B2C commerce is changing in unexpected ways. The COVID-19 pandemic has forced businesses to find new ways to engage with their customers.

For digitally mature brands, this meant investing in their ecommerce platforms, focusing on social commerce, and providing a seamless customer journey across digital channels.

For other organisations, it meant accelerating long-term digital transformation projects, shifting to new business models like DTC (direct to consumer), and finding ways to deliver innovative, contact-free experiences.

To find out how the landscape is changing, we surveyed nearly 1,400 commerce leaders and analysed the behaviour of consumers and business buyers worldwide to discover.

- How B2C is adapting to a changing world

- What B2C commerce future trends are emerging

The results have been published in a handy infographic (click to download) summarising the main points for how B2C Commerce is changing.

Two big trends that impacted B2C commerce

Even with rapid upheaval continuing into 2022, clear B2C future trends have emerged. Let’s take a B2C commerce deep dive into the New Normal.

1. Contactless payments are booming

According to our report, cashless payments grew 90% in the face of social distancing concerns. Customers turned to contactless cards and increasingly used their phones. As a result, mobile wallets are no longer just for online ordering.

2. Stores become fulfilment centres for online discoveries

The closure of stores led to a fresh wave of digital-first consumers. These digital converts discovered a 24-hour ecommerce world of fast customer service and easy delivery options.

B2C players had to find new ways to keep traditional shoppers on their side. Enter click-and-collect options and kerbside service. By turning shops into ‘dark fulfilment centres’, B2C operators united physical and digital commerce to provide safe, customer-centric experiences.

The digital transformation of brick-and-mortar stores

The seismic shift towards digital commerce doesn’t mean that there’s no longer a place for the physical shop in the new customer journey. It just has to be re-imagined. Today’s businesses need to double down on the innovative solutions that have been previously suggested.

Stores can function as more than just places to make a purchase, for instance, they can be:

Tactile showrooms for brands

Communal hot spots for demonstrations

Spaces for product launches

Online fulfilment centres

AR and VR experiences can turn stores into immersive environments and must-visit destinations.

BC2 players focus on personalised, digital experiences

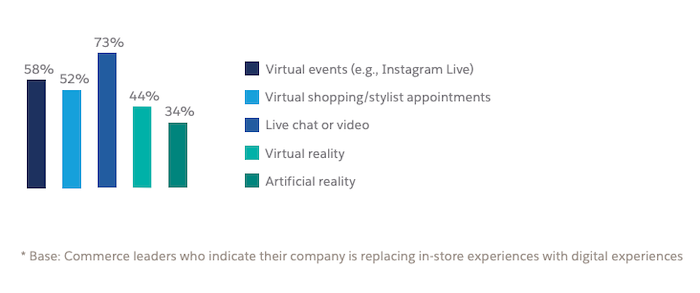

Without face-to-face interactions, B2C players have had to step up their game to provide personalised experiences. A large majority (73%) have implemented live chat or video, while 58% have started running virtual events.

Furthermore, 66% of high-performing companies (those that say their organisation is extremely successful at digital commerce) are offering more digital experiences than in 2019.

This is in contrast to only 24% of underperformers; those who say their organisation is unsuccessful or uninvested in digital commerce. Successful B2C players are leveraging digital to not only navigate the uncertain climate but to keep up with new-age consumers.

A B2C commerce deep dive shows key future trends

The State of Commerce report tells us that 56% of consumers are spending less time in physical stores and more time online. They’re also going online through different channels. Social media, Internet streaming, and web browsing are the top ways that consumers are shopping online. So now B2C operators are focusing on these areas.

According to our report’s B2C commerce deep dive, 88% of high-performing companies are increasing investment in their contextual commerce or embedded commerce experiences. In just three months, 41% of businesses improved their online experience with the addition of real-time web chat or video chat.

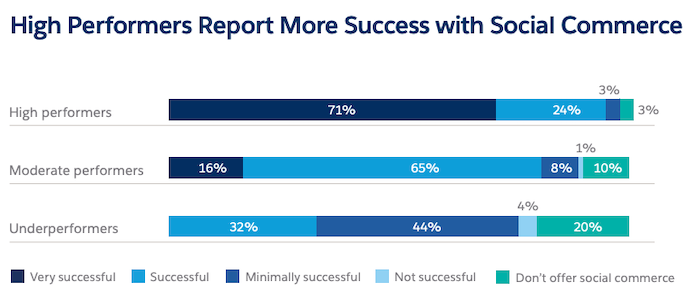

Social commerce is also breaking out in a big way. In Q2 of 2020, digital traffic from social media referrals rose by an impressive 104% year-on-year. But leveraging the power of social media isn’t as easy as it looks, especially for underperforming organisations that might not have the right technologies.

While high performers have been very successful in using social commerce, underperformers are struggling. In fact, 20% of underperformers don’t even offer social commerce.

B2C commerce future trends are creating a roadmap for tomorrow

The pandemic challenged businesses and industries around the globe, but few have been as affected as B2C organisations. They’ve embraced new D2C opportunities. In fact, 68% of consumers say they’ll continue to shop for essentials online, even after the crisis has passed.

The pandemic also prompted businesses to rethink the role of the physical shop. By moving away from the store being just a purchase point, and re-imagining it as a tactile showcase for products, B2C operators can become stronger, more agile and resilient than they were before the crisis.

By optimising their ecommerce platforms and digital channels to provide connected experiences, B2C organisations will be prepared to meet the needs of their customers.

Download the State of Commerce report here.