Get your FREE 30-day trial.

Please complete all fields.

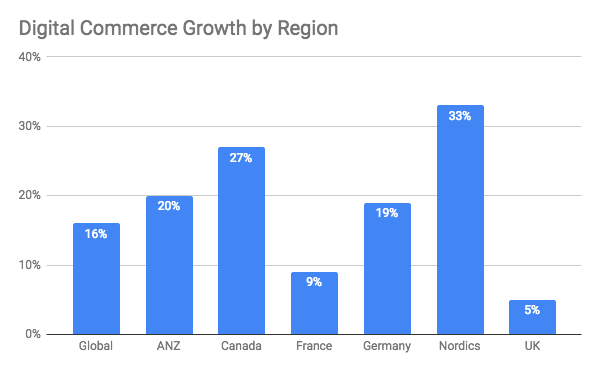

As our latest Shopping Index reveals, the first half of 2018 maintained a healthy pattern of global digital commerce growth. Digital revenue continued to grow 16% globally for the quarter.

But global performance barely scratches the surface when it comes to predicting local shopper behavior. This quarter, we decided to uncover the true differences between shoppers across the globe. When we look specifically at Europe, the view is similar on the surface, but as you delve deeper into the details, there are some interesting differences between the countries in the region.

Let’s take a look at three of the stand out stories:

Digital Growth

The Nordic region is the outstanding performer in Europe with 33% digital commerce growth. On the flip side, the UK had a very quiet quarter, seeing only 5% growth. While this may be a reflection of digital commerce maturity levels in these markets, it is certainly noteworthy to see such sluggish performance in the UK, particularly when you consider its growth rate was twice as high in Q1.

Mobile

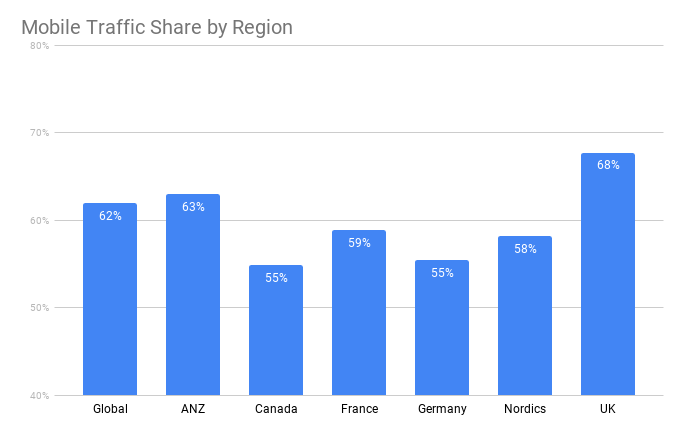

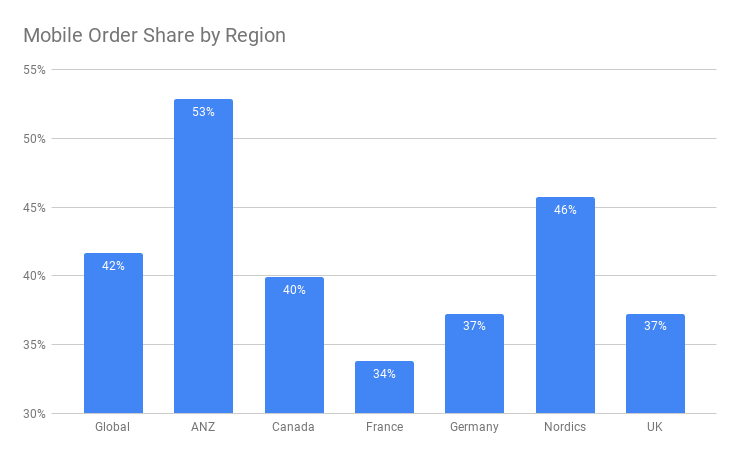

Having just provided a rather gloomy view of the UK, it is interesting, but not necessarily surprising given market maturity, that UK traffic share for mobile continues to increase steeply – up to 68%, well above the global average of 62%. Mobile order share, while growing, remains stubbornly below the average (35%) and more on par with Germany.

France, Germany, and the Nordics all come in between 5 and 10% less than the global average for mobile order share. The Nordics, however, punched well above its weight and beat the global average with an order share of 46%, Only the ANZ region did better.

Social

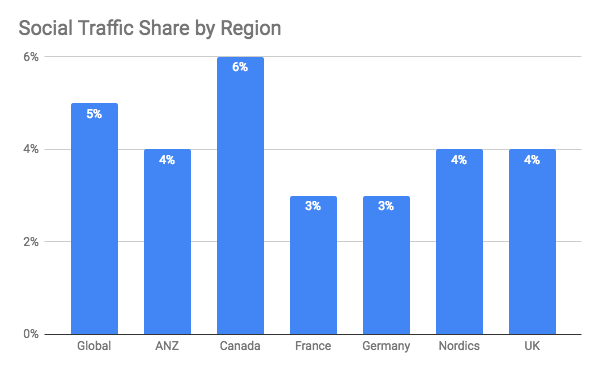

When social is mentioned as a channel, it is usually in terms of explosive growth. That is certainly not the case in Q2, and it is clear that this phenomena carries across the region. All European countries fell below the global average of 5% of all traffic coming from social sources. The Nordics and the UK both declined, quite considerably in the case of the latter, while Germany and France remained flat at 3%.

In summary, Q2 provided a mixed picture for digital growth within these key European markets. What is certain? Mobile will continue to be the key driver of growth and points towards its critical role as the connective tissues between channels in the consumer journey.

For more data-driven insights and a look at the true story of shopping, check out the latest Shopping Index, an analysis of the activity of more than 500 million shoppers across the globe, with a focus on key markets: U.S., Canada, U.K., Germany, France, Australia/New Zealand, and the Nordics. This battery of benchmarks provides a deep look into the last nine quarters and the current state of digital commerce.