Though it can feel daunting, putting together a business plan is a really crucial and exciting step when turning your dreams into something tangible.

Bringing your great idea to life with a well-considered plan to back it up will not only mean you’re more likely to be successful, but also can be helpful in understanding and achieving your goals, achieving funding, and proving to key stakeholders (like investors, banks or even potential co-founders) that you mean business.

In short, a business plan is a crucial tool when starting your business. There are plenty of reasons for this, but here are three key reasons why:

It shows the financial viability of your business idea. By writing how you plan to make money and how much it will cost, you will quickly realise if your idea is financially sound.

It will provide clarity. A business plan will help you articulate what problem or need your business addresses and why it’s necessary for your target market. This will help your future marketing and selling efforts and will provide a clear picture of what you are working to accomplish.

It will help establish goals and benchmark against other players in the industry. Writing a business plan will help you establish benchmark goals and targets to ensure that your company is always moving forward.

So, if you hadn’t considered writing a business plan until now you might want to get started - even if you are not looking to seek investment right now.

Loads of entrepreneurs have a great idea but aren’t quite sure how to explain it. With 50% of start-ups failing within the first 5 years, we want to help get you on track for success - and it starts with an effective business plan.

Your basic business plan framework checklist

Here’s a useful checklist for the 9 key sections to add to your business plan. Almost every business plan follows the same framework. You can expand this however you’d like, but make sure these essential pieces are in place:

1. Executive summary

This is effectively an extended elevator pitch for your business. Here, you’ll outline your idea including what you’re offering, your mission statement, and how your business is uniquely positioned to succeed.

2. Company overview

This section will provide a quick glance at your business history, location, the core issue your business solves and a brief overview of your target market and any core ideas of growth you have - which you’ll explore further later in the business plan.

3. Industry overview

Here, you’ll answer this question: what does the rest of the sector look like and how are you planning to fit into or challenge it? You can do this using data such as statistics, consumer demographics and any industry trends.

4. Market analysis

This section needs to contain details about research you’ve validated to prove there is demand for your business, including who your competition is and what market share it has, if there are any barriers to entry for the market and perhaps most importantly, how you’ll distinguish yourself from the rest of the market - what is your unique selling point?

5 Sales and marketing plan

What strategies or tactics will you use to achieve your business goals and mission? You should also explain how you’ll sell your products, your pricing and advertising strategy, and how you intend to market your unique selling point to potential customers in order to increase your market share and grow your business.

6. Team structure

Here’s where you’ll explain the legal structure (sole trader, partnership etc) and key members of your business, including a brief overview of their involvement in the company and if they own any of the business.

7. Operating plan

This section will detail what the day-to-day practicalities of your business will look like. A good guide for starting is to answer the following: Where will your team be based? What expenses will you incur? Who needs to be hired?

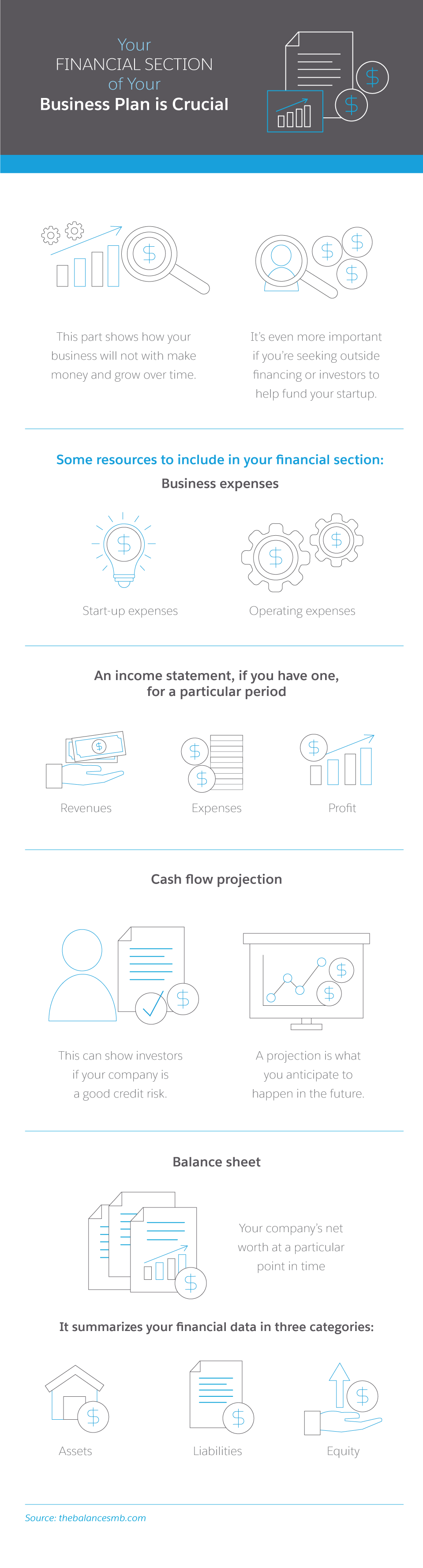

8. Financials

The financial section of your business plan is crucial, particularly in gaining trust and credibility from key stakeholders such as potential investors or to gain a bank loan. It is where you need to show how your business will make money and grow over time, so it’s important as a minimum to honestly break down a cash flow projection to show you can identify and mitigate risk, a balance sheet to detail the assets and worth of your business, and anticipated expenses.

Nobody expects you to be a financial whiz, so you may want to consider getting some outside help writing this up or getting it checked over.

9. Appendix

Last but not least - here’s your chance to add links, documents (such as bank statements) and citations to help you support your business plan.

By following this business plan template, you’ll have no problem turning your great idea to reality - so you can then keep working on building your business. Check our infographic below for a recap so you don't miss any steps.

Learn more about Salesforce for Small Businesses or check other interesting free resources in our Resource Center.