or its reported financial metrics including GMV growth and comparable customer GMV growth.