Lots of companies spend their time responding to lucrative requests for proposals (RFPs), but Kathryn Bennett suggests they could win more of them by asking themselves a few questions first.

The director of RFP Excellence at Canadian-founded Loopio — which provides software to assist with proposal responses — knows North-American small and medium-sized businesses (SMBs) would like to win more of the bids they submit.

The problem is that they see so many dollars available through procurement offices that they develop a fear of missing out.

“They see all these potential RFPs out there, all these dollar signs, and they feel they need to chase all of it. This means teams are spending time responding to ill-fitting opportunities,” Bennett told Salesforce Canada in a recent phone interview. “Instead, consider what gates your teams have established -- or need to establish -- in order for opportunities to progress through your sales funnel. That’s where you get the wins.”

Loopio refers to those “gates” as a “go/no go” decision framework that SMBs use as a strategic lens to pick the RFPs that fit with their mission and capabilities. Developing a go/no-go framework also requires figuring out how much time and effort your firm typically puts into bidding on an RFP, what your customers are looking for and what the return on that investment could be if your firm gets picked.

“Having that clarity upfront keeps you from the waste that plagues most organizations,” Bennett said. “Large companies may be able to absorb those costs, but for small companies, putting in $5,000, $10,000 into an RFP and losing? That can be a huge shock to the system.”

A close up look at RFP trends

SMBs might be understandably late to realize what kind of data they need in this area, which is why Loopio has provided them help via its recently published 2021 RFP Response Benchmarks & Trends Report.

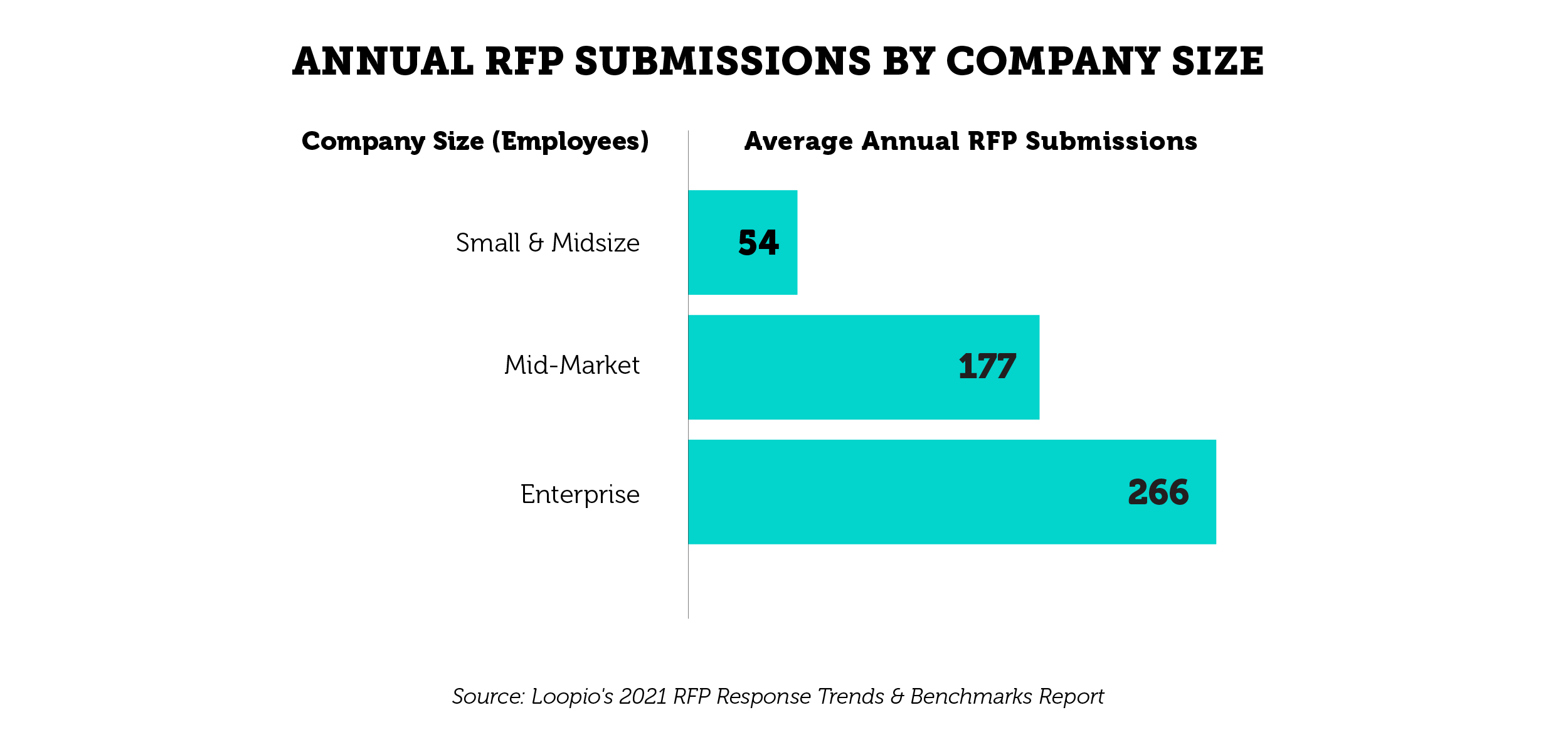

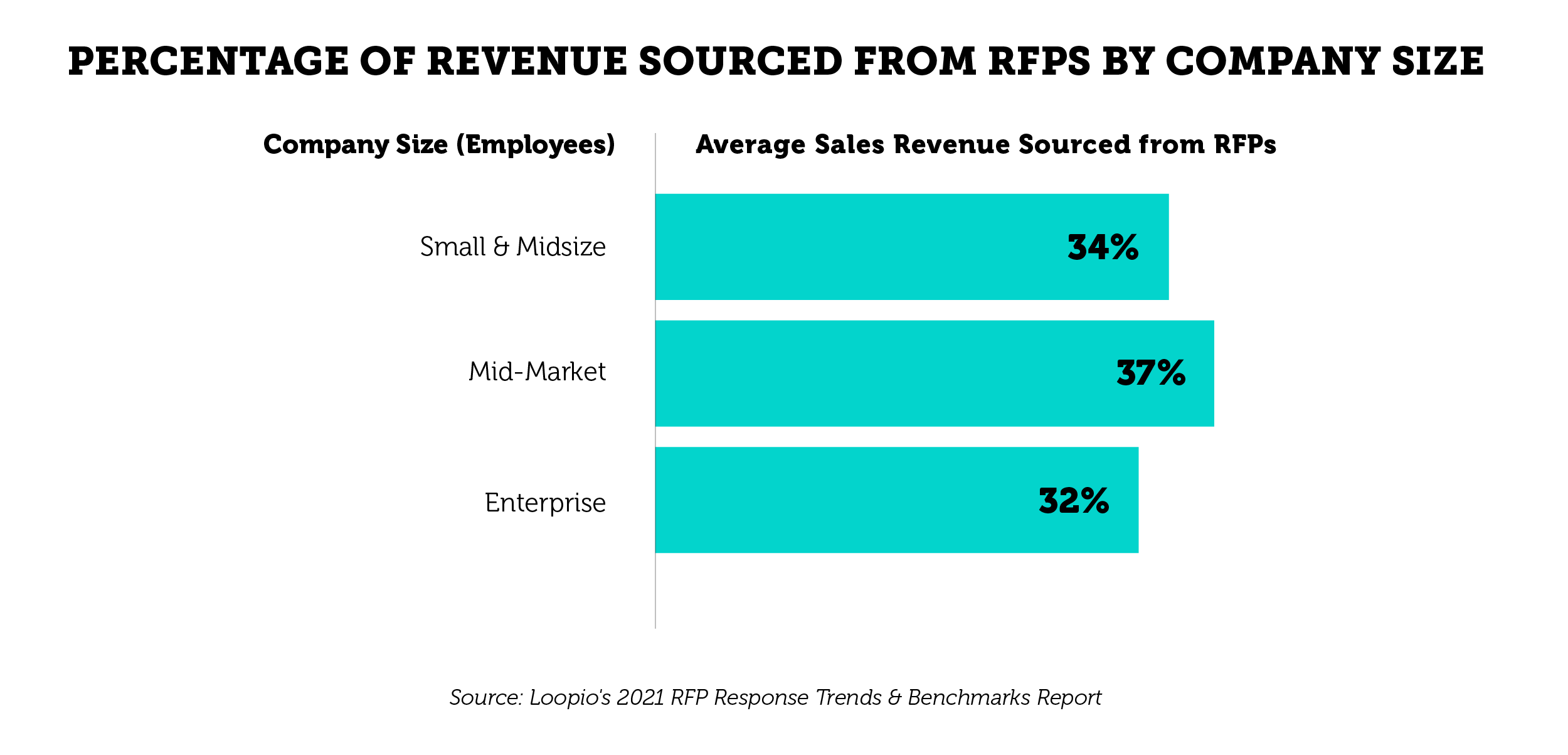

Based on data collected from more than 650 RFP teams spanning more than 15 industries across North America, Loopio’s research drives home the importance of RFPs in helping meet growth objectives. It also shows that SMBs in particular may need to adopt some suggested best practices.

The data shows, for instance, that 32 per cent of small and mid-sized teams win fewer than 35 per cent of their bids. Yet Bennett suggested just a cursory glance at public sector RFP sites like Merx can illustrate just how big the opportunity for Canadian companies can be. In fact, Loopio’s report showed that on average, RFPs can generate up to 34 per cent of annual revenue for SMBs.

“If you want to become a supplier to large organizations, RFPs are kind of a requirement,” she said. “You need to be sophisticated enough as a sales team to deliver high-quality RFPs. If you’re rapidly-growing and you’re not building that skeleton, your sales engine could suffer.”

Building upon digital adoption

Beyond the tips outlined in the report — such as involving more stakeholders and focusing on writing a higher-quality response — Bennett said Canadian firms should recognize proposals as another area where adopting digital technologies can dramatically boost their speed and overall results.

Loopio, for instance, has gone through its own digital transformation by adopting Pardot to manage marketing campaigns, DocuSign to streamline contract processes and Sales Cloud to capture leads and support opportunities. Salesforce CPQ has also made it easier to bring greater transparency to Loopio’s customers around pricing and upgrades.

Lots of companies have adopted a CRM like Sales Cloud to become a central hub for all the data related to a deal, of course, but Bennett said RFP-related information is often still lost in a sea of document files, spreadsheets or even sticky notes. Loopio’s software is helping companies tackle that problem. In fact, 69% of top performers report having an RFP response solution. In doing so, its customers are achieving many of the same benefits around managing RFP data that Salesforce pioneered in areas like sales, marketing and service.

Even better, tools like Loopio can now be used in tandem with Salesforce to offer a picture of how RFPs are tied to deals and revenue. Bennett saw this first-hand in a previous role, where she was also a Salesforce user.

“What I loved about Salesforce is how it helped me identify the transition points where the RFP was positively or negatively influencing the sales process,” she said. “We were able to measure how many RFP opportunities we were able to actually close versus how many we just got to the demo stage on, and then we could troubleshoot our sales processes.”

Bennett even suggested a protip: using the date function in Sales Cloud to track everything from when an RFP process starts to how long it took to complete and other milestones along the way. Competing on RFPs is often a very linear, detail-oriented project, so even simple features like this can really help with visibility on how RFPs impact the sales cycle and overall revenue.

Although the pandemic took an economic toll on many industries, Loopio believes a lot of what appeared like lost revenue may be simply delayed. This is all the more reason for Canadian SMBs to arm themselves for more wins.

“Investing in the right tools will help you get to your goal in 2021,” she said.