Much has been written about the imminent disruption to the traditional business model of banking that is forcing the widespread change that is being witnessed within banks. Some of this change is fairly well documented – for example, the launch of asto.io, a neo bank for small businesses to succeed and grow, launched by Santander in Europe. Or the disruptive lending business model built by non-banking lender DMI Finance in India.

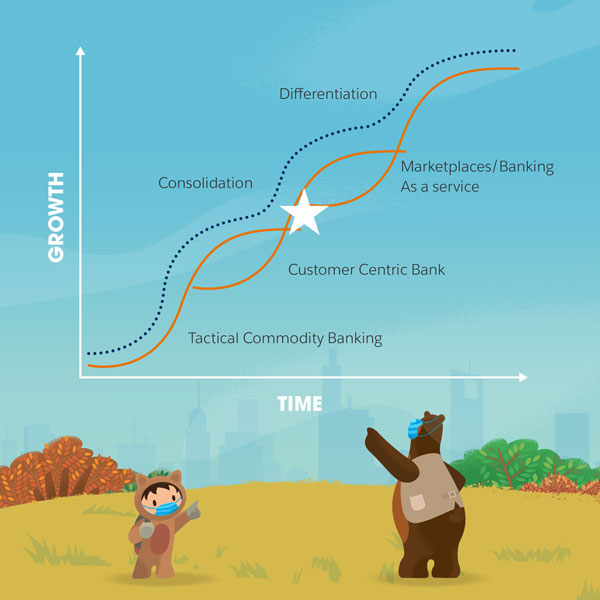

The widely popular “S” curve explains the changes in simpler terms. The industry itself has gone through a period of consolidation aided by evolution from tactical commodity banking to customer-centric banking. Now, it is now trying to grow through differentiation by transcending narrow business model definitions. The most progressive and bold institutions are re-imagining themselves as marketplaces. The white star on the S-curve relates to the approximate position of the Indian banking industry in this journey.

If banking was thus far all about being a “one-stop-shop” for all financial needs of a customer, and many banks tried hard at getting that right by themselves, it is abundantly clear now that they have to become “platforms” that experience delivery or innovation partners can plug into. While doing so, banks have to deliver a great experience on the traditional model.

Imagine this – if less than 10% of all loans in the US are originated via banks, and if non-banks are market leaders in every category of financial services in the US, the question staring at the banks is how do they plan to remain relevant to their customers? In India too, the consumer lending market is now dominated by non-banks that have grown aggressively on the back of innovation and new technology.

As one can imagine, growth from here on is now about driving DIFFERENTIATION. The success of Platform Business Models in other industries is inspiring banks to go down this path for differentiation. Simply put, platform businesses drive consumer growth and stickiness via superior experiences, leveraging indigenous and externally partnered innovation. Because of this captive customer base, in turn, innovators partner with the business platform. In management literature, this is often referred to as Positive Network Externalities.

How does this apply to the world of banking? And what implications does this have on technology consumption?

As Shivashish Chatterjee, Co-founder and Managing Director of DMI Finance says, “Salesforce is like the motherboard of our operations, bringing everything together. The microprocessors and chips that we plug into that motherboard are our partners (distributors & retailers for e.g), our service providers (bureaus and credit file providers), and our customers”. This is as good as a platform business model can get that drives credit decisions in 95% of loan applications in less than 60 seconds. (for more on DMI Finance, please read: Customer success story – DMI Finance).

At Salesforce we ask ourselves this question – how can Salesforce help our customers in the business of banking exploit TRUST and SCALE, which the other agile competitors of our customers are unable to. Can we offer technology that will enable banks to connect the consumers of capital with the providers of capital through simpler, frictionless journeys?

We’ve been there, done that with disruptors, and are now eager to do that by partnering with banks in India.

Find out how Salesforce can help banks engage with customers by building insightful, personalised journeys.