In the next 4 minutes, you will learn what high performers in B2B and B2C organisations are investing in, their top priorities, and how you can thrive in a changing world.

To gauge the current state of commerce, Salesforce Research conducted a double-blind survey that generated 1,373 responses from commerce leaders worldwide.

The report classifies survey respondents across three tiers of performance:

High performers: classify their organisation’s success in digital commerce as extremely successful.

Moderate performers: classify their organisation’s success in digital commerce as moderately successful.

Underperformers: classify their organisation’s success in digital commerce as unsuccessful or have not invested in digital commerce at all.

In this blog, we focus on high performers’ top priorities, investments, and areas of growth in the age of digital commerce. But before diving into the results, it’s important to understand how ecommerce has changed on a global scale.

How high performers have evolved in the face of COVID-19

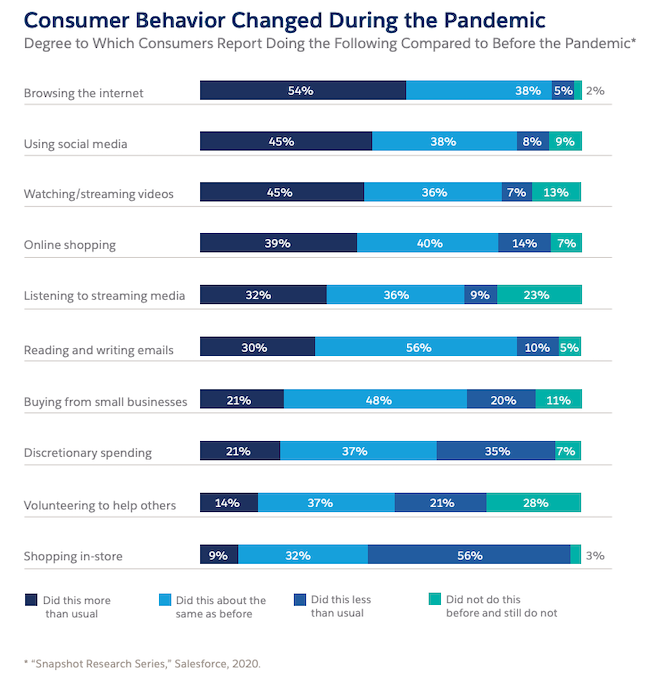

Addressing the digital imperative has been a priority for many commerce organisations since the start of the Digital Age. However, the global pandemic rapidly accelerated the adoption of digital transformation strategies. As a result, businesses were forced to meet their customers in new ways and on new platforms.

As shops closed, innovative ways of doing business emerged. Click-and-collect services skyrocketed, the number of D2C (Direct to Consumer) options rose and omnichannel journeys became the norm.

Ecommerce also saw a meteoric rise. Seemingly overnight, everyone became a digital-first consumer. Ecommerce revenue increased by 75% YOY in Q2 of 2020 and 55% in the third quarter.

“68% of consumers said they’ll continue to buy essential goods online after the pandemic.”

Even as the global pandemic took hold, online purchases of essential goods made directly from manufacturers rose 200%. This shows that the opportunity for B2C companies to develop their D2C channel is steadily growing. Now is the opportune time for B2C organisations to establish digital relationships with consumers.

B2B enterprises are also finding investment opportunities amid the pandemic. For instance, some leaders are leveraging ecommerce to better support direct sales. Sales teams can bring in larger strategic revenue, while ecommerce provides the baseline for ongoing transactions.

B2B high performers increase investment in digital commerce

It’s clear that ecommerce can be a big revenue generator for both B2B and B2C organisations, but it’s not guaranteed. This is why we are looking at the priorities of the high performers.

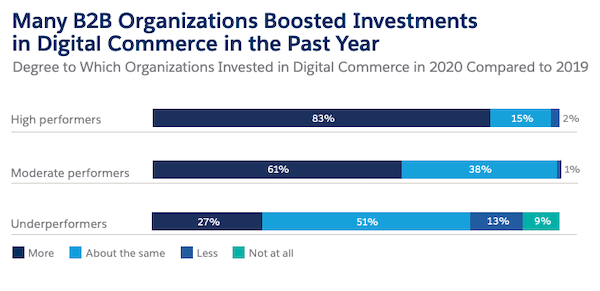

In our survey, we discovered that 83% of high performers increased their investment in digital commerce over the past year.

This is in stark contrast to underperformer. We found that only 27% of underperforming B2B organisations increased investment in their digital channels in 2020.

A majority of B2B organisations are also confident that digital sales will reach over 50% of their business within the next few years:

30% of respondents said that digital channels will provide more than 50% of B2B revenue in 2020.

55% of respondents said digital channels would provide more than 50% of B2B revenue in three years.

Investing in digital capabilities has helped high performers maintain their sales base in transitional times. It's also enabled them to increase agility and seamlessly shift to remote or hybrid work.

“Thirty-eight percent of B2B organisations say they were extremely successful at managing remote sales. That figure rockets to 70% among high performers.”

B2B operators utilised the shift towards digital engagement to position their sales reps in advisory roles. This works well for business buyers who expect vendors to personalise engagement. Our report shows that 31% of B2B organisations increased the size of their sales teams rather than reducing their investment (16%).

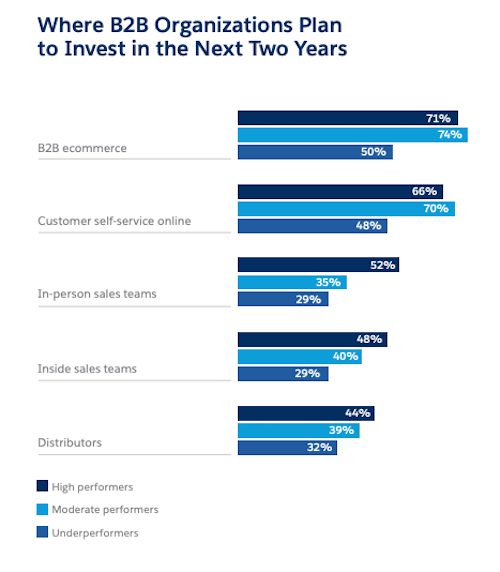

Although high performers are betting big on ecommerce, this doesn’t mean that in-person sales teams are falling by the wayside. In fact, 52% of high performers are planning on increasing investment in sales teams within the next two years.

Top performers are also increasing their investment in online self-service options for their customers. This works well for today’s consumers who are becoming more independent in their buying decisions.

B2C high performers are turbocharging customer engagement

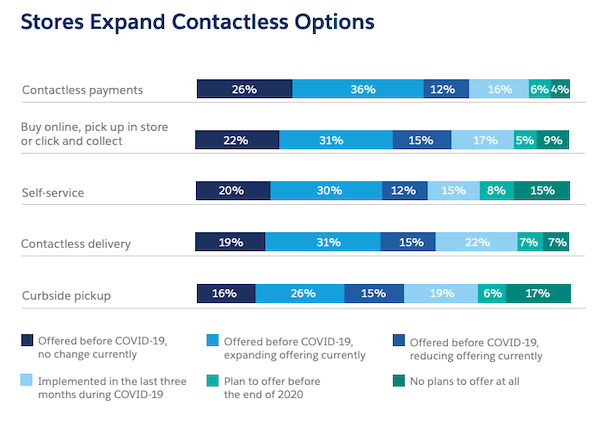

Brick-and-mortar shops still have a place in the business landscape. Curbside service, click-and-collect, and contactless payment options — including mobile wallets — have all become more popular among consumers:

By minimising risk and prioritising convenience, B2C organisations have found ways to stay relevant. However, B2C leaders may have to do more than offer contactless payment options in the future.

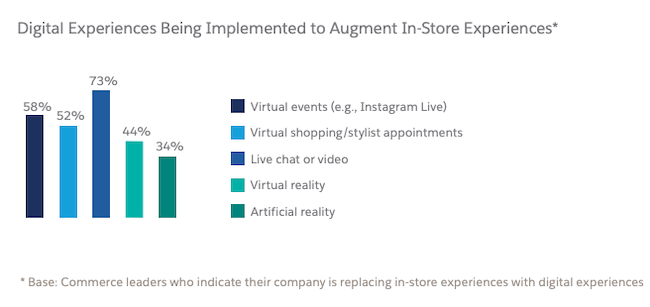

Consumer adoption of digital commerce spiked since 2020, prompting many B2C organisations to test out new consumer engagement strategies. Without the option of in-person interactions, B2C high performers utilised different technologies to provide the same level of personalised engagement online:

We discovered that 73% of B2C decision-makers have implemented live chat or video. Moreover, 58% are saying that they’re running virtual events on platforms like Instagram Live.

Successful businesses have always adapted to changing customer behaviours and expectations. So as more consumers transitioned to ecommerce, B2C organisations followed by increasing their investment in digital channels.

“When asked to what extent they replaced in-store experiences with digital substitutes, 66% of high performers answered “more.””

Among B2C organisations, moderate and high performers consider website and social media presence to be the “most important investment opportunities”. Conversely, underperformers are still focused on investing in brick-and-mortar shops.

Top priorities for both B2B and B2C high performers

Let’s take a moment to summarise everything and narrow down the top priorities for both B2B and B2C high performers.

B2B high performer priorities

70% of high performers excelled at remote sales since 2020. These are also the same B2B organisations that increased their investment in digital commerce by 83% within the same year.

A majority of top performers plan to invest in B2B ecommerce, customer self-service online, and in-person sales teams.

High performers are 4.5x more likely to track customer staffing changes than underperformers.

73% report that the customer service team is more involved in commerce experiences.

To summarise, B2B high performers are investing in digital commerce as a strategic driver for growth. They’re also cognisant that not all business buyers need a rep’s assistance and may prefer self-service options.

Top performers are also more likely to track customer staffing changes to get a holistic picture of their customers’ needs.

B2C high performer priorities

A majority of high performers prefer digital experiences over in-person or in-store experiences.

High performers have more success with social commerce, i.e., selling products via social media. In fact, 84% report high engagement on how-to videos.

88% are increasing their investments in contextual commerce, i.e., ‘buy now’ buttons on social platforms like Facebook and Instagram.

High performers are investing in content management systems (CMS) to manage contextual commerce.

Essentially, B2C high performers are finding the most success online via social media platforms. And it makes sense. A substantial number of consumers were born during the Digital Age, so shopping online may be more comfortable than shopping in person. But the drive towards improving customer engagement goes further than just building and managing an ecommerce website.

B2C high performers also understand the emotional power of social media. Being able to engage with consumers on their favourite social media platforms elevates ecommerce to the next level. And B2C leaders are continuing to improve on this buying experience by adding the element of contextual commerce.

What does the future of commerce look like for high performers?

The State of Commerce report reveals a future in flux. The transformative power of COVID-19 was felt across the world, and tomorrow’s business looks to be more flexible, connected, empathetic and purpose-driven.

High performers have adapted as needed. By offering new commerce options and developing innovative strategies, they’ve positioned their organisations to thrive on new frontiers. In fact, 66% of high performers said they’re replacing in-store experiences with digital ones.

This shift towards an ‘anywhere, anytime’ shop – complete with highly personalised communications, targeted offers and unique experiences – will help B2C organisations fit seamlessly into their customers’ lives. And in this e-driven world, business relationships will no longer be limited to opening hours and physical spaces.

The high performers will make the most out of this unique opportunity. Meanwhile, the underperformers will need to rethink their strategy, hit the accelerator on digital transformation, and try to close the gap on their competitors.

Read more about the State of Commerce

There are many valuable insights in the State of Commerce report that were not covered in this blog. For instance, high performers list their most important factors when picking a digital solution (it’s a must-read). The report also breaks down B2B and B2C commerce by industry, country and role.