Get your FREE 30-day trial.

Please complete all fields.

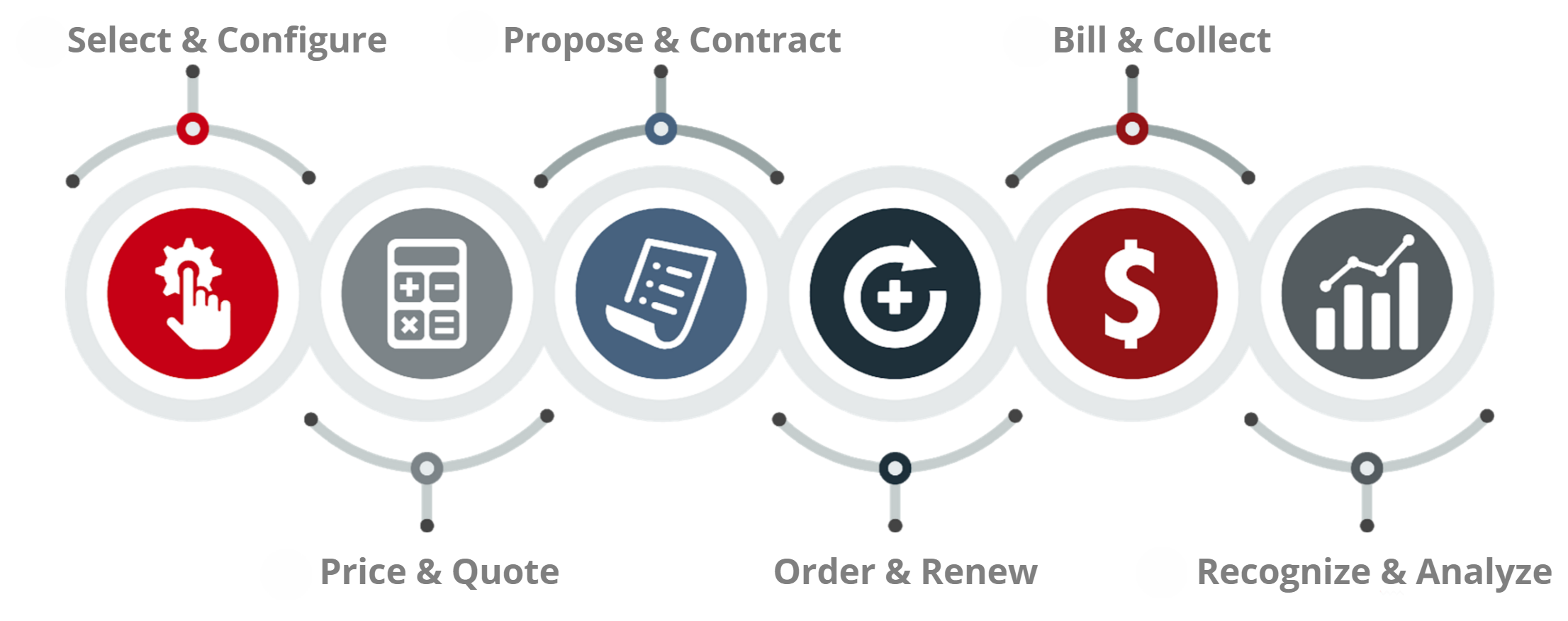

This is the final installment in an eight-part series looking at the typical failure points in the last mile of the sales cycle, often referred to the Quote-to-Cash process.

In our previous installment, we looked at recognize & analyze, which gives you complete visibility into your entire Quote-to-Cash (QTC) process, from selection of the items offered in a quote through the billing, invoicing, and collection of the revenue after a deal has been won.

Let’s now recap what we’ve uncovered across this entire series, and provide a few tips for how you can get started down the path towards your own quote-to-cash solution.

The premise of this series was that you don’t want to lose everything you’ve worked for by falling down in the last mile of your sales process. After weeks or months of hard work from your entire team, the most important part of the sales journey is closing the deal and collecting the revenue.

We’ve shown again and again that the typical process, however, is fraught with risks and bottlenecks that hinder your ability to grow your business.

Relying on documents and spreadsheets opens up the chance for manual errors. Working across different systems opens holes for details to fall through. Referencing uncontrolled information risks using outdated details or inaccurate data.

It’s not just the tools you use. The paradox of risk is that adding review and approval cycles to guard against it adds more time to deal cycles and sucks up more resources, yet still does not eliminate manual errors and mistakes.

It’s difficult to understand why most companies use marketing automation to find and reel in leads, use Salesforce to manage and streamline their sales process, only to pull most of that digital data out of those systems to support manual efforts in the final steps of a deal. Oh, and then finance, customer service, and others all need to reference that data eventually, and get it into their own systems.

Across your entire Quote-to-Cash cycle, the opportunities for mistakes are many. But the opportunities for automation are also many!

Automated Quote-to-Cash guides sales reps through the deal process, eliminating chances for error by guiding them through their choices. It also keeps executives happy throughout the process.

Here are some of the benefits delivered by automated quote-to-cash solutions:

Along the entire process, QTC also helps provide visibility that just isn’t possible with manual processes. Risk levels and pipelines are now transparent, as are current breakdowns of deal sizes, margins, payment terms, and other metrics that help you guide your business.

Your next step is to get started with Salesforce Quote-to-Cash! Check out our quick demo video now.