The Salesforce All Wrapped Up report is an annual snapshot of the holiday shopping period's digital commerce and customer service metrics between 20th November and 31st December. It analyses the behaviour of 500 million global shoppers, 88 million messages, and 4 billion service cases that happen during this busy time. Essentially, this data truly represents what shoppers are doing or saying - the true story of shopping.

Let's unwrap the findings from 2018 to uncover the story of holiday shopping world-wide. While that story was one of difficulty and hardship in the UK, there are certainly some key learnings that retailers can take forward into 2019.

The global anatomy of the season

The first significant finding is shoppers globally are buying earlier than ever. A strong Cyber Week contributed to 50% of holiday shopping complete by Monday, 3 December. Interestingly in the US, Thanksgiving became a key digital shopping day as the third highest day for driving revenue. Clearly, customers are shopping earlier than ever before.

Mobile and social commerce also made notable leaps. Mobile shopping overtook desktop for the first time, with 48% of orders coming from mobile compared to 44% from computers. However, social media was the major growth channel for holiday sales traffic - with a 22% increase in social traffic share (YOY), and Facebook/Instagram accounting for 93% of site visits.

What happened in the UK?

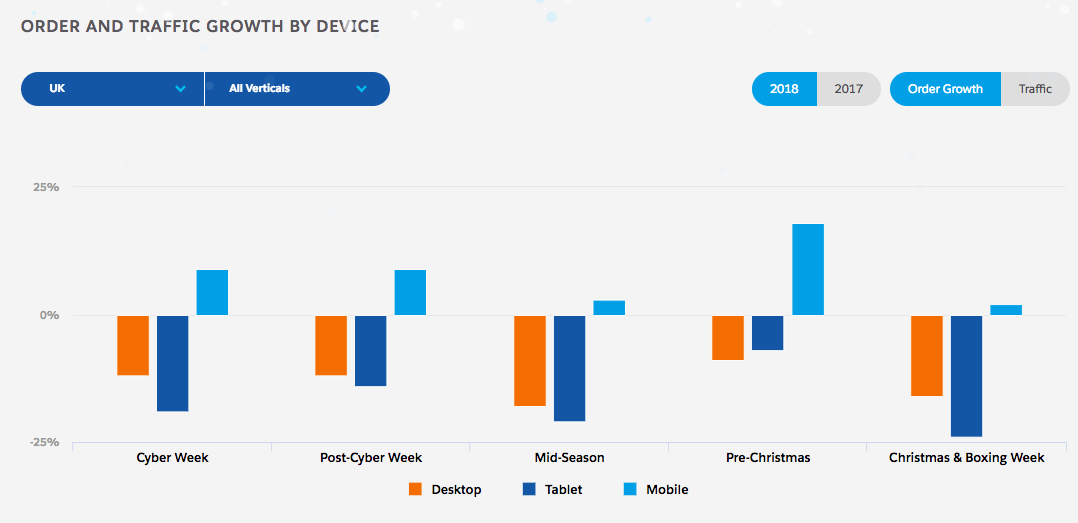

Contrary to global trends where customers flocked to the Cyber Week sales to start their shopping early, a lack of confidence amongst UK customers saw this year’s festive period receive a notable drop in revenue growth. Revenue growth was down -4% during Cyber Week and -13% Christmas and Boxing Week. Boxing Day (revenue) growth was down -7% in 2018 in the UK, compared to +12% growth over the same period in 2017.

Commenting on last year's performance Jamie Merrick, Director of Industry Strategy and Insights at Salesforce Commerce Cloud observes: “There is no doubt that UK retailers are experiencing tough trading conditions in today’s uncertain political landscape. The slowdown in retail growth is reflected in both Salesforce's Commerce Cloud Shopping Index and this week's BRC reporting” On a more reassuring note, he adds: “At the same time, we know that customers are expecting more from their shopping experience both online and offline, and that's reflected in the growth of mobile shopping - one of the bright spots in the UK results.”

Lets face it the mobile device is the remote control of our daily lives. And it was no different this season. As highlighted by Jamie, the order and traffic growth by mobile device was up +2% in the UK, showing customers are increasingly turning to their mobile device. The ease and on-the-go access of mobile shopping is compounded now by the mobile wallet for even more frictionless purchasing, as well as AI breaking down the barriers between inspiration and purchase. This rise in customer mobile use is a clear indication of the benefits for retailers in investing in mobile shopping experiences.

Looking forward in 2019

December may have passed, but retailers are already preparing to lay down the groundwork for this year's holiday period.

As we've seen from the All Wrapped Up findings globally and locally, mobile continues to be a critical channel.

Greater than this, “to ensure retailers remain competitive they need to leverage technology to be where customers are and remain agile as consumer adoption of new technology changes over time. It’s sink or swim in today’s increasingly competitive landscape; retailers can ensure growth by investing in the customer experience and personalising their approach through the use of technologies” such as AI & social integration.

Want to know more?

Check out more insights in the All Wrapped Up report and subscribe to our upcoming webinar with Drapers on 21st February where we discuss main trends, lessons and takeaways from the holiday shopping season.