Customer Acquisition Cost (CAC) is more than just a buzzword. It is an essential customer metric to track in today’s hybrid business models. For example, consider this – as a business, you recently engaged an influencer to promote your services on social media, and the response has been great.

But are you able to objectively define ‘great’? Can you accurately track responses and return on investment (ROI) on this marketing campaign? Can you put a number on how much it ultimately cost you to influence someone to buy your services as a direct result of this campaign?

Most importantly, can you reduce the CAC and optimise spending while driving ROI?

What is Customer Acquisition Cost?

Customer Acquisition Cost (CAC) is a metric that allows companies to measure the cost of acquiring a new customer. Clubbed alongside the customer lifetime value (LTV) metric, tracking CAC helps businesses measure the value generated by a new customer.

The metric involves considering all the expenses incurred while convincing customers to purchase products or services a business offers. This includes time and investment made on research, marketing, and advertising. Ultimately, enabling businesses to calculate the ROI of customer acquisition.

The resultant figures can help businesses make data-driven decisions on how much resources they need to spend on acquiring a particular customer.

How to calculate customer acquisition cost (CAC)

Note that

- The values in both fields must be within the reporting period selected

- In order to arrive at an accurate assessment of customer acquisition cost, sales and marketing expenses should also include indirect expenses like employee bonuses and commissions.

Customer acquisition cost example

Example one: Retail

Assume that you run a retail store that sells bags. Last month, you spent a total of INR 16,00,000 on sales and marketing-related expenditures. This expenditure included paying your sales personnel, running training programs for the new employees, and executing an in-store influencer campaign to attract customers to the store.

As a result of your sales and marketing efforts last month, your store reported that new customers bought 250 bags. Your Customer Acquisition Cost is, therefore, INR 6,400.

INR 16,00,000 / 250 = INR 6,400

Example two: IT Services

Last month, your sales reps signed up 60 new customers (each customer’s lifetime value, according to the company’s customer retention calculation, is INR 10,00,000. Here’s what all of this means:

Total salaries for sales personnel: INR 14,00,000

Total spend on search engines: INR 1,00,000

Total sales and marketing expenses = INR 15,00,000

New customers acquired in a month = 60

Total Customer Acquisition Cost = 15,00,000/60 = INR 25,000

Customer Value or Retention = INR 10,00,000. Therefore, for every investment of INR 25,000, you can generate a revenue of INR 10,00,000.

Why is Customer Acquisition Cost Important?

CAC is an important metric that helps you evaluate the performance of your sales and marketing campaigns. Determining your ROI on sales and marketing will enable you to make data-driven decisions on customer acquisition and customer retention.

As with the examples above, determining that for every investment of INR 25,000, you can generate up to INR 10,00,000 in revenue demonstrates the effectiveness of your sales and marketing functions.

More importantly, once you calculate and understand the costs of acquiring a new customer, you can fine-tune these expenses and reduce them to boost ROI.

You can even track CAC channel by channel. If you use multiple channels to acquire new customers, you can use CAC to determine how each channel performs and choose to invest more in ones that fare well. For example, the cost of acquiring a new customer could be higher via in-store campaigns than social media campaigns. In that case, you can pivot funds to social media to maximise returns.

Ultimately, understanding CAC helps maximise profits and profitability. For example, Silver Arrows, a franchise partner and dealer for Mercedes-Benz, drove down the cost per conversion by nearly 33% and increased revenue by INR 20,00,000 per month through data-driven marketing. . By accessing performance data in real-time, the brand was able to continually fine-tune its marketing campaign for maximum impact.

How to use CAC effectively: Pair it up with Customer Lifetime Value (LTV)

CAC is an effective business metric that can help evaluate sales and marketing efforts. However, in order to make the most out of CAC, we recommend combining the metric with Customer Lifetime Value (CLV). Customer lifetime value is a metric that predicts how much total revenue a customer can be expected to generate for a business.

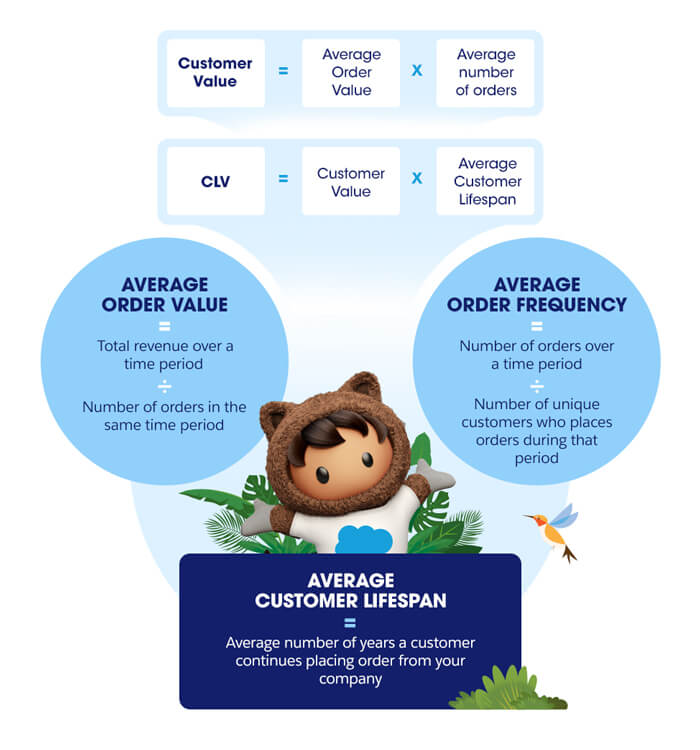

Here’s what you need to arrive at before you calculate your customer lifetime value (CLV)

Average order value: Calculate this number by dividing your company's total revenue in a time period by the number of orders over the course of that same period.

Average order frequency: Calculate this number by dividing the number of orders over the time period by the number of unique customers who placed the orders during that period.

Average customer lifespan: Calculate this number by averaging the years a customer continues to place orders from your company.

To calculate the CLV:

- First, find the customer value by multiplying the average order value with the average number of orders

- Then, multiply this derived customer value by the average customer lifespan.

- The resulting number is the customer lifetime value (CLV)

Calculating CLVs will give you an estimate of how much revenue you can expect an average customer to generate for your company over the course of their relationship with you. Therefore, your business’s CLV to CAC ratio can give you an indication of a customer's value relative to how much it costs to earn them.

Interpreting the CLV/ CAC ratios

Finding the right balance for a CLV/ CAC ratio is essential to successful investments. Ideally, it should take roughly one year to recoup the cost of customer acquisition, and your CLV to CAC should be 3:1, i.e., the value of your customers should be three times the cost of acquiring them.

If it's closer to 1:1, that means you're spending just as much money on attaining customers as they're spending on your products or services. If it's higher than 3:1, like 4:1, for example, that means you need to spend more on sales and marketing and could be missing out on opportunities to attract new leads.

With Salesforce Marketing Cloud, you can track all your sales and marketing efforts in one place. It could be your single source of truth where all the data on customers, from lead creation to conversion and also continued engagement post sales are available in a unified format. This can help various teams evaluate the marketing mix, assess channel effectiveness, access purchase history, explore upselling opportunities, and more.

Real-time dashboards can help monitor sales and marketing performance, enabling swift data-driven decision-making. The comprehensive 360-degree view of customer data on Salesforce can help determine the customer lifetime value more accurately than ever, helping minimise acquisition costs. Furthermore, by upselling to the existing customer base, organisations could offset the new customer acquisition costs as well.

How a CRM can help you improve and reduce customer acquisition costs

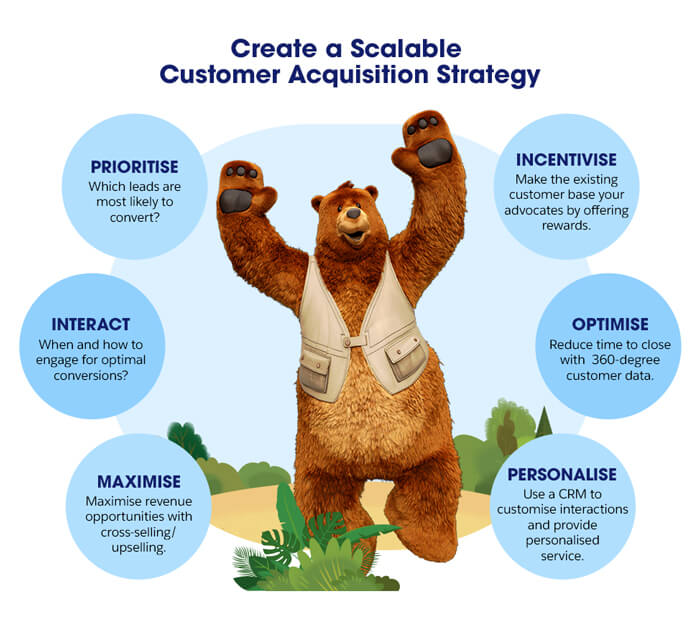

In order to improve your CAC, you need a scalable customer acquisition strategy. One that involves smartly utilising your CRM’s capabilities to support your metrics and gain insights.

You can start by identifying and fixing leaks within your sales and marketing funnels, curbing marketing efforts in low-performing channels, and scaling efforts in channels that have proven to generate high-quality leads. Here’s how a CRM can help:

Prioritisation: With all your leads consolidated on one platform, you can prioritise leads and opportunities that will result in conversions based on previous interactions with your business.

Interaction: Determine who, when, and how to engage with your customers so your optimal responses can boost customer acquisition.

Maximisation: Maximise revenue opportunities by selling to existing customers. Identify all cross-selling and upselling opportunities with ease and smartly reduce CAC costs.

Incentivisation: Incentivise existing customers to act as referrals to discover untapped opportunities within existing relationships.

Optimisation: Optimise every sale by reducing the time to close by equipping your team with a 360-degree view of your customer, achieving great CACs, and even increasing CLV by providing delightful customer experiences.

Personalisation: A customer-focused CRM will always capture customer data through every source. For instance, Salesforce enables a 360-degree view of the customer from data across channels to give sales reps the opportunity to customise interactions instead of pursuing a one-size-fits-all approach.

Ultimately, CRM can help you prioritise customer satisfaction to ensure repeat purchases from happy customers and strong word-of-mouth recommendations to bring in new customers. Unified data from a trusted CRM platform can help keep track of all relevant business metrics while you explore opportunities for upselling or acquiring new customers. It also helps in plugging leaks in your sales and marketing funnels, allowing you to save on customer acquisition costs.

In addition, dashboards can help monitor progress efficiently and course-correct based on real-time insights.

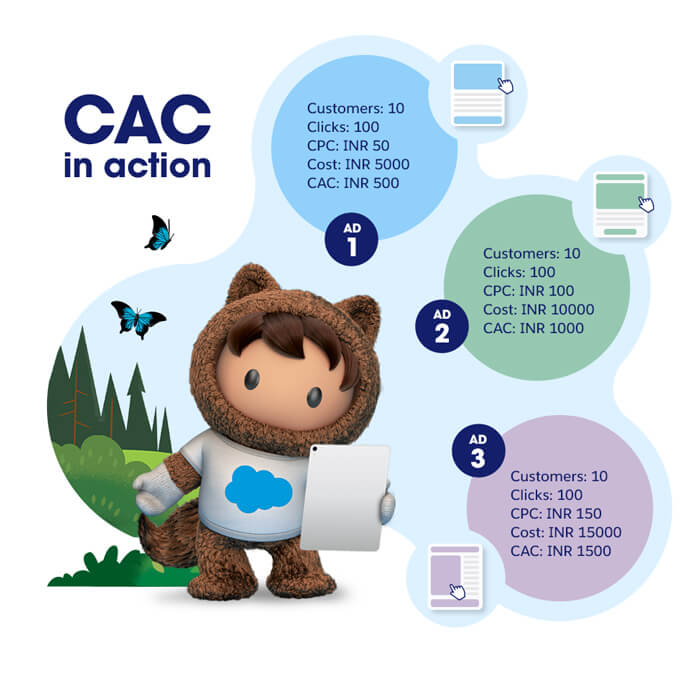

Customer acquisition cost in action

Let’s revisit a CAC in action, taking into consideration all the factors that affect it.

You own a jewellery store in your town. As part of your ongoing efforts to acquire new customers, you’re running targeted ads on Google. Let’s assume you are running three pay-per-click ads.

You’ve received 100 clicks on each of your Ads. Ad one costs you INR 50 per click, Ad two costs INR 100 per click, and Ad three costs you INR 150 per click. Let’s say ten customers have completed a purchase post by clicking on each ad.

That means you paid INR 5,000 for Ad one, INR 10,000 for Ad two, and INR 15,000 for ad three. If you divide this by the number of customers you’ve acquired from this campaign, your CAC is INR 500 in Ad one, INR 1000 in Ad two, and INR 1500 in Ad three. With just this level of information, marketers can take a call on which ads they have to continue to run and which ones they must pull the plug on.

But is this all? Not quite. In order to calculate the CAC in detail, you must also consider the costs involved in making the ad. Did you get your agency to do this? Did your in-house designer design the ad? How much are you paying your marketer to run this ad, monitor progress, etc.? It would be best if you also accounted for how much commission your sales team receives once the customer is acquired.

CAC ultimately consists of these factors combined with the total value your customer (CLV) brings to the company. Here’s what that looks like

CLV / CAC = CLV CAC ( Basically, lifetime value based on a particular acquisition cost)

Let’s say the CLV per customer is assumed to bring INR 5,00,000. Applying that calculation to our ad reveals that Ad one, while seemingly performing well at the beginning, costs INR 1,000, Ad two costs INR 500 and Ad three costs INR 333.

While it may seem like Ad three is the best option, in the long run, a low CAC to CLV ratio could lead to lower investments on acquiring new customers and therefore sustenance of the business itself.

Therefore, your best bet on reducing CAC and maximising profits comes by running Ad two.

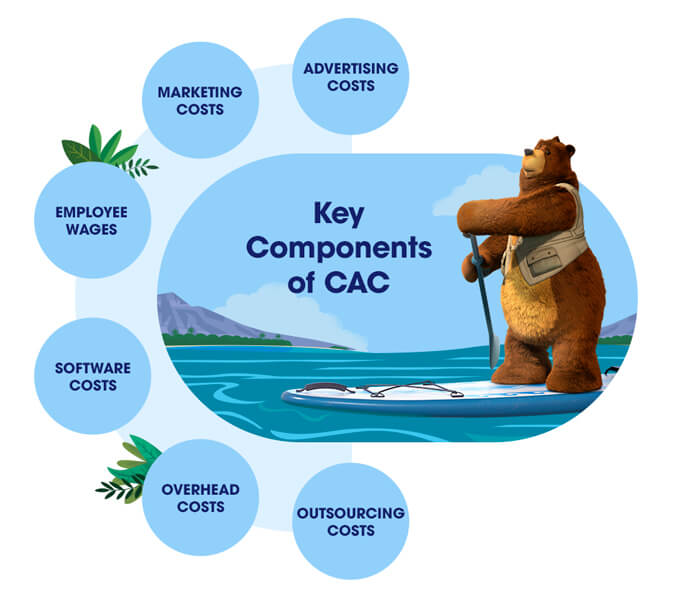

Breaking down the components of CAC

Advertising Costs

Digital Marketing: This includes costs of Google ads, display ads, social media marketing, native advertising, and search engine marketing.

Traditional Marketing: Amount spent on print and outdoor advertisements like newspapers, television, banners, flyers, etc.

Marketing Costs: Amount spent on digital marketing, influencer campaigns, event marketing, etc.

Employee Wages: Consider salaries, incentives and commissions given to the sales and marketing staff.

Software Costs: This includes costs involved in using a CRM, marketing and analytical tools, etc.

Overhead Costs: Ensure you include hidden costs like travel expenses, publicity costs, money spent on free trials, events, dinners, etc.

Outsourcing Costs: Include any costs incurred by outsourcing campaigns to freelancers, designers, etc.

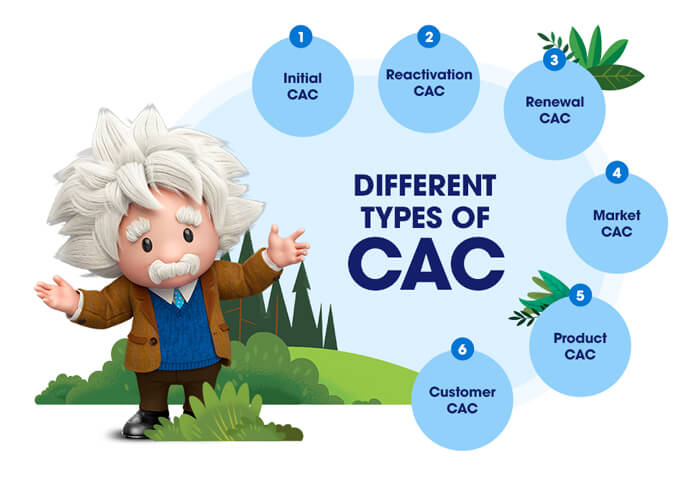

Over and above these, ensure you calculate different types of CACs based on customer types, marketing channels, product lines, etc. Some of them are:

- Initial CAC: Cost of acquiring a customer for the first time

- Reactivation CAC: Cost of acquiring customers previously lost

- Renewal CAC: Cost of continuing to engage with existing customers

- Market CAC: Cost of acquiring customers in a particular market or region

- Customer CAC: Cost of acquiring customers within a certain profile like gender, age, etc.

- Product CAC: Cost of acquiring a customer for a specific product or service

Optimise Customer Acquisition Costs and drive growth

Actively measuring and tracking customer acquisition costs is important to scale effectively, no matter the size of your company. Leaders and management can rely on these metrics to make informed choices on advertising and marketing spending, while CAC metrics help investors evaluate how profitable your company can be.

CAC metrics can also help you allocate resources smartly to reduce hidden costs and maximise profits. Remember, if you are starting to calculate your CAC, include the lifetime value of customers into the mix to arrive at the true cost to the company.

From a funding perspective, for early-stage companies, general guidelines for the targeted CLV/CAC ratio are:

CLV/CAC: ~3.0: Ideal target range as the pace is sustainable (and reasonably profitable)

CLV/CAC: <1.0: Considered unsustainable and implies the company is facing difficulty monetising its newly acquired customers

CLV/CAC: >5.0: While the value received on a per-rupee basis is high, depending on the context, this may or may not be perceived as a good metric. If you are an early-stage start-up, consider spending more and reaching more customers than focusing on cost reductions.

When you prioritise your key business metrics, you and your management team will be able to spot and capitalise on hidden opportunities for growth. With Salesforce CRM, you can connect sales, service, marketing, commerce, and IT, to collect rich data across channels, monitor performance, and personalise experiences in real time.

The 360-degree view of your customer will help your sales and marketing team with the insights required to increase average order values, improve product margins, reduce customer attrition, expedite the sales cycle, and reduce acquisition costs. The result? Your business gets a competitive advantage that facilitates faster sales growth while maintaining cost efficiency.