Salesforce Senior Managers, Michelle Grant and Rosemary Okolie, breakdown four key digital commerce trends in Europe.

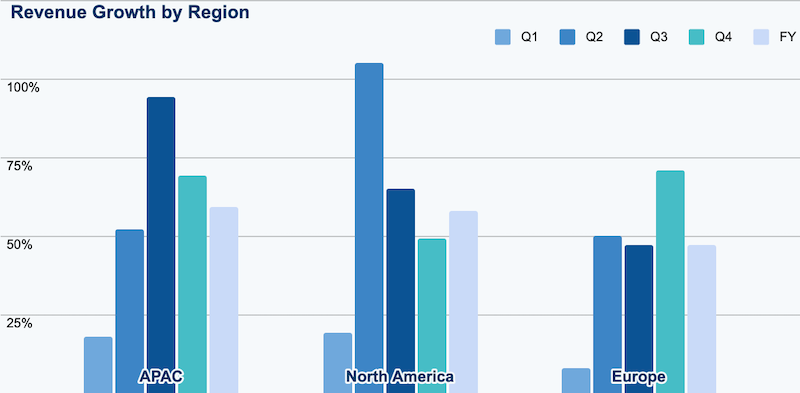

Due to the COVID-19 pandemic, shoppers turned to e-commerce for their safety and to obtain goods when non-essential retail was closed. According to Salesforce’s Shopping Index, European e-commerce grew by 47% in 2020 – slightly lower than the 56% growth rate for the world. The chart below shows overall revenue growth by region per quarter.

Like many other countries around the world, European countries closed non-essential retail in March. Although the Netherlands and Sweden did not close non-essential stores, many retailers, especially global retail chains, closed their doors voluntarily. These store closures contributed to the first spike in e-commerce sales, with a growth of 51% in the second quarter of 2020.

As non-essential retailers opened their doors again in May, e-commerce growth slowed only slightly in Europe to 47% in the third quarter. However, the rapid rise in COVID cases in Europe around autumn caused many governments in Europe to close non-essential retail again. As a result, e-commerce sales soared during the peak shopping season. European e-commerce grew by 72% in the fourth quarter of 2020, much higher than the global growth rate of 56%.

Our data uncovered four top trends in European shopping in 2020:

Trend 1: Italy saw an e-commerce boom in 2020

Italy experienced the fastest growth in 2020 at 81%. As the fifth largest e-commerce market in Europe, its smaller size allowed for higher growth. However, the largest and second-largest markets, the UK and France, rounded out the top three fastest-growing countries. E-commerce grew 61% in the UK and 58% in France. The UK and French governments closed non-essential retail during the fourth quarter, which caused a surge in online sales during the critical peak shopping season.

On the other hand, Germany grew the slowest in Europe with an overall growth of 22% in 2020. According to consumer surveys by McKinsey, only up to 20% of Germans experienced a net increase in intent to shop through e-commerce, compared to 40% for the French and the British. The surveys also found that Germans were more comfortable shopping for groceries and non-essential items in person than their French and British counterparts.

Trend 2: Conversion rates followed lockdown trends

In the second quarter of 2020, conversion rates for each European country grew compared to the first quarter of 2020. Europeans shopped with greater intention online due to the lockdown measure put in place, including the closure of non-essential stores. Once stores opened in the third quarter, conversion rates dropped. When stay-at-home orders were reinstated in the fourth quarter, conversion rates once again rose.

The UK and Netherlands led Europe for the highest conversion rates throughout the year. Italy, on the other hand, consistently had the lowest conversion rate. Its highest conversion rate was 1.5% in the second quarter. This suggests that Italian retailers can optimize their websites to better cater to the influx of new online shoppers.

Trend 3: Essentials and wellness took centre stage in 2020

Another key trend gleaned from monitoring shopping activity through 2020 is that European shoppers chose to prioritise spending on essential items - specifically Food and Drink, as well as Health and Beauty.

The Food and Drink category saw the most growth in 2020 at 137% versus the previous year, with notable spikes in ecommerce sales during the second and fourth quarter as shoppers turned online in droves during the lockdown. This massive shift towards digital channels in the grocery sector, alongside the opportunities and challenges that come with it, was highlighted in a recent report created by Salesforce in collaboration with Internet Retailing. The report also details the rising health and wellness trend brought on by the pandemic, so it’s unsurprising that this category saw the second most digital commerce growth in Europe last year at 112%.

It’s worth mentioning that Active Apparel, including Active Footwear, also grew at a healthy pace in 2020 - 71% and 97% respectively, no doubt driven by the casual fashion trend, and an increasing focus on fitness, that has been spurred on by the pandemic.

Trend 4: Mobile and social shopping surged

It’s no secret that the pandemic was a catalyst for social media activity, with social commerce, in particular, seeing a marked increase. In the second quarter of last year, orders from social-referred channels grew an impressive 87% year-on-year in Europe - almost double that of the first quarter. Mobile phones accounted for most of the social orders (86%), which is no surprise given that consumers globally spent a significant 1.6 trillion hours on their mobile devices in 2020.

By country, Italy (+291%), the UK (+140%), Spain (+93%) were the top three in terms of year-on-year increase in social orders in the second quarter of 2020. This is a trend that’s unlikely to subside and here are some tips on how to maximise the value of social.

For more data-driven insights, check out the interactive drill-down of our Q4 Shopping Index. The data gathered on more than one billion digital shoppers, from key markets such as the U.S., Canada, U.K., Germany, France, Italy, Spain, Japan, Netherlands, Australia/New Zealand, and the Nordics, makes for a rich source of insights and trends.