Get your FREE 30-day trial.

Please complete all fields.

IT budgets at financial institutions are increasing, and that increase is going toward digital transformation. According to EY’s 2018 Global Banking Outlook, 59% of banks expect to increase their IT budget by over 10% in the next 12 months, and 85% of banks cite implementation of a digital transformation program as a key business priority.

Digital transformation means solving traditional problems with modern technology. Done well, all stakeholders benefit – employees, managers, customers, and shareholders.

One way to analyze the impact of digital transformation is with the 3C Model. Developed by Japanese organizational theorist Kenichi Ohmae, the 3C Model is a business strategy framework that focuses on three success factors: the company, the customers, and the competitors.

So, how will digital transformation affect your company? This includes not only the obvious automation and productivity improvements but also cultural change (more Cs!).

Technology enables companies to operate more efficiently. DocuSign – a provider of electronic signature technology and a Salesforce AppExchange partner – enables greater employee efficiency while reducing the cost of printing, faxing, scanning, and overnighting paper. Its customer, UBS Wealth Management, reduced average processing time for its five most widely used forms from 11 days to 13 minutes, saving its advisors an estimated 51,000 hours/year.

Additionally, leading digital-first companies often find they can recruit talent easier, onboard them faster, and retain them longer. “Our employees are constantly asking for better tools to engage with our members, so providing a simple, flexible user experience is a competitive advantage for us,” says Lisa Colangelo, senior vice president, retail at Coast Capital Savings Credit Union, the largest credit union in Canada by members.

Increasing collaboration with productivity tools can make employees feel more engaged and inspired. It’s no surprise that companies with highly engaged workforces outperform their peers by 147% in earnings per share.

How will digital delivery impact customers? Ideally, you should be able to draw a direct connection between an IT investment and a specific, quantifiable improvement such as CSAT, average spend per customer, or decreased attrition. Use third-party research firms, internal assumptions, and vendors’ customer surveys to estimate the expected incremental profit versus the required investment.

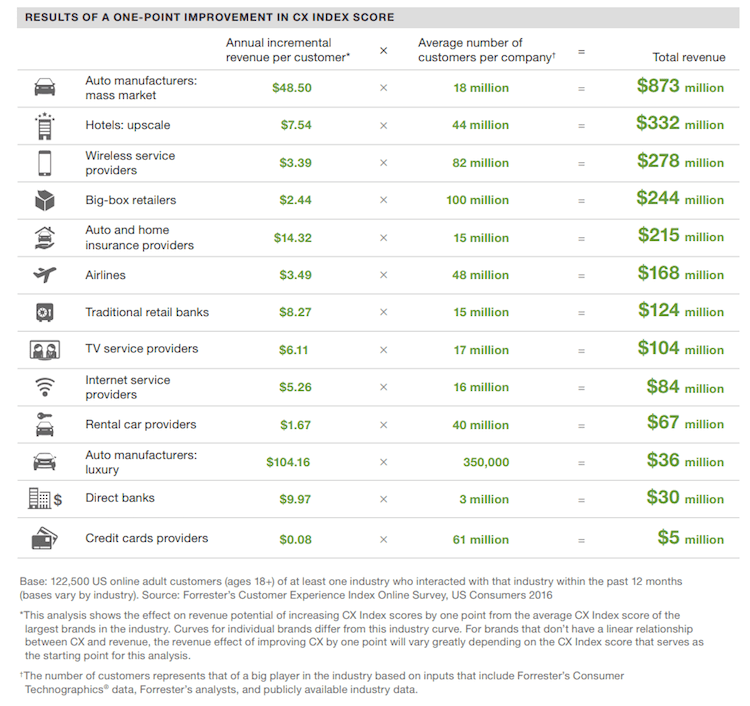

Recently, financial institutions have prioritized customer-centric business models as Fintechs, and nontraditional players like Amazon threaten market share. Banks that deliver a better customer experience acquire more clients through word of mouth, increase the average number of products per household, and support client retention. Forrester Research quantifies a direct relationship between customer experience scores, and improved top-line revenue: as shown in the table below, just a one point increase in customer experience scores can improve banking revenue per customer by $8-10 per year.

Finally, how are competitors innovating with digital technology, and what is the risk of delaying similar investments? Digital transformation allows your company to not only steal market share from competitors but also save revenue at risk from attrition. Today, artificial intelligence (AI) products can analyze the risk of a customer attriting and proactively assign a service rep to reach out to save the business.

The best software partners for technology projects can provide unique insight into industry trends, top-of-mind concerns from executives, and an innovative industry-specific product roadmap.

There are many lenses with which to view the impact of digital transformation. Other frameworks to consider include, the 3 P’s of People, Process, and Product as well as the “B2B Elements of Value” analysis by Bain & Company, a management consultancy.

Remember that digital transformation requires not only investments in software and services, but also preparations for cultural change management, the ability to execute with a growth mindset, and buy-in from leadership. The considerations in this framework should be used during the annual budget process, strategic planning, and throughout the year as needed.