Get your FREE 30-day trial.

Please complete all fields.

In Q1 2013, there were 374M mobile daily active users (DAU) on Facebook. By Q3 2014, there were 703M, an increase of 65%. Mobile monthly active users (MAU) increased by 50% in the same time.

In Q1 2013, there were 374M mobile daily active users (DAU) on Facebook. By Q3 2014, there were 703M, an increase of 65%. Mobile monthly active users (MAU) increased by 50% in the same time.

These mobile growth numbers far outpace the overall growth rate for Facebook, and the percentage of total daily active users who are on mobile has risen from 64% to 81%. Since Q3 2013, the number of mobile only monthly active users – people who don’t use Facebook on a desktop or laptop at all – has risen from 254M to 456M.

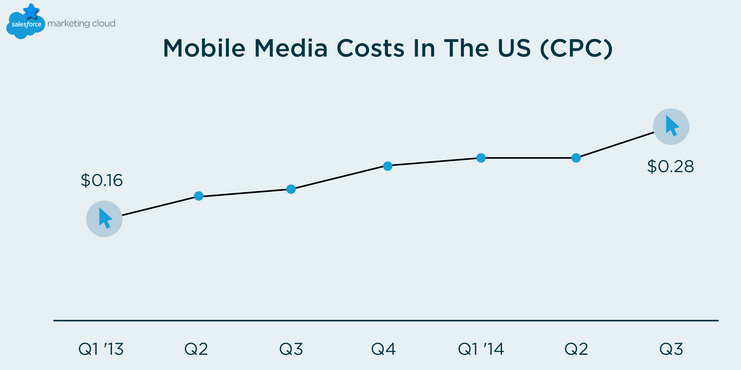

In the United States, CPC costs for mobile ads have risen each of the last seven quarters, totaling an 80% increase to $0.28.

Social.com has seen even faster growth in mobile ad spend than Facebook’s mobile user growth. Our customers have increased their overall mobile ad spend by 239% when comparing the nine month period from January 2013 to September 2013 versus January 2014 to September 2014.

The increase in demand for mobile advertising inventory has seen advertisers pay an increasing premium for their ads overall, both in CPC and CPM terms. Advertisers are increasingly looking at the premium range of targeting and creative options on Facebook to successfully optimize their media spend.

In the United States, CPC costs for mobile ads have risen each of the last seven quarters, rising a total of 80% to $0.28. CPM costs have risen as well, however the CPM growth rate peaked in Q1 2014, and have somewhat stabilized in Q2 and Q3, at $4.50.

Savvy advertisers in 2015 are refining their mobile strategies to take advantage of all of the robust targeting options Facebook has to offer and expand their reach to include both the Facebook mobile newsfeed as well as the Facebook Audience Network to reach their customers where they are spending their time.

We look forward to an exciting year ahead for advertisers in 2015 and look forward to bringing you more insights from the social advertising world throughout the year including a detailed look back at the all important Q4 in advertising.