Get your FREE 30-day trial.

Please complete all fields.

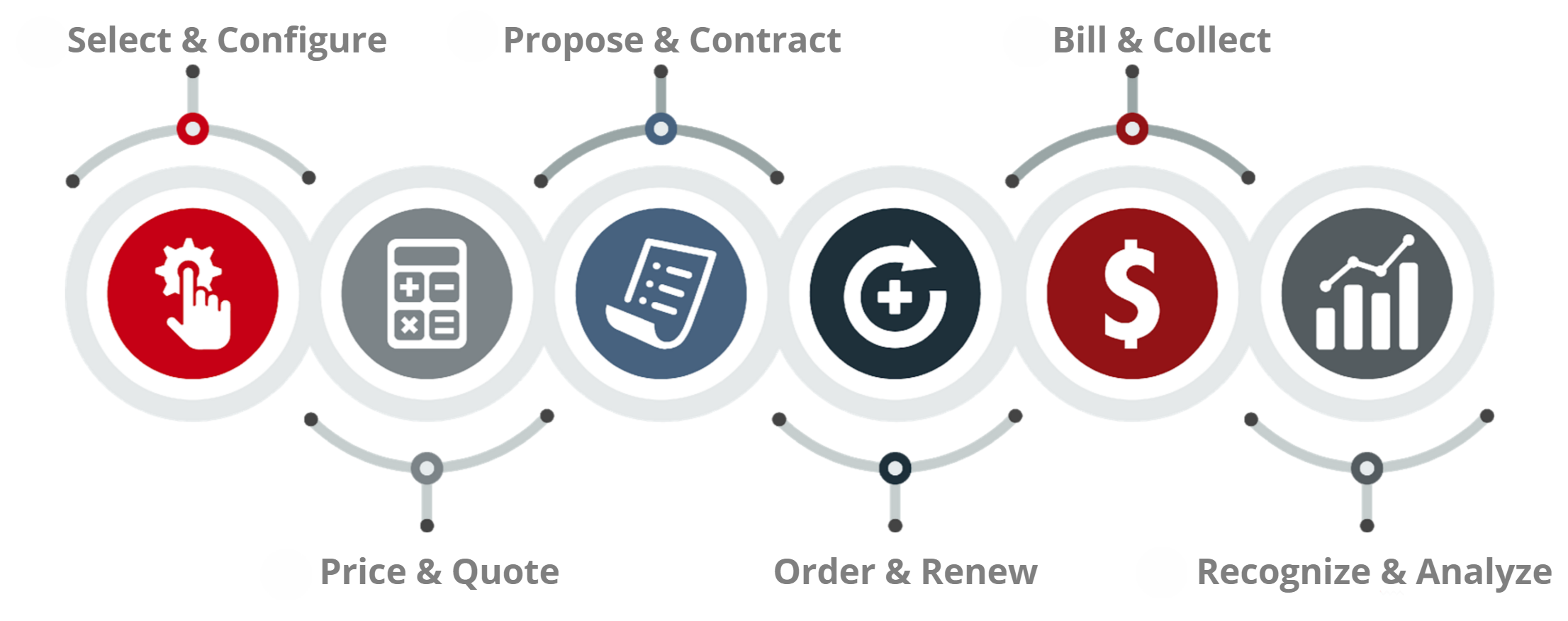

This is the sixth in an eight-part series looking at the typical failure points in the last mile of the sales cycle, often referred to as the quote-to-cash process.

In our last installment, we looked at orders & renewals, where the quote-to-cash (QTC) process converts the elements of a won deal into an accurate order, which is automatically pushed to your back-end financial systems. It’s also where renewals are automatically turned into quotes as renewal cycles approach.

In this installment, we’ll look at the next step: bill & collect. This step helps speed your process for invoicing customers, whether once or for a recurring subscription. It then helps you manage and collect payments, ease tax requirements, and streamline revenue recognition and other reporting needs.

If you’re at the bill & collect stage in the customer lifecycle, you’re doing pretty well. The deal has been won, the contract signed, and the once-prospect is now a customer. However, you still have to get paid, which is where billing and collection comes in.

Billing and collection is complex, with many components, from order management to subscription billing to taxes to reporting, each with its own layers of additional complexity. In most companies, these activities are handled through back-end financial systems that are disconnected from the front-end CRM, quote, proposal, and order systems. It makes for yet another patch of potholes in the last mile of your QTC cycle.

It’s been a key theme in this entire “Last Mile” series, but manual data entry is the biggest roadblock in seamless QTC. When systems are disconnected, the data that sales entered to create the quote has to be entered yet again--and entered correctly--into another system.

Let’s drill down on the specific areas where problems might arise during billing & collection and where automation can help.

Generating the invoice is usually the first step in the billing process. If you have complex terms or schedules, having the ability to configure and schedule different billing cycles could be important. You’ll also want instant reconciliation of invoices for visibility, and be notified of failed or missing invoices.

As payments come in, avoiding complications is key to maintaining customer satisfaction and sound financials. You may get partial payments, payments in other currencies, or a single payment that must be allocated against multiple invoices. Customers also miss payments or checks bounce or they overpay. Managing disputes, refunds, and the dunning process can cause nightmares if not handled properly.

Customers sometimes need to pay with credit cards, so facilitating those transactions, as well as managing expiration dates, is not to be overlooked. (Alternatively, notifying customers of looming expiration dates can be an opportunity for an up-sell offer!)

With financials comes reporting and taxes. If you’re global, that adds a layer of complexity with currencies and VAT. It’s imperative that any billing and collection system can manage your global business, or your plans to become one.

There is also the tangled web or reporting requirements related to being in business, not to mention the reporting visibility you need to run a business. Having the right tools improves speed and accuracy, and can help you stay on the right course, or quickly make changes.

Automated QTC converts orders into invoices based on the exact parameters of the deal as entered by sales and accepted by the customer. There’s no rework, no copy-and-paste, no data entry. It makes life easy for finance and accounting and accounts receivable, because new orders flow directly into their existing systems.

Automated QTC also offers a one-stop solution for your invoicing, collections, taxes, and reporting needs. In addition, automation can help manage revenue and billing for subscriptions, one-time billing, and usage-based billing scenarios.

It all adds up to time and money saved for your company, plus a better experience for your customers. Oh, and with Salesforce CPQ, it all happens within the Salesforce platform. Bonus!

Blur Group helps enterprises eliminate waste and inefficiency in their procurement process with their cloud software and managed services platform. One of blur Group’s biggest areas of growth is their services commerce offering, which uses social networks to drive sales and helps to replicate a consumer’s experience on Amazon for buyers of business services.

Growth is always good, but blur Group’s success created a large volume of invoices, prompting them to looking for a billing system that could handle their growth while simplifying their processes and streamlining their reporting. Their orders were complex, so any billing system needed to be customizable and able to integrate with their existing tools and platforms. They found all of that, and more, in Salesforce's billing solution.

With Salesforce's billing software, blur Group is now able to invoice and bill with ease, creating statements of work and invoices which are sent directly to customers. Salesforce allows blur Group to stay on top of the billing process and have more time to focus on other aspects of their business. Instead of spending hours managing billing and struggling to create reports, they can now complete billing tasks in just a few clicks.

“With Salesforce, we know that customers get the right invoices at the right time,” said Eduard Grama, Projects and Payments Manager at blur Group. “We receive payments faster and don’t have any delays on our projects. I would definitely say we are happy with Salesforce's billing solution and all the services provided.”

Next, we’ll dive into the final phase of the QTC process: recognize & analyze. This phase is where you move from managing your process to running--and growing--your business. Recognize & analyze provides visibility into the full customer life cycle – from quotes to cash. It’s the culmination of QTC!