The rise in the cost of living, political concerns, and supply chain constraints continue to take their toll across the global retail landscape. According to the Salesforce Shopping Index, global online sales declined 2% year-on-year (YoY) in the third quarter of 2022. The number of digital shoppers (-4%) along with order volumes (-5%) were down from a year earlier, as consumers across the globe remain cautious about spending.

Meanwhile, in Europe, the impact of the war in Ukraine - which has driven up energy prices and in turn has helped drive inflation, economic uncertainty, and an invariably negative effect on consumer confidence - is very much evident. So, it is no surprise that this region's decline was a little steeper than the global average. Online sales across Europe in the third quarter of 2022 declined by 9% YoY, with order volume down 1%. Consumers in the region spent more on fashion - in particular Footwear (+18%), as well as Handbags and Luggage (+17%) - while the ongoing shift away from Toys & Learning (-22%) and Home (-19%) categories continued.

As we head into the peak shopping season, expectations are that there won’t be notable online sales growth over last year - if these Q3 results are anything to go by - regardless of the fact that peak season shopping has started earlier this year, much like we predicted.

For now, let’s dive into some of the specific countries to give us a better indication of how the peak season might play out.

Nordics

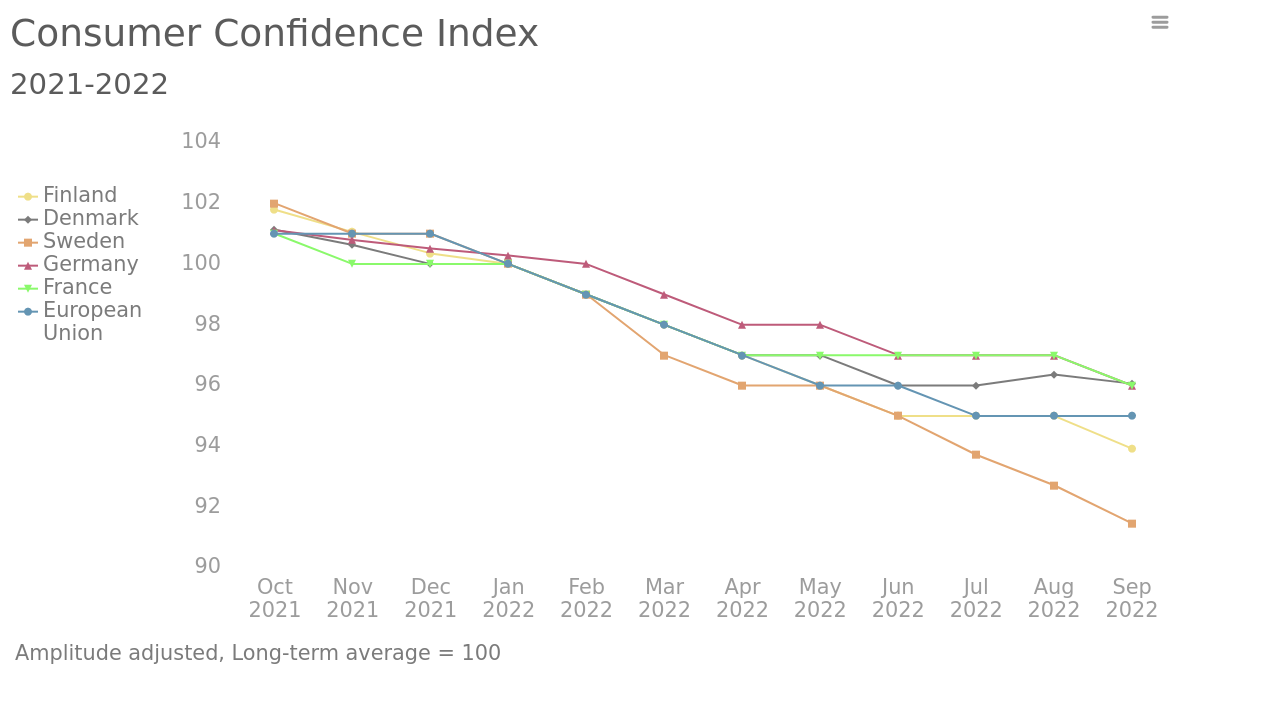

The Nordics saw the biggest drop in Q3, with online sales falling 21%, order volumes declining 12%, and traffic down 8%, compared to the previous year. That’s following the massive growth in eCommerce enjoyed by the region over the last two years. Despite a strong start to the year, data from the Organisation for Economic Co-operation & Development (OECD) shows that consumer confidence in the region - specifically in Sweden and Finland - is declining faster than in other countries in Europe, so no surprise that data from the RetailX European Consumer Observatory shows that online shopping frequency is also on the decline.

Source: OECD, RetailX

In addition, consumer spending patterns in the region have shifted more towards Fashion and Food and Beverages, and away from some big-ticket items such as Electronics, shows RetailX data.

UKI

The UK also had a hard time of it in Q3, with the country having to contend with the ongoing effects of Brexit, alongside a state of political flux and the aforementioned issues faced by retailers across Europe. Online sales in the UKI declined 13% YoY, order volume dropped 8% and traffic remained flat.

Navkinder Sanghera, Head of UKI Retail and Consumer Goods at Salesforce, summarises the UK retail landscape:

“As the aftershocks of the pandemic and rising inflation and interest rates persist, the challenges that consumers face continue to hamper spending. These headwinds are making it much more expensive and volatile to run a retail business too. This has put a renewed focus on the importance of digital technology to be resilient, and also create compelling and personalised customer experiences.

As we look toward the holiday season, leaning into data, analytics, and AI to connect digital and real-world customer interactions and adapt to shifting consumer behaviours must be top of mind for every business leader.”

Eastern Europe and Spain

All that said, there were some bright spots to be found across Europe in Q3. eCommerce in Eastern Europe grew 6% in the quarter and order volume was up a healthy 17%, despite a 2% decline in traffic. That growth can likely be attributed to notable hikes in nominal wage growth rates that have been seen across the region over the last few quarters, which translates to more discretionary spending. Oxford Economics expects that wage growth will remain high in the region, with the downside to that, of course, being that soaring inflation in the region will remain for longer.

Elsewhere, Spain continues to defy the trend in online shopping seen across Europe over the last couple of quarters. The country recorded a modest YoY growth of 2% in Q3, with orders growing a decent 17%. Overall traffic grew 10%, driven by an 11% growth in desktop and 10% growth in mobile traffic.

Shopping Insights HQ

The peak holiday shopping season is just around the corner and the stakes are high. Here at Salesforce, we’re committed to bringing you real-time data and insights to drive your business throughout the season. Check out our Shopping Insights HQ, where we’ll track shopping behaviour and sentiment throughout the season. From Halloween to Cyber Week and from post-Christmas to Valentine’s Day and beyond, this is your new one-stop shop for all things consumer insights-related.

Methodology

Powered by Salesforce platform data, the Shopping Index uncovers the true shopping story. We look at the previous nine quarters to uncover a deep understanding of how consumer behavior is evolving and how the market is moving. The Shopping Index analyzes the activity and online shopping statistics of more than 1.5 billion unique global shoppers from more than 61 countries. This battery of benchmarks covers both the recent history and current state of digital commerce. Several factors are applied to extrapolate macroeconomic figures for the broader retail industry, and these results are not indicative of Salesforce performance.