The Indian insurance sector has traditionally followed a product-centric model where the agents are the face of the company; the experience with agents represents the larger experience with the brand. With very few communication channels available to them, customers were often apprehensive about digital modes and preferred the human touch.

Recently, privatisation and the rise of digital ecosystems have seen the insurance industry evolve to meet the demands of younger and digital-first consumers. These consumers want a personalised discovery-purchase-renewal experience on par with fintech-and neo banking apps. Accordingly, insurance providers are leveraging digitisation and automation to create immersive customer experiences, reduce costs, and achieve efficient business growth.

5 ways insurance companies can leverage technology for enhanced customer experiences

1. Personalise to improve customer journeys

Collecting high-value data at every touchpoint of the insurance buyer’s journey goes a long way in ensuring an excellent customer experience. For example, IoT-powered devices such as fitness trackers and wearables can be used to support existing customer data. The user patterns gathered from these devices could be used by health insurance providers to customise offers. Such contextual and quality customer data can be used by insurance providers to:

- Create custom solutions and policy offers. Using AI, companies can build risk profiles instantly, price premiums based on this risk, and offer personalised solutions to customers.

- Provide financial advice at key milestones of the customer’s journey to build a long-term relationship

- Tweak messaging to make it more personalised and relevant, basing it around key life moments, customer aspirations, family structure and more

A CRM solution focused on insurance service providers, such as Salesforce Financial Services Cloud, integrates customer data from multiple sources to create a single source of truth. With Financial Services Cloud, sales and service reps have access to detailed customer profiles and receive alerts on life events and milestones. This enables agents to engage in meaningful and personalised conversations with clients across any device, transforming them from insurance agents to financial advisors.

2. Simplify decision-making with real-time guidance

Most insurance customers, whether first-time or repeat, find that navigating the overwhelming amount of information available is challenging. Tech-based solutions, complemented with the reps’ knowledge, can simplify claims processes and documentation and provide better product understanding. This helps simplify the insurance experience at all stages- from exploration and purchase to renewal.

Financial Services Cloud can help smoothen the process of knowledge transfer from agent to customer by:

- Creating platforms optimised for product search according to client criteria, or to aid self-service. Customers can explore product lines, compare features, quickly access information about specific insurance policies and gain necessary clarity before making a purchase.

- Enabling companies to deploy AI-enabled chatbots to answer routine questions

- Letting service agents access previous interactions to easily clarify customers’ doubts, or prioritise tasks based on case urgency. Customers can also use an SOS button to communicate directly with a service rep in case of an emergency.

3. Make it easy for the customer to reach you on the channel of their choice

4. Simplify operational processes and claim clearance with AI and automation

Tech-enabled prompt claim clearance has a direct and positive effect on customer experience. For example, AI and ML-based algorithms can be used to scan and interpret huge volumes of data to streamline claims processing and provide faster settlement to customers.

Financial Services Cloud can help reduce claim handling and processing time through

- Automation of underwriting and claims processes

- Easy access for sales teams to tools like premium calculators

- Virtual submission of claims documents and relevant transaction details

- Easier regulatory compliance, greater coordination and reduced error incidences

- Self-service facility for customers to resolve queries

5. Optimise distribution efficiency for a customisable user experience

With higher distribution efficiency, insurance becomes a pull product, creating more room for quality customer experience that focuses on reducing customers’ risk sensitivity, boosting overall trust in the insurers and their offerings.

Appropriate messaging across channels, self-service models, and straightforward insurance products help boost direct distribution without intermediaries. In addition, marketing automation and conversational customer interactions can help build better networks for boosting policy sales.

Use Salesforce to enhance customer relationships in the insurance sector

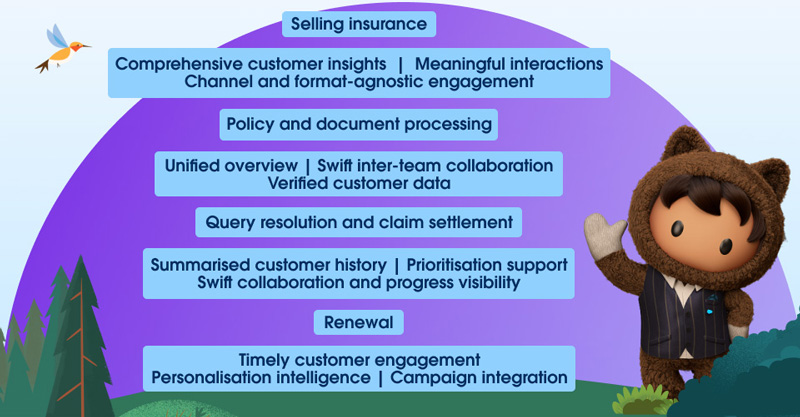

Financial Services Cloud: Enhancing productivity at every stage for insurance agents

Make customer experience a key driver for your growth

Read more about how technology can be used to simplify processes and boost revenues in the insurance sector.

A new day for Indian insurance with customer-centric technology

Using technology across touchpoints for a digital-first customer insurance journey

Why it might be time to automate your insurance claims experiences