Get your FREE 30-day trial.

Start by selecting a product:

Banks, like most companies, face an urgent imperative to reimagine themselves and seize new growth opportunities.

Most bankers surveyed by PwC view attracting new customers as one of their top challenges. However, banks also recognise the need to deepen their customer relationships and focus more on customer profitability. Hence, enhancing customer experience is the number one investment priority for banks globally.

This renewed focus on customers is crucial, because only 27% of customers surveyed by Salesforce describe the financial services industry as completely customer-centric. Similarly, only 27% feel that financial institutions provide great service and support.

To close these gaps and improve customer satisfaction, banks need to embark on a transformational journey. This means making everything customer-centric: from marketing and sales, to service and digitalisation. When you start with the customer and work backwards, you will be better-positioned to deliver incredible experiences that build brand loyalty and drive revenue.

Here are five ways to build this kind of customer-centricity:

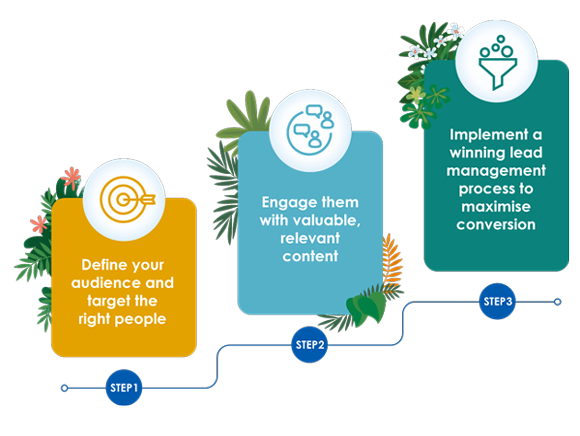

To attract new customers, your marketing campaigns need to reach audiences that are actually interested in what you have to offer. The first step in that direction is to define the right audience by combining:

Together, these insights can help you zero in on the best-fit prospects for your bank, and then target them on the channels and devices they prefer.

Once you’ve gained a prospect’s attention, start building a relationship of trust with them. Provide meaningful, useful, and engaging content in exchange for the customer’s personal data. This, in turn, will help you personalise their experiences further.

Next, create an appropriate internal sales cadence. Set up automatic notifications to help sales reps determine when to email a prospect, when to call, when to wait, and more. This streamlined workflow can help reps maximise conversions, and ensure repeatable sales success.

Being truly customer-centric is about knowing your customers in-depth. Build a 360-degree view of each customer, including needs, key life events, products portfolio, circle of influence, complaints filed, satisfaction level, etc. The more you understand your customers, the better you can anticipate and meet their needs.

Being customer-centric is also about making the customer experience as frictionless as possible, from onboarding to servicing and beyond. Empower your teams with all the customer information they need at their fingertips, so that they can serve customers seamlessly.

When everyone in your organisation has a single source of customer truth, then it won’t matter that your customers are interacting with different teams or lines of business. They will experience your brand as a single, unified entity across touchpoints.

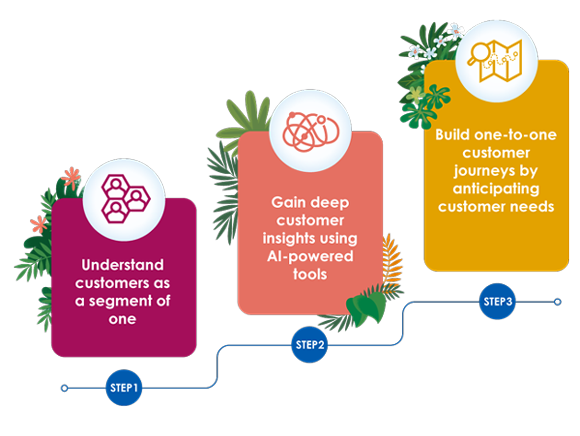

Today’s customers expect hyper-personalised experiences. That means understanding each customer as a segment of one. A unique individual whose personality, lifestyle, preferences, needs, and environment are constantly evolving.

The challenge is to enable this kind of personalisation at scale. Artificial intelligence-powered tools can help by swiftly processing customer transaction history, digital behaviour, channel preferences, life stages, and other data. With the resulting insights, you can predict the needs of each customer, and determine the best way of serving them.

Let’s say you roll out a new offer or marketing message based on your customer insights. To ensure that it translates into the desired customer action, focus on building personalised customer journeys. This set of tailored customer experiences can help you reach customers through the right channels, at the right time, encouraging the desired response.

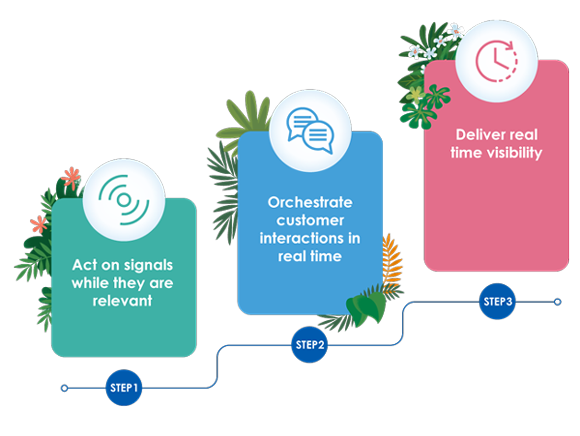

Customer insights usually have a short life. So, it’s important to evaluate and act on them while they’re still relevant. Interactions need to be analysed in real time to deliver personalised customer experiences.

Once you do that, track how the customer responds. Use artificial intelligence to infer their intent. Then, re-adjust your customer interaction strategies in real time.

Try and transform each touchpoint and interaction into an opportunity for a meaningful customer conversation. For example, if a customer is accessing knowledge articles around closing a fixed deposit on the bank portal, you could analyse this web behaviour in real time along with signals from other customer behaviour (provided that the customer has consented to this data being used). If a customer is exploring the best credit card options via a bank’s online chat, a next best offer such as “the credit card with the highest cash back” can be generated and sent to the customer via a message, in-app notification, or on any other preferred channel.

Finally, measure the impact of personalised communication and offers on your KPIs. The more real-time metrics you have, the faster you can fine-tune and personalise customer journeys to deliver greater satisfaction.

Open banking is an opportunity for your bank to keep customers at the centre, and offer them more choices, convenience, and personalised experiences. You can do this by opening your application programming interfaces (APIs) to third parties to access your data or functionality.

You can choose from either of two open banking approaches.

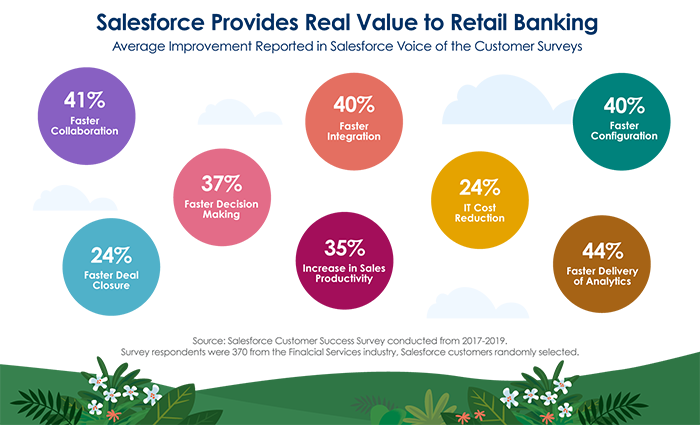

Salesforce enables you to delight customers by putting them at the centre of your business. With our Customer 360 platform, you can listen to customers better, anticipate their financial needs, and deliver seamless experiences at every touchpoint.

Rich customer profiles and smart insights help you identify new opportunities to deepen customer connections, and convert more leads. Meanwhile, powerful collaboration tools and artificial intelligence help your teams work faster and smarter to get things done.

Learn more about Salesforce for retail banking.

This post originally appeared on the I.N.-version of the Salesforce blog.