Get your FREE 30-day trial.

Please complete all fields.

In 2016, Salesforce produced our first report dedicated to mobile commerce, the Mobile Shopping Focus Report, which analyzed the shopping activity of over 400 million global shoppers. In it, we noted that some brands were already adopting a mobile-first strategy to ecommerce, and we predicted that, “We are now on the path to mobile-only.”

Has that come to pass? Not exactly. As we turned the corner into 2018, our quarterly Shopping Index shows that mobile phones, while closing the gap with computers, still trail computers in share of ecommerce orders; in Q1, phones accounted for 41% of orders while computers led with 49%.

So we asked ourselves, how is a device that is so omnipresent in our everyday lives not resulting in an even higher level of actual online sales? To understand it, we knew we had to go back to the data. But this time we had to look through a new lens. We needed to understand what is unique about mobile shopping experiences. The result is the 2018 Mobile Shopping Focus Report.

In it, we interview mobile experts, compiled all our empirical mobile commerce data, and spoke to brands to understand what it means to be a leader in mobile commerce. What are mobile leaders doing, exactly, that makes them leaders? What can all retailers learn from their example? Check out a sneak peek of some of the report highlights below.

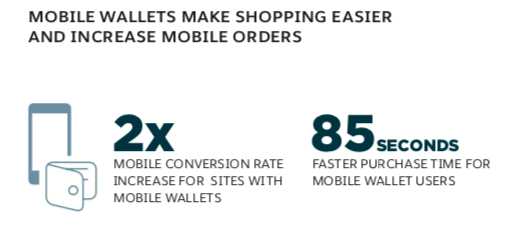

Mobile wallets result in more orders

The average mobile buyer must tap their way through three checkout pages before finally reaching the order confirmation page. Embedded within those pages are dozens of form fields where mobile shoppers must painstakingly tap in their order details on tiny keyboards.

The reality of the current mobile buying experience is that it doesn’t align with the way that modern consumers want to shop. That is, a journey made up of micro-moments that they nonetheless expect to be fast and convenient. A big part of that convenience and speed is offering choices in payment, including and especially, mobile wallets.

When we look at retailers that have embraced mobile wallets, the results are clear: Mobile wallet shoppers spend about 90 fewer seconds on site than their conventional payment peers, yet convert at a rate twice high as shoppers who were offered only traditional payment methods.

Personalized product recommendations drive one-third of mobile revenue

There is a lot of buzz in the industry on the power of AI and its impact on retail. And for good reason. AI-powered product recommendations drive 26% of all digital revenue. But these powerful tools are massively underutilized; only 7% of shopping sessions click or tap on a product recommendation.

Personalization is having an incredible impact on mobile sessions too. In fact, in the mobile context, AI-powered product recommendations are driving almost a third (29%) of all mobile revenue, yet, only 5% of mobile shoppers currently use this incredibly powerful tool.

The message for brands? Implement AI-powered product recommendations, and position them prominently on the product detail page so shoppers are compelled to click.

Placement of product recommendations has huge impact

When we analyzed top performing mobile sites, we found one thing they had in common was placement of product recommendations on the product detail page (PDP).

As it turns out, the sweet spot for recommendations on the PDP is between the product details and the reviews. Retailers that place their AI-powered recommendations here enjoy a 14% increase in conversion rate and a 25% higher add-to-cart rate than recommendations placed elsewhere on the page

The data is clear — mobile is the most important device for retailers today. However, developing a data-driven mobile strategy can be difficult. Luckily, we’ve taken the guesswork out of it. Download the report for in-depth analysis, including customer stories from leaders in mobile commerce, Johnston & Murphy, Lancome, PUMA, and Rack Room Shoes.