Get your FREE 30-day trial.

Please complete all fields.

Banks are awash in financial data about customers, but they struggle to make the data useful and actionable for the employees that serve customers. They live with a legacy reality that has been a barrier to enabling customer-centric business strategies for years. The core platforms that enable the industry are largely product-centric, and they are siloed by product. Banks will have multiple product-centric platforms in order to provide diversified financial products to their customers. A customer is not understood as a person. A customer is a collection of financial accounts in various core platforms that rarely share data at a customer level. Unfortunately, this is equally true for B2C and B2B banking. How can a bank deliver differentiated customer experiences when they do not know what products customers have or their perceived value to the bank? How can they recommend new products without understanding who they serve and what they need?

Growing the customer relationship through product diversification is the primary objective of most banks. It is easier to sell additional products to an existing customer, and they know a customer is less likely to attrite as the number of products grows. They also know there are key life events (i.e., marriage, children, retirement) that change the customer’s financial needs, and product diversification is dependent on understanding and acting on those life events as they occur. These business objectives are mature and well understood in the industry, but most banks struggle to leverage the data they have at appropriate moments in the customer lifecycle. Frankly, they can't even provide a meaningful 360-degree view of a customer for their internal audiences of tellers, bankers, mortgage officers, and financial advisors. Their legacy platforms are simply not designed to enable the strategy.

Delivering a platform to enable customer-centric strategies in a bank has also been hindered by another key reality. Banks are organized by go-to-market channels, and technologies are typically put in place to enable a single channel. Branches, call centers, ATMs, mobile, and Internet banking all typically use different technologies to enable the banker and customer experience. The resulting business and technical architectures begin to look like giant hairballs.

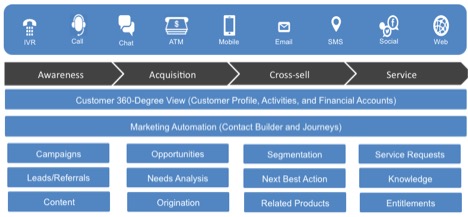

Insulating employees and customers from the complexity of the core platforms requires a new look at the customer engagement platform. Providing a comprehensive customer engagement platform is the focus of Salesforce, and we provide pre-integrated marketing, sales, and service capabilities on a common application platform. It supports all channels for customer and employee engagement and provides a process platform for the customer lifecycle (see below).

The characteristics of this platform are critical to the success of any bank. This platform is designed to enable omni-channel customer engagement. The customer can freely change channels and the employees interacting with the customer have a full view into all historical customer interactions and financial accounts. The platform is agile, so changing business requirements can be quickly enabled through configuration without disruption to the core platforms. The platform is proven to deliver high performance and security for large user communities. It was fundamentally designed to capture all customer interactions and insulate employees and customers from the complexity of back end platforms. All customer interactions (tasks, meetings, notes, campaigns, leads, opportunities, and service requests) are stored on the Salesforce platform. The core platforms are then used for their primary purpose - transaction processing. This division of labor is a key advantage of this architectural approach. It also greatly simplifies the integration requirements in most banks.

However, in order for the customer engagement platform to come alive, it must be integrated to the various core platforms in the bank for financial account information. It is often perceived as a daunting task for our banking customers to consider integrating all the core platforms to Salesforce. The integration chasm must be crossed in order to address the needs of the customer engagement platform, but it is not as difficult as many people expect.

The technical methods are not new or revolutionary. In fact, some might be disappointed this post does not include some integration revelation. The good news is that all of these strategies have been proven with multiple Salesforce customers, and the technologies are mature and well understood in the technical/integration community.

All enterprise architects and integration architects are familiar with the pros and cons of batch and real-time integrations. It is also worth saying that both methods will be used in most deployments. Selecting the right integration method for a given business objective is not the primary focus of this post. The remainder of this post will instead focus on an architectural model that will support batch and real-time integrations.

One of the most common integrations in banking is exposing customer financial account data to sales and service users in a 360-Degree View of the customer. Marketing users also require product information as part of a customer marketing profile. This data represents one of the largest perceived challenges, because the data is sourced from multiple core platforms.

This dataset has some interesting characteristics to consider. Rows are added relatively infrequently for a given customer, since they are only added when a customer adds a new product. Also, other than account balance information, the data is updated infrequently. The challenge with the dataset is the variety of data sources. Many of the source systems are also on aging technologies, so the integration strategy is often dictated by limited available options.

Given the characteristics of the dataset, it is a great candidate for batch integration. Virtually all core platforms support batch integrations. For the most part, sales users do not require real-time financial account data, and mobile performance with this data is more predictable when the data is stored in Salesforce. If current balance is deemed necessary for contact center users, this can be done with a web service integration for the field update. This keeps the service lightweight. Tools like Informatica, Jitterbit, and others provide the ability to do high volume data imports into Salesforce, and a nightly batch will typically meet the business requirements for the vast majority of bank users. The web service integrations could be executed on an enterprise service bus or a point-to-point web service integration.

One final thought on this architectural model. Many banks already have a consolidated data environment with all customer product data. Sometimes it is referred to as a "enterprise data warehouse" or an "operational data store". If this capability exists, it is an excellent data source for the financial account data. It is often created for profitability or marketing purposes, but the dataset is generally pretty complete and updated daily. It allows the bank to execute batch integrations with Salesforce with a single data source that is “good enough” from a data currency point of view.

This greatly simplifies the batch integration by leveraging an existing enterprise data asset. If it does not exist, don’t take the time to build it first. It is not worth the cost and project delays. Modern ETL and data integration tools like Informatica and Jitterbit make sourcing data from multiple platforms relatively easy.

Creating a customer engagement platform that is separate from the multiple transaction platforms is an elegant solution to the age-old problems presented by legacy core platforms. It allows the bank to be responsive to the changing needs of their customers across all channels without retrofitting the interaction models for all the core platforms. It also allows the bank to provide actionable customer insight to employees at the point of interaction and is “future proof” based on its ability to pull in data from changing endpoints.

It is possible that some of the legacy core product platforms will not provide modern integration methods. The financial account data does not need to be perfectly complete to be useful to customer facing employees. This approach allows the bank to incorporate new data sources as they become available, so a phased approach is quite viable. Also, the approach provides the opportunity to quickly incorporate product platforms from acquisitions into the engagement platform. This will be a journey, and this architecture model will allow banks to gradually change or enhance core platforms without impacting the customer experience.

One last challenge: get started now, and go fast! If you have the data warehouse, use it. If not, begin leveraging batch integrations from the core platforms. Waiting for the perfect integration strategy to be completed is unnecessary, and technologists are inclined to pursue the perfect model first. To paraphrase Voltaire, don't let perfect get in the way of useful.