Get your FREE 30-day trial.

Please complete all fields.

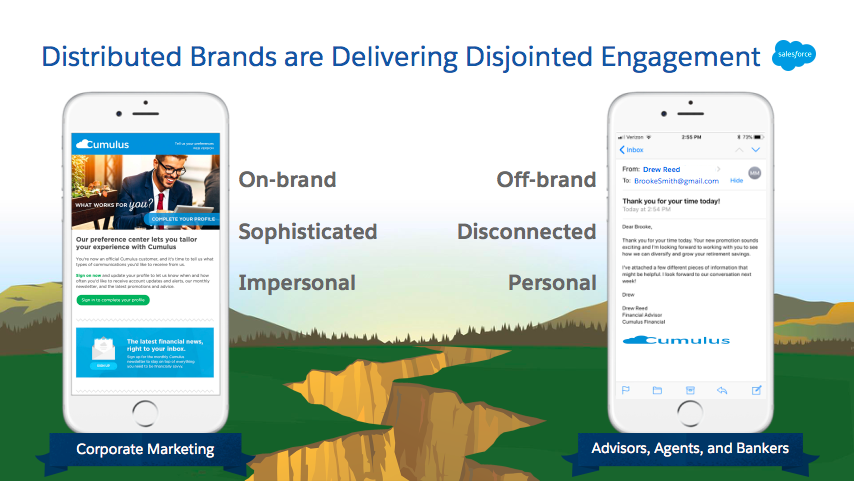

In the financial services industry, one chink in the armor of a customer journey can spell disaster. While corporate marketing teams develop and approve on-brand communications, financial advisors, insurance agents, and brokers don’t always follow suit. These people on the front lines, who aren’t necessarily seasoned marketers themselves, may send digital communications that don’t align with corporate brand and messaging guidelines. One-off messages don't work as effectively as dynamic, multitouch journeys based on how the customer responds or engages with the content.

When communications from one company don’t look, feel, and sound the same, this can ultimately lead to a disjointed customer experience. In the financial services industry, in particular, a fragmented experience could erode trust and present other issues.

Let’s take a look at some of the concerns that financial services companies face as they try to create more seamless customer journeys.

In retail banking, hidden defectors — or consumers who purchase products such as mortgages from competing financial institutions — are leaving bankers empty-handed.

One study from Bain explains this gap in loyalty: “When the ball is up for grabs, a primary bank wins 64% of all purchases on average. But look at what walks out the door: Credit cards, loans, insurance, and investments are the most purchased categories at competitors, whereas the primary bank tends to get a higher share of new, low-value deposit accounts.”

Bankers, then, seem to be facing loyalty issues. Some of the burden to retain consumers falls on corporate marketers and, in turn, bank representatives. Corporate marketers can build a suite of journeys that pulls in dynamic content based on consumer behaviors. If one consumer has a checking account with a Bank X but has been searching for a first-time mortgage, for example, bank representatives can use a prebuilt email journey to engage that consumer with helpful information on mortgage products.

Local bank representatives can personalize these messages even more by driving consumers to contact them directly for further conversations.

Wealth management professionals have gotten used to seeing assets under management (AUM) slip away when wealth is transferred from one generation (for example, a mother or father) to a younger generation (for example, daughters and sons). In fact, “PwC studies have shown asset attrition of more than 50% on intergenerational transfers in many markets.”

Forbes explains this phenomenon further:

The bulk of American money is officially being transferred from baby boomers to the next generation, meaning roughly $30 trillion in assets will change hands …Today’s young adults, however, are looking outside of the institutions that keep their parents’ money. This massive market is looking to invest for the first time, and FinTech companies are locked in a heated battle to capture that first investment dollar.

Upon the death of a parent, for example, a son or daughter may transfer assets to a different financial institution (especially the growing pool of robo advisor companies like Betterment, Wealthfront, Robinhood, and more). For wealth advisors, there’s a lesson here to keep the lines of communication open — and relevant — for their older clientele.

With premade journeys, corporate marketers at wealth management companies could help their advisors run educational campaigns about how to effectively transfer wealth to the next generation. Advisors could even include information about setting up a meeting to discuss the transfer of AUM.

This sort of personalized digital experience can help build stronger, more trusting relationships, and ideally encourage the next generation to keep assets with the wealth management company.

Keeping consumers happy is easier said than done, and this is evident in the insurance industry where less than 30% of policyholders are happy with their current plan or insurance company. One of the main reasons consumers are unhappy is that some insurance companies are failing to provide a digital experience that’s seamless and intuitive.

The WIR (World Insurance Report) Voice of the Customer survey found that “Insurers scored lowest in connecting and engaging regularly with customers as well as having a complete view of customer data and relationships.” A smooth digital experience can help solve both of these issues.

Corporate marketers at insurance companies can create journeys that engage policyholders on a regular basis. Imagine being able to drive consumers to informational blog content via prebuilt email journeys, giving these people context around their insurance plans. Finding ways to build relationships using smart digital experiences is a win-win for corporate marketers and insurance agents alike.

To illustrate how distributed marketing works, take a look at how a prospective customer who’s in the market for an IRA engages with a financial services company and one of its agents:

Brooke, a young professional in her early 30s, wants to start investing more money for retirement.

She researches IRAs online and finds a company (“Company X”) she thinks fits her needs.

She fills out a contact form on the company’s website and receives a follow-up email from the corporate marketing team.

She’s paired with a local financial advisor who reaches out to her via a phone call.

After the phone call — based on the information Brooke has provided — the advisor accesses a number of preset journeys created by the corporate marketing team. The advisor can then personalize emails along the chosen journey. Brooke sees the email messages and knows instantly they are from Company X. The messages are professional yet personal. The financial advisor knows he has the support of his company's marketing efforts and that he's working off a sound foundation.

Learn more how Distributed Marketing from Salesforce can help your financial services company create on-brand marketing content for consumers.

You can also explore these other helpful resources:

Introduction to Distributed Marketing – This blog post shares more about the value of our Distributed Marketing product.

PCMag.com article – This article from PCMag.com explains more about how our Distributed Marketing product works.