The financial services industry was completely altered by COVID-19. Nobody could have predicted the global pandemic. To align with the current business landscape, Salesforce conducted a second survey to measure how the financial services industry had changed and what new insights we could gather.

Almost 2,800 financial services leaders worldwide have been interviewed for the research. The survey was conducted in two parts: before the pandemic started and then again almost twelve months later.

This gave us a unique look at how the financial services industry weathered the crisis. It allowed us to split the organisations we studied into two archetypes:

Growers: those that accelerate toward growth in the next normal with a focus on long-term relationships.

Stabilisers: those who mitigate short-term risks and stabilise operations with a focus on short-term wins.

What did they do differently? Is one archetype more prepared for the New Normal than the other? The results of the report gave us some valuable answers. But first, let’s look in more depth at the issues.

What are the different types of financial services?

The global financial services leaders surveyed for the report came from the following sectors:

Wealth management

Banking

Insurance

Capital markets

Many financial service institutions (FSIs) are seen as ‘traditional’ establishments. They have a customer base that appreciates more traditional ways of working. So the switch to online business interactions was a struggle for some. The challenge for FSIs was to keep up with the pace of digital transformation.

‘Improving customer experiences (CX)’ was ranked at #1 in the list of business priorities in the 2019 survey. But as businesses were thrown into upheaval during the pandemic, priorities were upended. In the second survey, CX had fallen to #5, creating a significant gap in customer expectations.

We can see that FSIs sacrificed CX for other priorities that they hoped would stabilise their business in the short term. This includes things like implementing new technology and developing new products and services. While technology is vitally important, it must still be balanced with offering exceptional CX.

Why is CX so important to the financial services industry?

Customers’ expectations of the businesses they used, including their digital offerings, were already increasing pre-COVID. The pandemic accelerated their expectations and the need for digital transformation.

We found that 68% of customers confirmed their digital expectations of businesses were elevated by the pandemic. However, those expectations weren’t met by FSIs. Only 23% of customers were satisfied by the financial services industry’s handling of the crises of 2020.

This obvious gap in CX was fuelled by various concerns, including:

Long-term financial stability: one in four customers feel concerned about their long-term financial situation.

Lack of perceived customer-centricity: only 27% see the financial services industry as customer-centric.

Insufficient services and support: only 27% feel that the financial services industry provided great service and support.

How the financial services industry is demonstrating change

What should the financial service industry do to adapt to the changes from the pandemic? Thanks in part to the digital imperative, customer expectations are even higher, and FSIs that aren’t prioritising CX are losing out.

Customers were understanding at the start of the pandemic, but over a year later, they’re expecting a smooth CX.

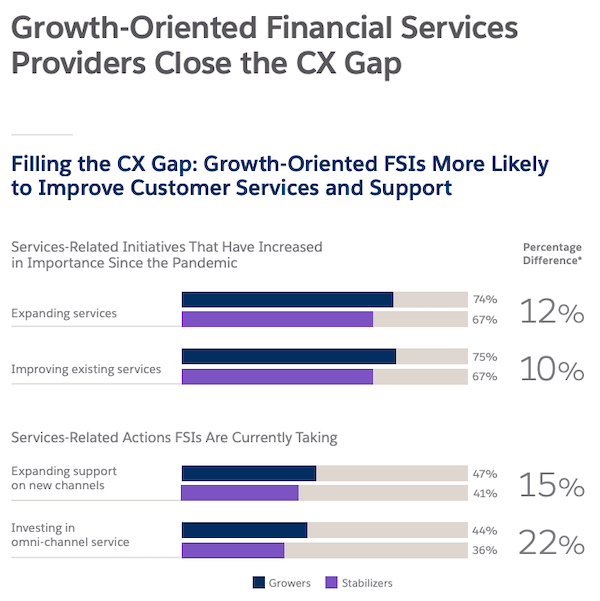

FSIs following the Growth archetype remain focused on CX, realising the importance of improving customer services and support.

What are the objectives of the financial services industry post-pandemic?

Like all businesses in the current economic climate, the objectives of FSIs should be to attract new customers and retain current ones. Excellent CX is essential for both of these.

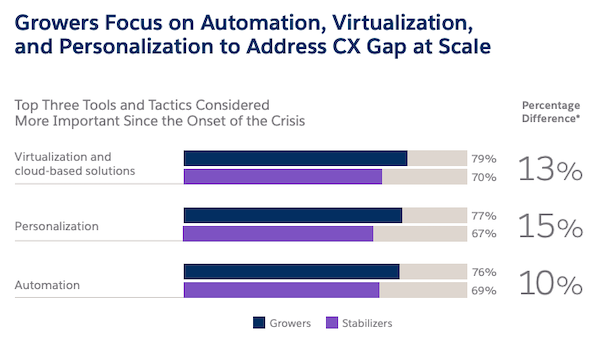

Automation is a crucial part of closing the CX gap and growth-oriented FSIs understand that. Growers cited automation, personalisation, and cloud-based solutions as the three tools and tactics that have grown the most in importance since the global crises.

While stabilisers are focused on the products they offer to their clients, growers have turned their attention to overall client satisfaction and CX. Here are some concrete ways that growers are working to close the customer experience gap:

44% of growers are already investing in omnichannel support, compared to 36% of stabilisers.

Growers are 21% more likely to emphasize client financial wellness compared to stabilisers.

Growers are 24% more likely to have taken steps to improve the user experience compared to stabilisers

48% of growers are currently personalizing communications and offers compared to 43% of stabilizers

Organisations in the financial services industry can thrive and grow in an uncertain socio-economic landscape. Growth-oriented FSIs are taking steps to stay ahead of the competition.

It’s important to look at your services through a customer-centric lens. You can do this by:

Taking action to support customer wellbeing

Offering life insurance policy deferments

Investing in omnichannel experiences to close the CX gap

Using automation and AI to excel

To find out how the most growth-oriented FSIs are taking steps to mitigate the COVID-19 pandemic, download the Salesforce Trends in Financial Services report.