Capital investments on the horizon? Real-time visibility can bring faster time to value

The need for new investments in the energy industry is rising. The current environmental, economic, and geopolitical landscape brings new pressures and opportunities.

Global sustainability demands play an important role, increasing the need for capital spending. According to McKinsey, reaching net-zero emissions by 2050 will require $9.2 trillion in annual average spending on physical assets, $3.5 trillion more than today. Think of programs to reduce gas emissions and increase the production and distribution of clean energy.

The question is, how can energy companies modernise the energy system while creating value for all stakeholders? Salesforce has leveraged its industry knowledge to build a unique, dedicated solution that can help energy companies innovate while meeting customer demands, increasing customer service, and controlling costs.

Let’s take a deeper look at the challenges and opportunities.

Why does the energy industry need to improve investment productivity?

Energy companies have increasing capital investment needs to contend with. Existing infrastructure need to be replaced, renewed, and expanded. For example, nearly half of the United States' existing natural gas infrastructure was built before 1960. Production needs are higher and require more resources.

At the same time, better capital allocation is vital as energy companies are facing tighter margins. There are limitations with space, raw materials, equipment and labour, all of which need to stay affordable. In addition, energy companies can face slow approval processes that hinder productivity.

And, finally, more regulatory scrutiny is now in place. While this is definitely a positive development, it does come with more challenges. Investment planning and execution need to have greater visibility to make sure the process meets all the requirements. New or increased sustainability reporting requirements need to be met. Access to capital is also tightly linked to sustainability performance, which provides a perception of environmental risks.

Roadblocks to delivering investment programmes

The investment delivery process can consume a lot of time and money. Without a digital solution to help centrally manage a large portfolio of projects, it’s common to see the following roadblocks:

A lack of real-time end-to-end visibility over the entire cycle that would allow for more effective risk mitigation and early detection of delays.

Inadequate feedback loops between the different phases of the process. This can compromise effective decision-making.

Poor coordination across functions and functional silos. This leads to an ineffective flow of information.

Disconnected IT systems and low process automation. This often means the entire cycle faces time delays, and the process can’t leverage data to become intelligent.

The answer to clearing these roadblocks, and in the process unlock new opportunities, lies in technology. A solution with advanced digital capabilities that can make sure investment deployment stays on-time, on-budget, and on-spec, by:

Improving project selection through the use of advanced analytics and data visualisation techniques.

Enhancing project execution through the use of digital technologies such as automation and IoT (Internet of Things).

Implementing better performance monitoring and optimisation through the use of advanced analytics and machine learning.

So investing in the right tech, a solution that solves specific challenges and allows the capture of innovation opportunities, is important. And even in times when budgets are being tightened, spending on tech can be a valuable investment. For example, companies across industries and regions are experiencing a 25% saving on IT cost and 26% increase in employee productivity using Salesforce digital solutions. (Source: 2022 Salesforce Success Metrics Global Highlights study. Data is from a survey of 3,706 Salesforce customers across the US, Canada, the UK, Germany, France, Australia, India, Singapore, Japan and Brazil conducted between June 8 and June 21, 2022. Results were aggregated to determine average perceived customer value from the use of Salesforce. Respondents were sourced and verified through a third-party B2B panel. Sample sizes may vary across metrics.)

Even besides the cost savings, technology will provide first movers a significant competitive advantage in speed, productivity, and access to increasing infrastructure opportunities over those who do not.

Salesforce Capital Investment solution

Salesforce’s digital Capital Investment solution ensures faster time to value and helps avoid cost overruns by making it easier to manage investment programs and related projects. And it doesn't matter how many projects are happening at once, it streamlines every part of the process and improves capital productivity.

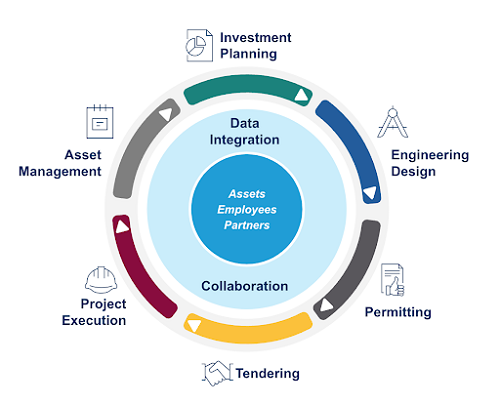

One component of the solution is an end-to-end capital investment console. This manages the complete journey, giving essential real-time visibility across the whole capital investment cycle. It also breaks down those silos by integrating all project data in one central location. This means stakeholders can more easily collaborate, no matter which part of the journey they’re working on.

The second component is made up of flexible, tailored digital solutions that contribute to each individual phase of the capex cycle. Each one makes its stage of the process easier and more efficient, allowing vertical deep dive analysis on planning, permitting, procurement, execution, operations and maintenance.

For example:

Investment Planning increases forecast accuracy by 15-20%

Engineering Design speeds up collaboration by 15-30%

Permitting reduces the time taken on admin tasks by 20-40%

Tendering lowers procurement costs by 3-5%

Project Execution boosts project productivity by 10-15%

Infrastructure Management increases resource utilisation by 20-30%

Sustainability improves time to carbon accounting by 70-80%

Whatever level of the process, Salesforce Capital Investment delivers tangible benefits. From capital investment to project to asset, the solution streamlines the entire cycle.

How Italgas benefits from the solution

As Italy’s leading gas distributor, Italgas was looking for a ‘single source of truth’ for its capital projects. After collaborating with Salesforce to put a Capital Investment solution in place, Italgas is projecting a 10-15% faster investment deployment.

Teams will be able to detect potential delays earlier thanks to end-to-end investment monitoring, and increase collaboration thanks to the connection of stakeholders and systems. Project planning will be easier thanks to the project single source of truth, with lessons learned and overall knowledge more easily shared. In terms of project execution, digitising the permit process will save time.

Deploying infrastructure projects at scale

The energy industry needs an agile and efficient way of deploying complex projects. Delivering benefits across the entire cycle, the Salesforce Capital Investment solution delivers a powerful Return on Investment (ROI). This is an addition to helping energy companies achieve their goals.

Check out our upcoming webinar - Deploying Clean Energy Infrastructure at Scale - The Digital Opportunity to find out more.