Salesforce recently sponsored an Innovate Finance event. This explored fintech as a force for good. Salesforce’s Ryan Joyce, Head of FinTech UK&I, joined the panel and discussed sustainable finance. You can find his summary of the event’s key talking points below.

In a capitalist society, behavioural change is often driven by financial incentives. That’s why sustainable finance is essential to address climate change. Financial institutions can divert funds towards companies that are Net Zero (or transforming to get there). Financial institutions can also incentivise consumers to make eco-friendly decisions. This increases momentum.

But getting investment in sustainable finance can be challenging. Financial services are not required to allocate capital towards green companies. And it’s not known whether Net Zero investments provide better or worse returns, which is a significant motivating factor. Plus, collecting accurate Environmental, Social, and Governance (ESG) data is difficult. Businesses aren’t required to submit full data sets. Because of this, there is no consistency in how ESG providers collate data and use scoring models.

Sustainable finance requires alignment around policy, data, and technology. Read on to discover the changes needed for sustainable finance to succeed.

How policy can contribute to sustainable finance

Government regulation is needed to improve the sustainability of lending, investment, and underwriting decisions.

The COP26 summit has enhanced the urgency of changes. But while there are positive signs, it’s still unclear what will happen.

One early sign that policymakers are taking action is the EU’s Sustainable Finance Action Plan (SFAP). The EU is examining the role of sustainable finance in support of the European green deal. The SFAP is a set of measures used to regulate banks, insurers, and asset managers across the EU. It should divert more capital towards sustainable investments. This regulation will also reclassify existing funds. This will reduce greenwashing, which is when things appear more sustainable than they are.

The UK will have its own taxonomy to tackle greenwashing. This will increase awareness of the environmental impact of financial decisions. It will also support investments in sustainable projects. This will be designed by The Green Technical Advisory Group (GTAG), which is chaired by the Green Finance Institute.

Meanwhile, the German regulator BaFin has released a draft regulation that would require banks to focus 75% of their lending portfolio on sustainable companies. This means that companies would need to prove their ESG credentials when applying for a loan. And banks will be restricted from lending to companies that don’t meet the criteria.

Another potential policy change that will impact sustainable finance globally is compulsory Task Force on Climate-related Financial Disclosures (TCFD) reporting. The Michael Bloomberg-chaired task force has developed a framework for disclosing climate-related risks and opportunities. It’s expected that this framework will be mandated.

Sustainable finance policy will also be determined by governments setting Net Zero targets. The US and the UK are leading the way with these commitments.

At the moment, reporting on sustainability is optional. Once policy makes this compulsory, businesses will have to provide accurate data. And it’s accurate data that is crucial for sustainable finance to grow.

Why accurate, consistent ESG data is key

There are many challenges in collecting consistent ESG data across over 125 providers. The lack of policy is a large part of the problem. Because of this, there is no set standard for ESG reporting.

Even across the top four reporting providers, there is only a 0.53 correlation, according to State Street research. The different measurements make it difficult to compare ESG credentials.

It can also be hard to know if data is accurate as companies submit it directly themselves. As businesses are not required to report on all measures, they can omit information. What’s more, private companies are not required to report at all — only public companies have an ESG score.

ESG scores are subjective. Data providers use different scoring models and data is not shared. It’s also complex to build holistic scores of the end-to-end process in the supply chain. A full score comprises three scopes:

Scope one: Direct — such as emissions from finished products, including distribution, travel, and transport

Scope two: Indirect — this may be energy required to power and cool factories

Scope three: Supply chain — this includes the mining and sourcing of raw materials

While most businesses can work out the emissions used in scope one and two, it’s harder for scope three. Scope one and two are within a company’s control, whereas scope three is usually handled by someone else. Because of the lack of policy, downstream suppliers are not motivated to collect and share data.

Another setback is that ESG data is currently held by companies as proprietary. Gavin Starks of Icebreaker One, who also joined the Innovate Finance panel, wants to improve data transparency. One project that Icebreaker One has worked on is Open Energy. This aims to create full transparency of energy generation and consumption.

The implementation of policy would regulate the industry. Mandating standard frameworks and metrics used would improve data consistency. And policies can also enforce companies, including downstream suppliers, to share data. Technology has the power to transform a business’s sustainability, but it needs data.

ESG analytics technology needs accurate data

Technology can play a greater role once policy and data challenges are addressed.

Salesforce can help businesses understand how sustainable they are. But all ESG analytics and insights are based on the information available. To get the most out of Salesforce, you need accurate data. And once you have the data, Salesforce makes it easier to analyse — and act on.

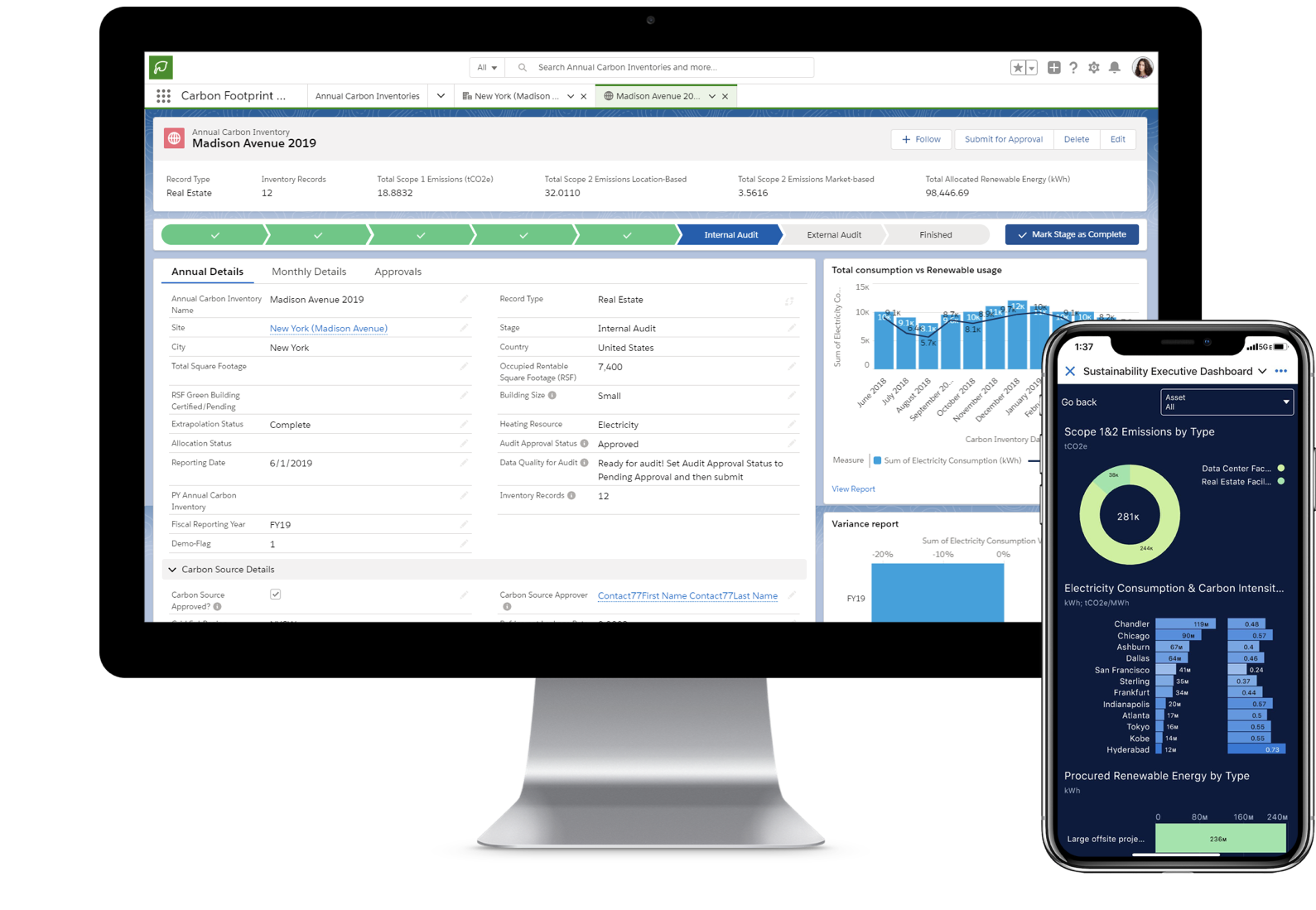

Sustainability Cloud helps businesses with carbon accounting. It removes the need for manual data collection. Instead, businesses can track energy consumption, travel, and the impact across scope one, two, and three with ease. Sustainability Cloud provides granular insights, trends, and competitive benchmarking. This encourages companies to take action. Measurement leads to change. Since measuring, Deloitte reduced emissions by 20% across over 330 thousand employees within a year.

Tableau CRM for Financial Services is another Salesforce solution that supports sustainable finance. It offers real-time analysis of sustainability across your credit or investment portfolio. It features rating history, comparison to competitors, related news articles, stock prices, and a deep dive into ESG scores. On a macro level, banks can assess the sustainability of their lending and investment across their portfolio. While on a micro level, bankers have actionable insights to tell their portfolio companies.

Looking into the future, blockchain, the Internet of Things (IoT), and artificial intelligence (AI) will all play a bigger role. These technologies offer a deeper insight into the supply chain. By enabling granular measurement, there will be greater supply chain transparency and traceability.

An example of this in action is HiveOnline. This uses blockchain insights to help agricultural co-operatives track sustainability, production quality, and yield.

There are many blockchain pilots, such as the TradeLens platform developed by Maersk and IBM. Blockchain pilots like these can:

Improve agriculture traceability by connecting information to farmers’ digital identities

Reduce inefficiencies in container shipping with updated shipping and logistics software

Create transparency in supply chains for consumer goods by using mapping to improve ethical sourcing

There is huge potential for technology to speed up sustainable finance. But it’s only possible if accurate data is available. And policy is required to create consistent standards of ESG data.

How Salesforce is supporting sustainable finance

Salesforce solutions, such as Sustainability Cloud, are helping businesses reach their sustainability goals. And as a business, Salesforce is committed to sustainability too.

Salesforce is one of 22 COP26 partners. We support the 1t trees foundation, and our employees have pledged 100 million trees by 2030. Salesforce Ventures has also launched a $100 million fund to support cloud companies. This fund is to address some of today’s most pressing needs — including climate action.

Businesses can drive change. Salesforce is Net Zero and we want to help every company reach Net Zero, faster. That’s why we have a climate action plan.

Want to start measuring your climate impact? Find out more about Sustainability Cloud.