An article written by The Economist Intelligence Unit

The digitisation of customer interactions requires customer services professionals ― and the executives who lead them ― to refocus their skills development.

The mass adoption of digital channels, from online sales to social media, should be an opportunity for companies and their customer service representatives to get closer to their clients. Yet many customer services leaders in Western Europe remain uncomfortable with digital disruption.

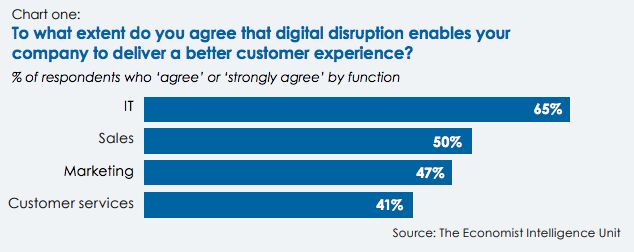

In a survey conducted by The Economist Intelligence Unit, just over half of all customer services leaders believe digital disruption has affected their companies in the last three years (54%), roughly in line with their colleagues surveyed in sales and IT functions. Unfortunately, they are less likely to say that it enables their companies to deliver a better customer experience (41%) than other departmental leaders included in the survey (sales, marketing and IT, see chart one).

Fewer still, less than one in ten (9.5%), “strongly agree” that their companies have adapted well to the challenge.

Justine Haworth, HSBC’s global head of digital engagement, is more positive. She believes that digital technology can enhance traditional frontline service roles, not threaten them with extinction.

Ms Haworth is a digital veteran, having introduced the first feature phone mobile banking app at First Direct years before the iPhone was even invented. Today, at HSBC, she is driving customer adoption of new ways to bank.

“Digital has been around for much longer than people might imagine. It started as something that was very small scale, the icing on top of the cake,” she says.

Today, most customer transaction activity, such as checking balances or moving money, is digital. That has freed up frontline staff, allowing them to take on more complex challenges, she says.

An inward perspective

Yet throughout the EIU survey, there is a sense that customer services leaders have a more inward-looking view of the impact of digital on what they do and their career development.

They are less likely than their colleagues in marketing, sales and IT to expect more disruption in the next three years (49% v. 54%, 56% and 59% respectively) in the next three years. They are also less likely to feel the need to network more with other colleagues (29%) and less confident in their own ability to do so (25%) when required.

Again Ms Haworth disagrees with the glum perspective of executives in her field.

In banking, as in other industries, digital was initially distrusted by traditional customer-facing staff in branches and call centres. Every customer and transaction moved online could mean branch closures or even job losses. That notion is outmoded, thinks Ms Haworth. Customer services, IT and distribution channels have to merge because that is what customers want.

“It is an understandable concern for our contact centre and branch distribution channels. The fact is the role of our frontline colleagues is as relevant now as it has ever been,” says Ms Haworth.

“The whole concept of working in silos is no longer relevant or viable. Actually, customers expect and need us to respond to their needs very quickly across all channels,” she adds.

That means that individual units must collaborate far more intensely than in the past. By working together, customer services, marketing, technical specialists, risk and human resources can accelerate new developments and knock down barriers.

“More recently, the organisation has woken up to the real implications of digital. We have become much more serious about the role that digital plays in our distribution and customer service model,” says Ms Haworth.

A sizeable minority of customer services leaders feel their departmental responsibilities have begun overlapping most with those of the sales function (37%). Although service executives believe cross-departmental responsibilities are merging to a lesser degree than their colleagues, they realise they have to get a better feel for how other functions work. A majority (81%) appreciate the need to collaborate with and understand the sales function; 70% feel the same about marketing.

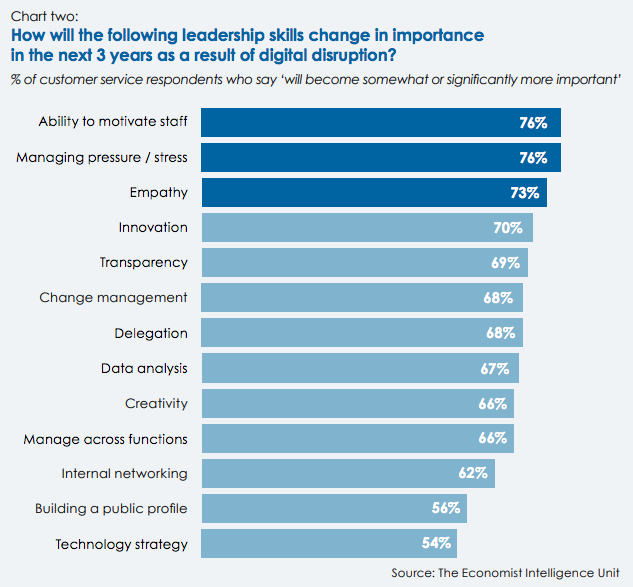

Nonetheless, customer service skillsets are changing. Leaders place more emphasis on soft skills such as empathy (36%) and creativity (36%) than their colleagues in IT (22% and 27% respectively). Hard skills are less important. Just 11% agree strongly that they need more digital skills and technical knowledge (see chart two).

HSBC is tackling the impact of digital head on. Ms Haworth’s role has expanded to ensure that staff understand new digital services and their benefits, for customers and employees alike. The bank even has a frontline training programme to build staff knowledge of digital so colleagues can help customers make the digital switch.

“We have to leverage that human interaction to support the move to digital,” says Ms Haworth.

Biometric identification is a good example of how staff can benefit from digital too. As customers no longer need to negotiate passwords and security questions, call centre staff get to deal with their enquiries faster and more effectively. The bank has also introduced biometrics more quickly into new geographical markets as colleagues share experience and expertise, says Ms Haworth.

The key to making digital strategies work for staff and managers is education and training, she believes. As repetitive and transactional workloads decrease, companies must empower all to upgrade their skills and professional qualification.

As staff deal with repetitive transactional tasks less often, they have time to address more complex customer needs. To do that effectively, they need training and a clear career path.

“It is about upskilling our frontline. If you work in a branch or call centre, you will be upskilled to deal with customers with more complex financial planning needs. We want them to have more rewarding work,” says Ms Haworth.

The bank has also introduced specific role disciplines for head office staff who design the products and services that frontline staff deploy. The formal structures allow any member of staff or management to build a career in digital, not just those who currently work in the IT environment.

“If you currently work in marketing and want to be a digital product manager, we now have a very clear role discipline, training and distinct career paths,” says Ms Haworth.

HSBC may be an exception for now, unfortunately. Our customer services survey respondents feel they have a lesser role in steering the company through the digital overhaul. Just 21% of our respondents feel strongly that customer services leaders are asked to help develop repositioning strategies. And 16% say they are cut out of the process altogether.

To climb the executive ladder, customer services leaders see more opportunities in moving to a different company that appreciates their existing expertise (35%), than taking on a new role with their current employer (15%).

For many, it seems that the digital customer services revolution is on hold.

Download the full report to gain actionable insights in to how digital disruption is affecting your career path: Building Leaders without Silos