Get your FREE 30-day trial.

Please complete all fields.

The automotive industry is one of many industries that have embraced advertising on Facebook, Twitter, and LinkedIn to reach customers in the places and on the devices where they spend their time. Auto advertisers see the value these ads offer car buyers and therefore continue to increase ad efforts. Car buyers have adopted channels like Facebook as a key way to get more information before making a purchase decision, be it from advertisements for brands they follow or by getting reviews and recommendations from users within their network.

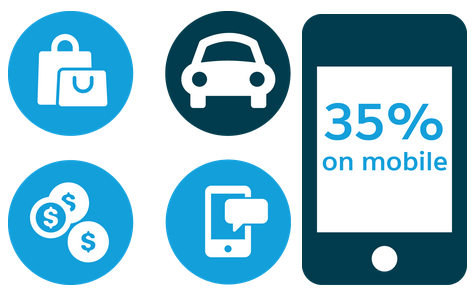

By 2018, Auto will rank as the second leading industry in digital ad spend, behind Retail and ahead of Financial Services and Telecom. US automotive digital ad spend reached $6.2 billion in 2014, a 19% increase from the previous year. Mobile spend within total digital ad spend was more than one-third (35%), at $2.2 billion, eMarketer. This trend will only continue to increase as advertisers respond to evolving consumer behaviors, which are seemingly more and more mobile.

According to eMarketer, Digital ad budgets within the auto industry are split with 60% spent on direct response and 40% on branding. Advertisers focus on encouraging consumers who are currently in-the-market for a new car to take actions. However, given the long time span associated with the car buying process, advertisers have designated spend towards brand awareness to secure a top-of-mind placement in consumer minds. This is essential in securing consumer attention once buyers enter the market and create their shopping lists.

According to our own data, on Facebook in the US in Q1, the Auto industry achieved a CTR of 3.57%, and a CPC of $0.17. Auto advertisers in Australia also saw success, with a CTR of 2.60% and CPC of $0.31. These metrics are impressive against alternate industries, all of which are included in our recent Q1 2015 Social.com Advertising Benchmark Report.

Auto advertisers should focus ad efforts on channels like Facebook which because customers are looking to their peers for recommendations, researching their purchase, and reading reviews.

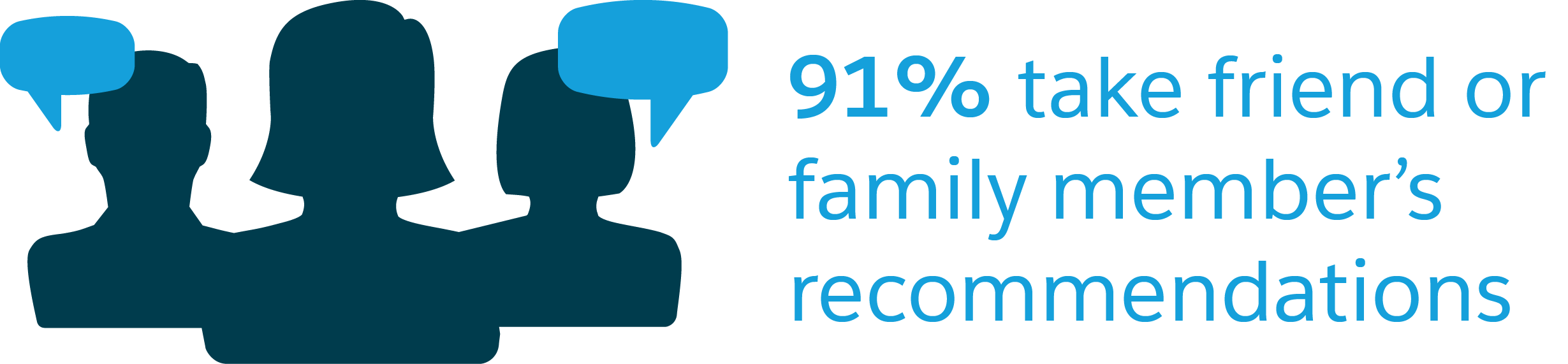

The first major social influence is a buyer’s peers. 91% of car buyers take a friend of family member’s recommendation as a factor in making a purchase decision, Crowdtap. 80% of buyers are more likely to turn to their network for advice in purchasing a car than a salesperson.

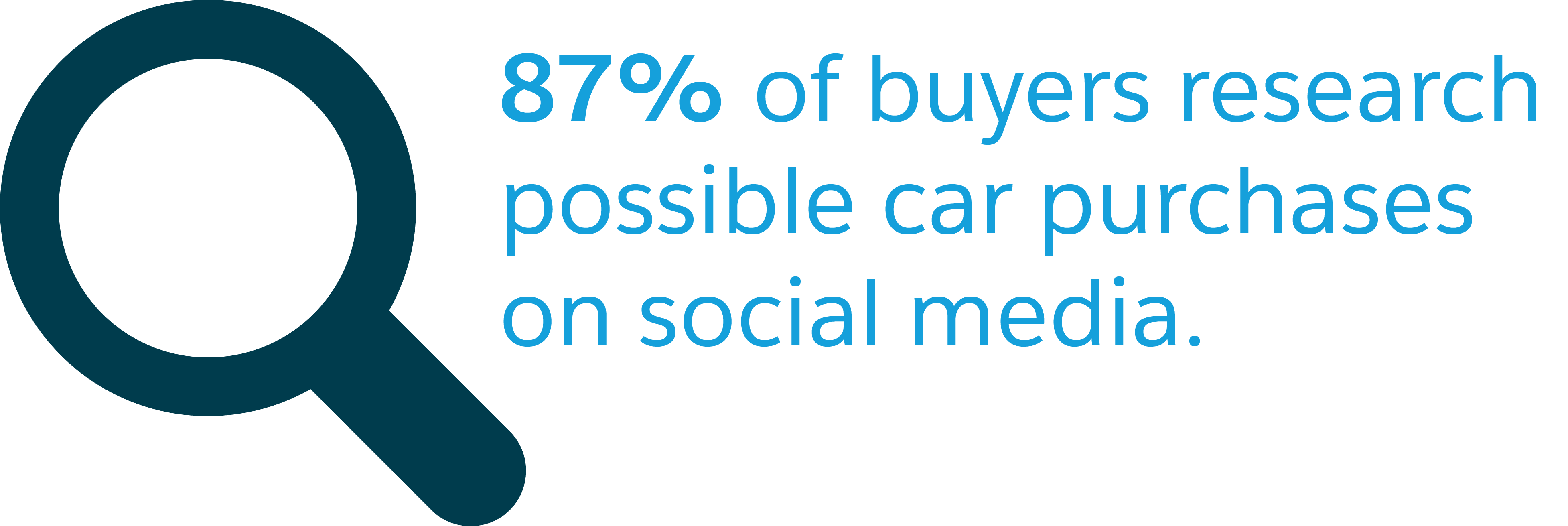

In addition, social networks offer buyers a wealth of information to aid in the research and discovery process. 87% of buyers research possible car purchases on social media. Not only that, but 68% went on to purchase a car they initially discovered on social media.

With ads placed on the same channels people are going to for recommendations from their peers, auto advertisers have the ability to use customer and prospect lists to tell a unique, customized story to appeal to the wide variety of customers that a brand may have.

One interesting way auto advertisers can use ads on these channels is through campaigns focused on increasing brand awareness with incentive to get individuals to the dealership. For instance, you can create a campaign that offers to remove sales tax when a user comes in to test drives and buys a car the same day. Bid oCPM on Facebook to get the best bang for your buck & reach as many people as possible.

If a user come in but doesn’t buy a car, gather their phone number and e-mail and use the brand's CRM to create custom audience in Facebook and/or Tailored Audience in Twitter. Use to target individuals with ads. You can create look-a-like audiences off that particular audience and target individuals that look like the original test-drive audience to get more and more people like them to go into the deal to test drive and potentially buy a car.

To read about how McDonald's and OMD partnered with social.com and found success in advertising, check out our case study.