Get your FREE 30-day trial.

Please complete all fields.

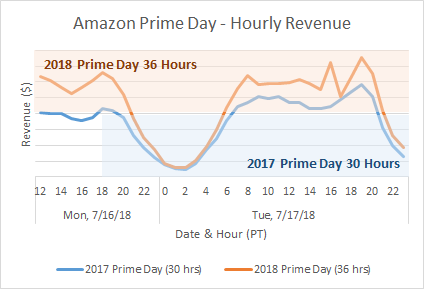

Over the next few days, shoppers across the US will eagerly await packages as a result of Prime Day, Amazon’s manufactured shopping holiday that ran for 36 hours from 3:00 PM EST on July 16 to July 17. We follow up our predictions from last week with the following analysis.

Early reports by Amazon show that this year’s Prime Day was the ”biggest global shopping event in Amazon history,” with consumers purchasing more than 100 million products. Sales, even when adjusted for the 36-hour period, surpassed Cyber Monday, Black Friday and Prime Day for Amazon in 2017.

While many post-event headlines focus on the categories with the steepest discounts, the impact of the outage on sales and customer satisfaction, or how well the giant incorporated Whole Foods into the event, we explore an emerging phenomenon that we unpacked last year — the positive impact that Prime Day has across the broader retail industry. To do so, we turned to shoppers and our North American Shopping Index, an analysis of activity from more than 500 million online shoppers every quarter.

Spoiler alert — it had a huge halo effect. Let’s take a look at Prime Day [and-a-half] 2018.

The rising tide lifts all ships

As expected, retailers experienced significant year-over-year growth in key digital commerce metrics. During this year’s Prime Day, digital commerce revenue grew a whopping 60% compared with Prime Day 2017. This was accompanied by a 41% increase in visits and 56% uptick in orders. It is important to note that this reflects a 30-hour event in 2017 compared to a 36-hour event in 2018. All that being said, it’s still very impressive considering Q2 year-over-year growth was 18% according to our quarterly Shopping Index.

Creative brands sail ahead

Prime Day brought out the creativity in several retailers and brands. An increasing number of retailers and brands embraced the spike in demand and awareness to create their own moments of engagement — and their own promotional events — to connect with shoppers in their own brand voice. Outdoor retailer EMS proclaimed it as Mountain Day, active apparel brand Rhone launched Lime Day, and Columbia Sportswear touted Cyber Summer. It is more critical than ever for retailers to highlight their uniqueness and quality as they compete against marketplaces on convenience and price.

Retailers dive head first into free shipping

While the 23% discount rate looks a lot like a typical summer Tuesday, 73% of all orders shipped for free, which is much higher than the 63% of orders that shipped for free over the past few Tuesdays. Clearly, free shipping is the standard for retailers to combat one of the key benefits of Prime. Many retailers prominently displayed this benefit and highlighted that no membership is required.

The mobile tsunami continues to surge

Shoppers were mobile during Prime Day, as phones accounted for 63% of visits and 43% of orders, up from 57% of visits and 37% of orders on Prime Day 2017. With mobile becoming the remote control to our daily lives, retailers must not only match Amazon’s marketing prowess on this day, but also optimize the experience for mobile’s small form factor.

Once again, Prime Day has proved to be a shopping event for all retailers. Taking a cue from Alibaba’s Singles Day, Amazon has taken the dog days of summer leading up to back-to-school season and motivated shoppers to engage and buy.