Get your FREE 30-day trial.

Please complete all fields.

The concept of ‘consumer experience’ has been such a hot topic of conversation for so long, you’d think that every brand is prioritizing customer-centricity and succeeding by delivering superior experiences.

But you’d be wrong.

In today’s shopping climate, retailers and brand leaders seem to understand that putting customers first is the only way to thrive — but they don’t always act like it. In a new research report, Consumer Experience in the Retail Renaissance, we surveyed more than 550 traditional retail, pure play, consumer goods, and branded manufacturing leaders about their approach to consumer experience.

Our report found that most brand leaders pay lip service to consumer experience, but not due attention. Download the full report for more details and data.

These findings may be a bit surprising given the near complete power shift from brands to consumers. A few proof points:

Brands are Overly Focused on Product – Not Focused Enough on Customers

Consumers enjoy unlimited shopping options, and with every purchase, they choose how, where and when they buy. This hypercompetitive environment means that brands must be laser-focused on the value proposition that matters most to their customers.

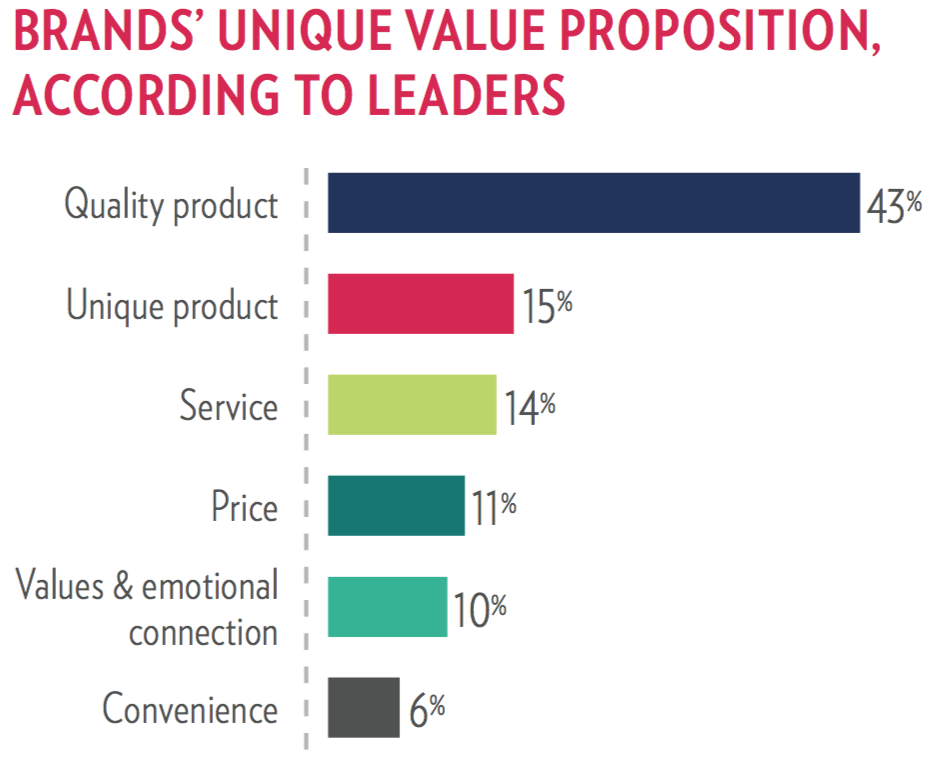

Yet in our survey, nearly 60% of brand leaders said their company’s unique value proposition is product quality or uniqueness — compared to 11% for price and 6% for convenience, as shown in the chart below.

Looking at these numbers, it strikes me that many brands are stuck on product differentiation as the thing that will set them apart from their competitors and drive customer engagement and loyalty. Don’t get me wrong. Product is key, especially for luxury goods, but for those brands feeling competitive pressure from online marketplaces, product commoditization, and new business models, it’s time to add service and convenience to differentiate on experience.

Interestingly, only 10% of surveyed brand leaders rated values and emotional connection as their unique value proposition. Brands may be missing this key opportunity to not only attract consumers, but sustain shopper satisfaction, loyalty, and advocacy. For example, consider the way that Tory Burch, KidBox, and Life is Good do well and do good.

The Consumer Experience is Disconnected

Global brands are attempting to get back to the basics and put consumers in the center of their business strategies. If you attend any industry conference, you’re sure to hear plenty of this customer-centricity chatter. But look under the hood of most organizations and you’ll discover that the reality is far different:

Despite the holy grail status placed on consumer experience, it’s often over promised and under delivered. And it’s especially disconnected at the top of the funnel: brands rated the biggest challenge as engagement and discovery (32%), followed by awareness and acquisition (24%). These two top-of-funnel areas collectively represent more than half of the areas that need the most improvement.

As brands look to attract and retain customers amid a hotbed of competition, the top of the funnel is a painful place to struggle.

Brand Leaders Don’t Agree on Consumer Experience Ownership

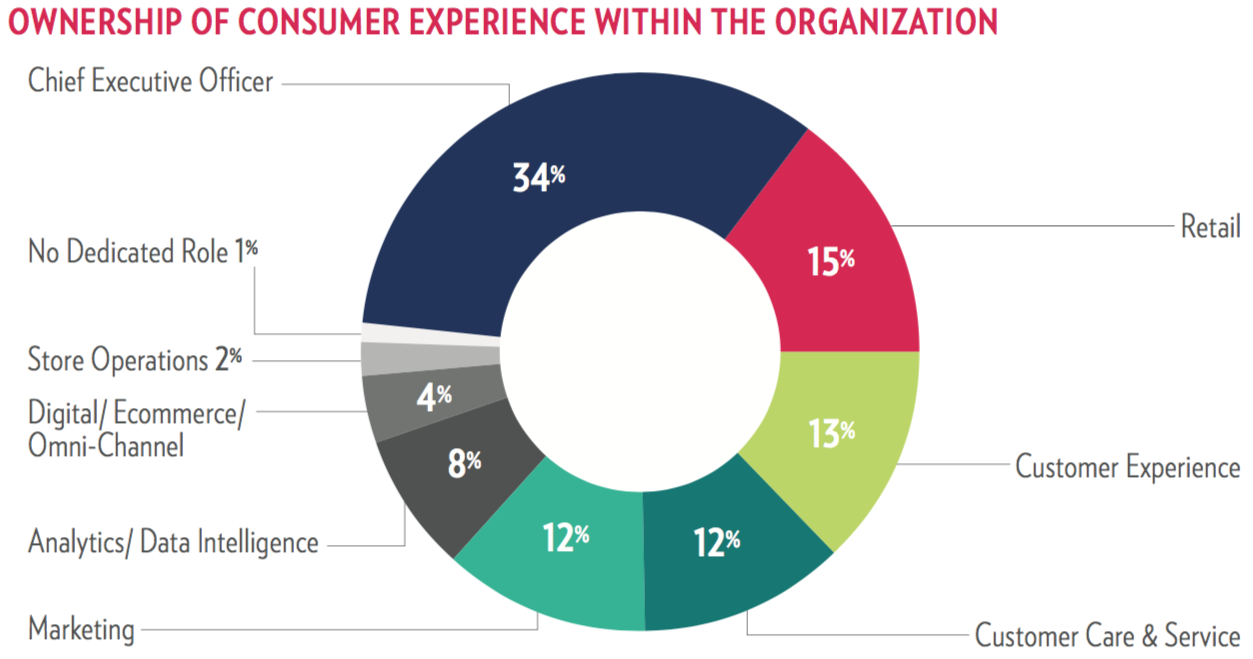

Despite the need for improvement, brand leaders don’t have a common blueprint on who owns the consumer experience. In our survey, no single role or department emerged that owns this strategy and execution. Results ranged from 34% for the CEO to 12% for customer care and service to 8% for analytics/data intelligence.

Perhaps unsurprisingly, results change significantly when C-level executives are asked who owns this responsibility: 72% of the C-suite say the CEO owns consumer experience strategy and execution. That’s compared to 21% of SVPs and VPs and 7% of both senior directors and managers who point to the CEO’s ownership.

In your organization, maybe it’s the CEO who’s the ultimate owner, or perhaps it’s a collaboration among multiple stakeholders. But no matter who’s accountable, consumer experience success relies on alignment, communication, and equally as important, data management and governance. In fact, we found that elite performers (brands whose revenue increased more than 10% in the past fiscal year) focus on data at nearly 2x higher rates than underperformers.

For brand leaders, the road to success is paved with data.

Want to Succeed in the Retail Renaissance? Make Data Your Bedrock

In the midst of this retail renaissance, data is the currency for consumer experience — to improve it today and lay a foundation for tomorrow’s technology and innovation. One of my favorite quotes on this topic is from Kyle Pretsch from Lucky Brands who said, “If your data is different in different places, it’s wrong everywhere.”

Here’s how elite performers are building on that bedrock. Follow their example to align, prioritize, and reap the benefits:

73% of elite performers are aligned across channels and functions to focus on consumers, vs. 51% of underperformers.

75% of elite performers have a clear definition of roles and governance for managing consumer data, vs. 32% of underperformers.

Elite performers are 3.2x more likely than underperformers to be executing a strategy for a single consumer engagement platform.

Want more data on the state of consumer experience among B2C brands? Download the new report Consumer Experience in the Retail Renaissance.