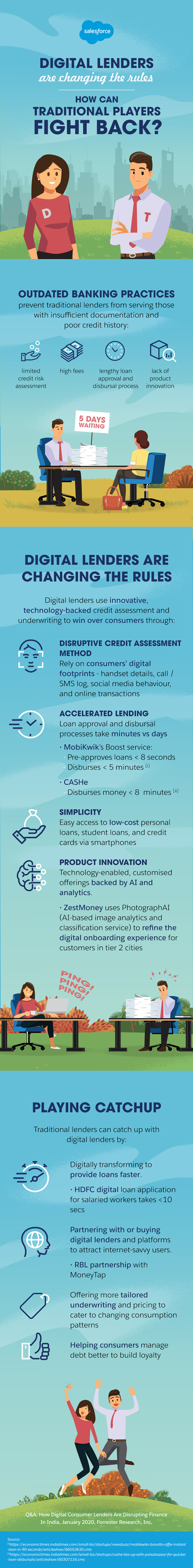

Traditional banks in India have a wider reach compared to other institutions. But their products and services are still inaccessible to 190 million Indians. In this scenario, digital lenders have emerged as a ray of hope for the unbanked and the underbanked - people living on the fringes of the society, small-scale businesses, and educated youngsters with limited or no credit history.

Modern-day banking rejects the typical lender-borrower relationship for an amicable partnership. Future-looking lenders must emerge as enablers, invested in the growth of their consumers. For this, lending institutions must commit to digital transformation to add speed, scale, and transparency into lending practices.