The automotive industry is undergoing a major reset. For many automakers, this marks the moment of reckoning. OEMs are resetting their product portfolios to include environmentally friendly fuel options, such as electricity and hydrogen. At the same time, sales models are being reset.

Customers' expectations, investor expectations, and the competitive landscape are some of the factors driving the sales model reset. Customers expect an elevated omnichannel shopping experience. In a market undergoing upheaval because of supply constraints, investors are looking for a faster return on investment. Leasing, subscriptions, and shared mobility are redefining the ownership experience.

Franchise model

In the traditional Franchise sales model, OEMs have a rather limited role to play in the customer purchase journey, with the retailer handling the bulk of interactions with the customer. Direct-to-Customer and Agency models have disrupted the customer purchase journey and the relationship between OEMs, retailers, and customers.

New age OEMs started with a clean slate and could quickly change their business model to an Agency or Direct-to-Customer model. In contrast, established OEMs must carefully navigate the transition to a new sales model. This is to maintain an equilibrium between existing retailer relationships and customer expectations.

Agency or Direct-to-Customer model

The majority of OEMs have either completed pilot programs for the new sales models or are in the process of doing so. The adoption of Agency or Direct-to-Customer models will continue to be driven by market dynamics in conjunction with the Franchise model for some time to come. This coexistence may be determined by factors such as geography, product line, or business unit. The recent pushback from the network for greater standardisation to ensure consistency and clarity of customer experience only means these models will continue to evolve and OEMs will need agility when going to market.

To drive this shift, technology will be pivotal. It is expected that the underlying solution will adapt at the engagement layer but be consistent behind the scenes.

In this series, we will see how Salesforce is best suited to power this shift for OEMs, helping them stay relevant in the market, meet customer expectations, manage the relationship with the ecosystem, and at the same time have the flexibility to adapt to rapidly changing market dynamics.

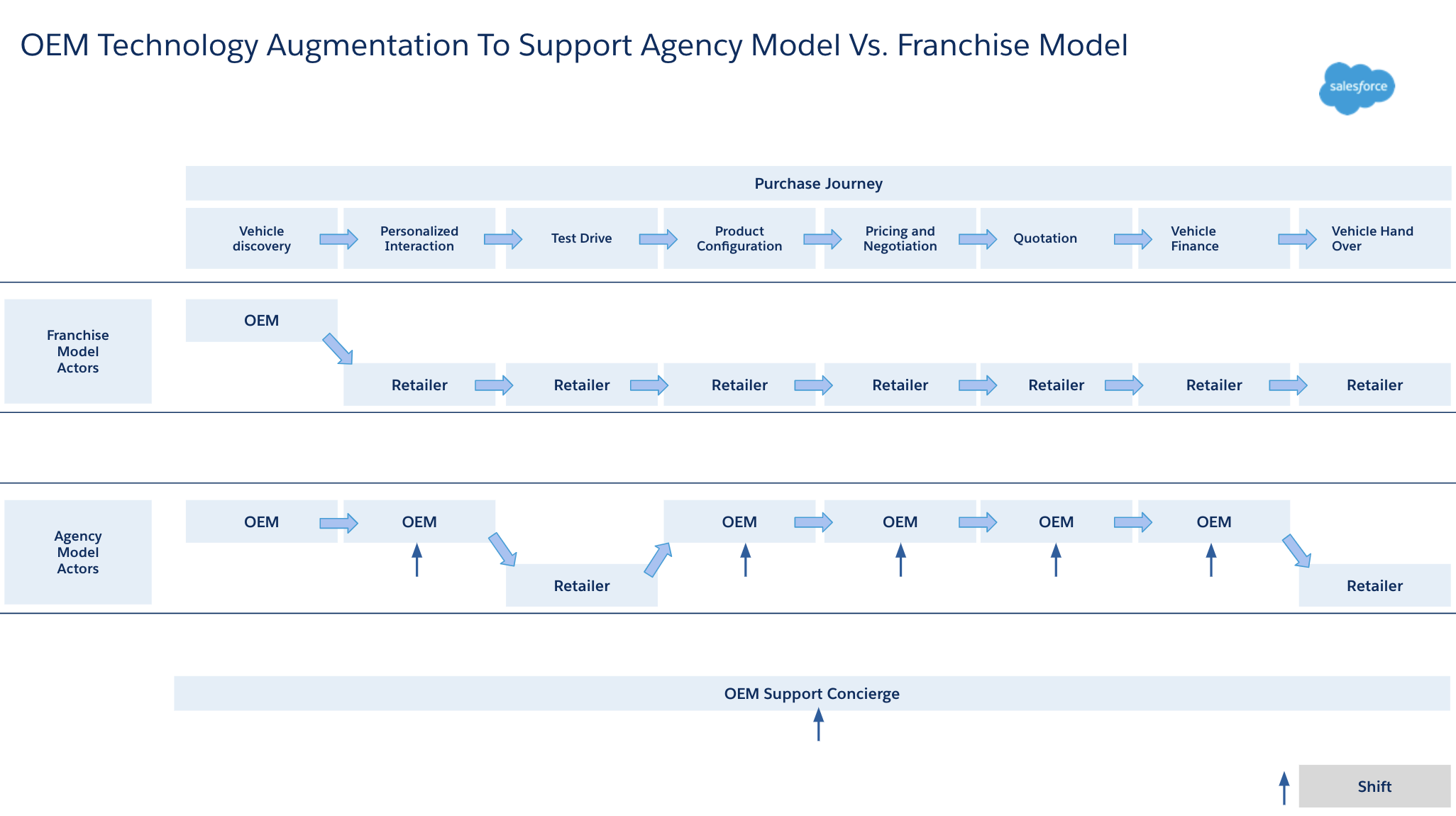

The diagram below compares the Franchise model to the Agency model concerning the customer's purchase journey and various touchpoints. OEMs have to do a lot of the heavy lifting in the Agency model, with a larger percentage of the purchase journey being direct interaction between OEM and customer, along with more handovers between OEM and retailers. To operationalise the Agency model OEMs need significant augmentation in technology capabilities, which was earlier handled by technology procured by retailers.

The Salesforce Customer 360 Platform offers this flexibility, with features to support processes, personas and coming built with the necessary compliance controls. It offers modularity to allow the OEM’s to choose and activate features based on regions, products, business units or other quantifiable factors.

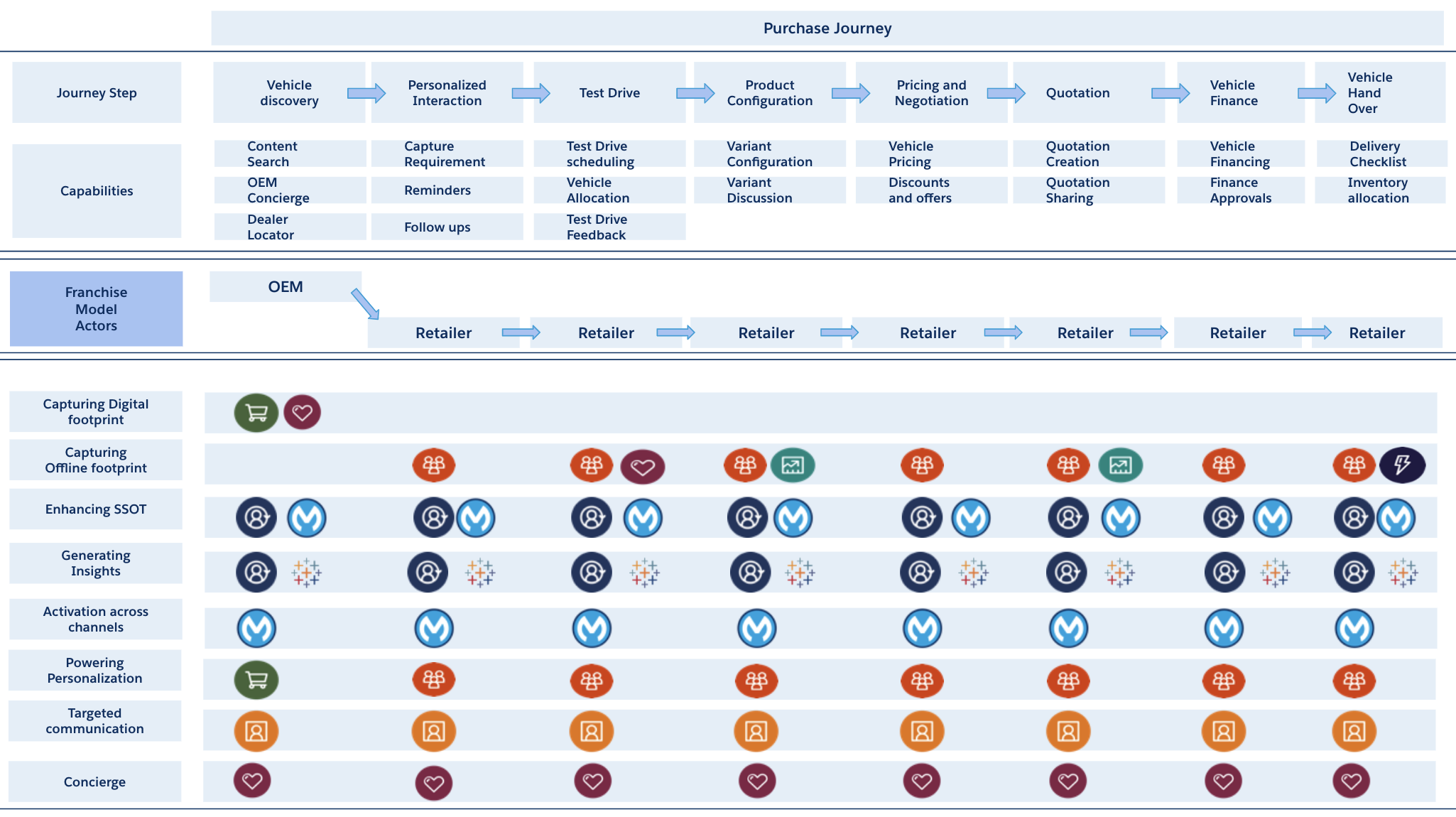

Following is a representative mapping of how Salesforce Customer 360 powers the purchase journey in Franchise model.

Salesforce Support Purchase Journey for the Franchise Model

A similar representation below maps how Salesforce Customer 360 powers the purchase journey in the Agency model.

Salesforce Support Purchase Journey for Agency Model

.png)

As evident, Salesforce Customer 360 offers modularity and flexibility just like LEGO® blocks which allow OEMs to test new go to market strategies and take data driven decisions while operating their existing processes in parallel.

In my next article we will see how Salesforce Customer 360 can enable subscription based economy for OEMs.

For more information about how Salesforce is helping to transform the automotive industry, please visit here.