Get your FREE 30-day trial.

Please complete all fields.

The Financial Services Industry has long been a big spender in the Digital Advertising space. In 2015, total US digital advertising spend has continued to see rapid growth, reaching $58B.

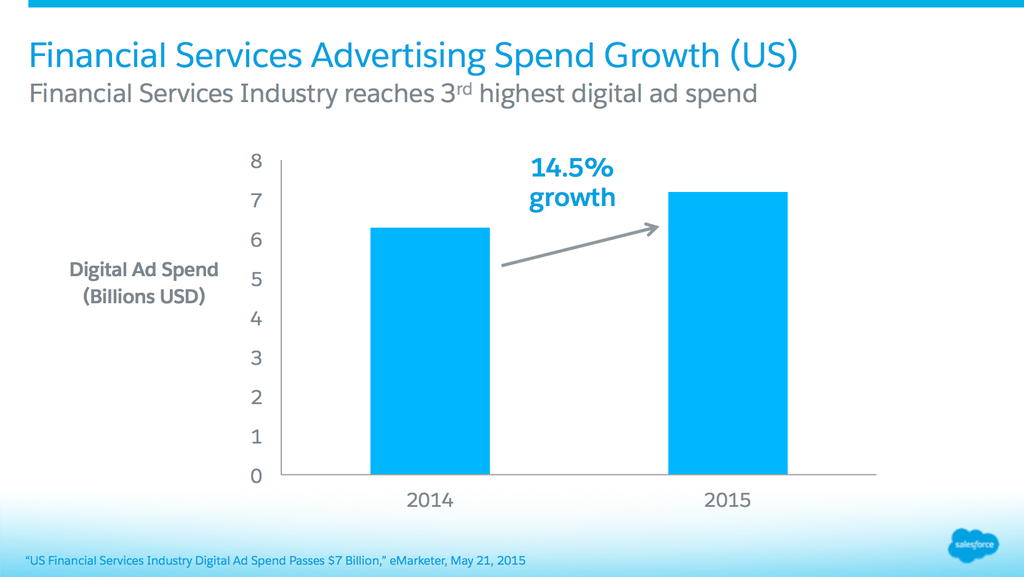

Financial services will rank third highest in overall share of total digital ad spend across all industries, following Retail and Automotive, previous subjects in this blog post series. Financial Services industry will own 12.3% of total Digital Ad spend, or $7.2B in 2015. This is a 14.5% growth in spend from 2014, and eMarketer estimates this growth will continue at a double-digit rate through 2018.

A Mobile-Focused Industry

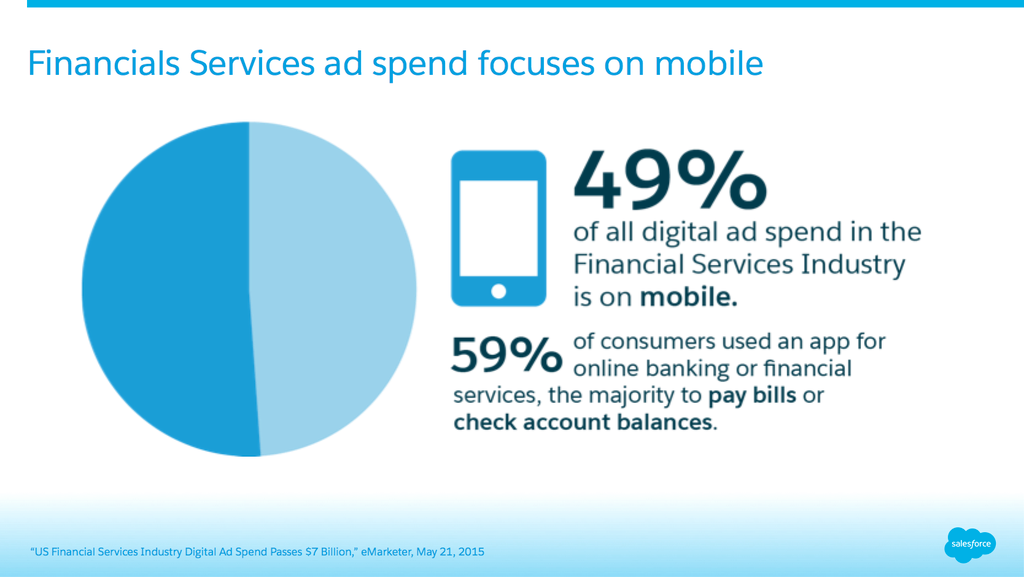

As of 2015, US mobile has surpassed desktop in share of digital ad spend, accounting for 52% of the total. It’s no surprise that just like in many of the other top digital ad spending industries, like Retail and Automotive, the Financial Services advertisers has noticed the importance of mobile. In 2015, 49% of total ad spend in the Financial Services industry will go towards mobile. Mobile ad spend hit over $69B, a 430% increase since 2013 ($19B), and is expected to reach $196B by 2019.

The reason for this mobile focus is due to the general mobile movement of consumers happening today. In the US, users spend almost 2.8 hours per day on a mobile device, compared to just 2.4 hours spent on a desktop. In addition, over half (59%) of consumers have used a mobile app for online banking or financial services, the majority doing so to pay bills or check account balances.

Highly Regulated, But Highly Motivated

The Financial Services industry is one of the most highly regulated and scrutinized across the board. SEC regulations around financial disclosures, user privacy, and data security are just three of the biggest factors challenging the digital activities of advertisers in this industry. Yet, even with these strict guidelines, advertisers are motivated to reach customers digitally.

Facebook is a great place for advertisers to build trust, increase awareness, and turn customers into long-term advocates. Facebook targeting allows you to find the right customer segment based on specific demographics like age, gender, and location. Financial Services advertisers have an even better opportunity to use their securely owned customer data to target advertising, because they have deeper relationships with their customers, including collecting customer email addresses, than many other industries. Salesforce’s Active Audiences allows you to use your stored customer data as a means of connecting with your customers across Facebook and other channels while using SHA-256 hashing to maintain the data security which is critically important to financial services companies.

Real Financial Services Companies, Real Success

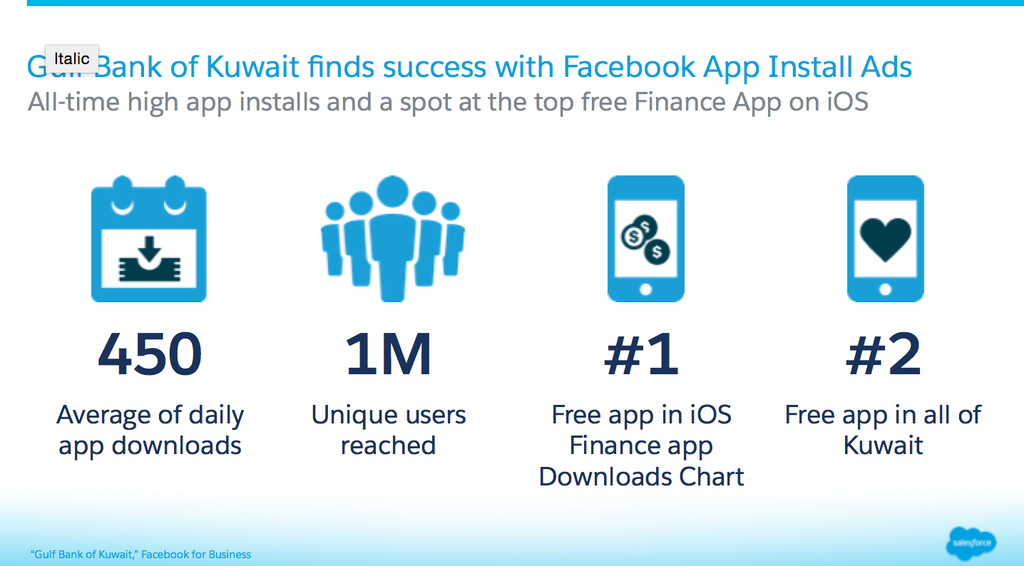

Now that you’ve seen the data, it’s time to see what real financial services companies are doing in digital advertising and what kind of success they have achieved. Let’s take a look at a part of the world that we don’t often shed light on. The Middle East’s Gulf Bank Kuwait, named “Bank of the Year” from The Banker, is an industry-leading financial services provider with over 56 strategically-placed branches all over Kuwait. With a new mobile app released, Gulf Bank of Kuwait partnered with their agency, OMD, to drive app installs among existing customers and spread awareness of the app and Facebook page. They decided to run mobile app ads, targeting Kuwait mobile users, over 21 years of age. In addition, Gulf Bank of Kuwait wanted to create separate tailored ads to reach English and Arabic speaking users, and those with interest in finance, business, real estate, travel, and shopping. In just one week after launching their ads, the bank saw an average of 450 downloads daily and reached over 1 million unique users. Gulf Bank of Kuwait’s mobile app became the number 1 free app in the iOS Finance app download chart after being launched for just 7 days, and additionally the second most popular of all free apps in Kuwait.

In addition to Facebook, LinkedIn is a key platform for advertisers in this industry given its extensive user base of high net-worth and highly educated individuals. LinkedIn today has almost 400M users, with 41% of total internet users earning $75k+ as members, as well as 46% of online college graduates. One brand in particular that chose to partner with LinkedIn for this specific reason was CPA Australia.

CPA Australia is one of the largest accounting companies globally, made up of over 150,000 finance, accounting, and business professionals. They wanted to build awareness, drive engagement, and increase followers. They used LinkedIn Sponsored Updates to target two specific audience segments: college students and young professionals, and mid-to-senior level business professionals. CPA Australia knew that LinkedIn would give them the ability to communicate tailored messages to their audiences in a professional space where these segments of users were already engaging with content. As a result, CPA Australia saw up to 4% engagement with sponsored content and 10% average conversion rate of users who went from click-through to followers.

Invest in the Future

Digital advertising has proven a smart investment for financial services advertisers, for more reasons than one. In an industry where customers expects personalization, care, trust, and privacy, there is much to be gained by targeting customers with the right message, at the right time, and in the space where they are spending much of their time. Continuously test and optimize your campaigns based off your own customer data. In addition, use that customer data to help gain valuable prospects that can become brand advocates in the future. The possibilities are endless.