What is it that makes consumers stay loyal to their regular grocery store? What does it take to catch their attention and be tempted by somewhere new?

Shoppers know that their favourite store isn’t perfect, of course. But there’s only so much friction they’ll put up with before deciding to take their custom elsewhere. That’s why it’s crucial that grocery retailers and brands make understanding their customers a priority.

Internet Retailing and Salesforce surveyed 6,750 European grocery shoppers to find out what makes them loyal to their current store. The results delved into consumer thoughts and behaviours around grocery shopping.

Here’s what we uncovered, to make it easier for grocery retailers and brands to meet consumer demand in 2022.

Loyalty only has a certain amount of ‘stretch’

The truth is that many of us are creatures of habit. We get used to going to a certain store, buying a certain product, displaying a certain behaviour. It’s only when we experience certain levels of friction that we start to consider changing that habit. And choosing where to shop for groceries is exactly the same.

The research showed that 69% of shoppers say they are loyal to a particular grocery retailer. Switching grocers means changing a habit, so consumers would need a good incentive to switch.

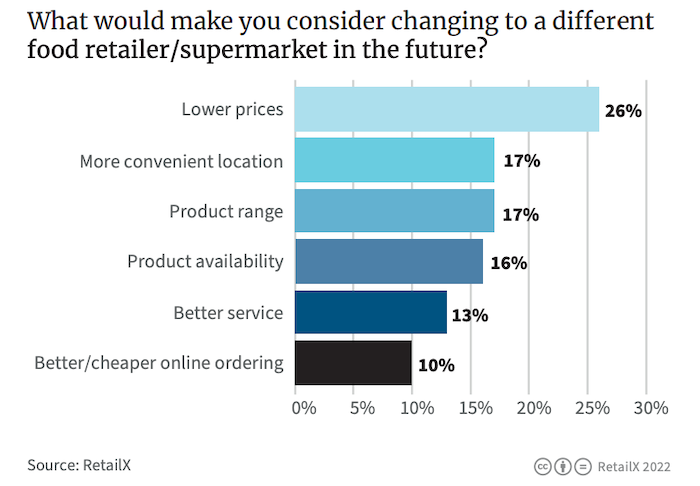

For most consumers, price plays at least some part in their loyalty to a particular brand. In fact, lower prices is the top answer to the question: ‘what would make you consider changing to a different food retailer/supermarket in the future?’

But despite coming out top, the percentage of survey respondents who answered lower prices was only 26%. We can see from those results that the question of loyalty is a lot more complicated than price.

Grocery store loyalty management starts with a robust loyalty scheme. The majority of European grocery shoppers (91%) are members of a loyalty scheme. They’re also willing to share information about their shopping habits through those schemes as long as they can see a benefit from doing so. In fact, only 8% don’t see the benefits of joining a loyalty scheme.

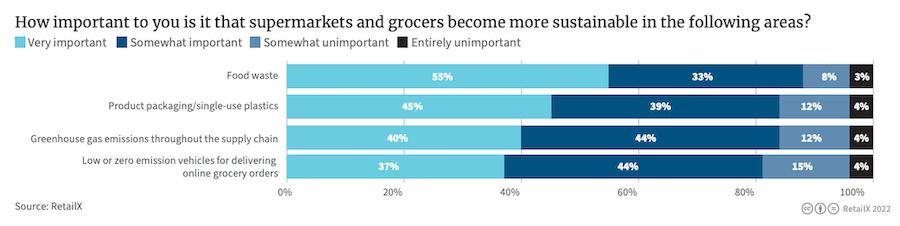

Sustainability matters to European grocery shoppers

Sustainability is currently and unsurprisingly a high priority for European consumers. In fact, 78% of them said they would switch to a new product, brand, or retailer if their regular one didn’t match up to their own ideas about sustainability.

We already know that sustainability drives loyalty. EU legislation only goes to highlight how important a change it is for retailers.

So the question is: are customers prepared to pay more for sustainability? The answer is that price often wins out here. The majority of grocery shoppers are unwilling to pay much more than they already do for more eco-friendly versions of their regular buys. Just under 40% are willing to pay up to 10% more and 26% wouldn’t pay more at all.

Retailers still control the relationship levers

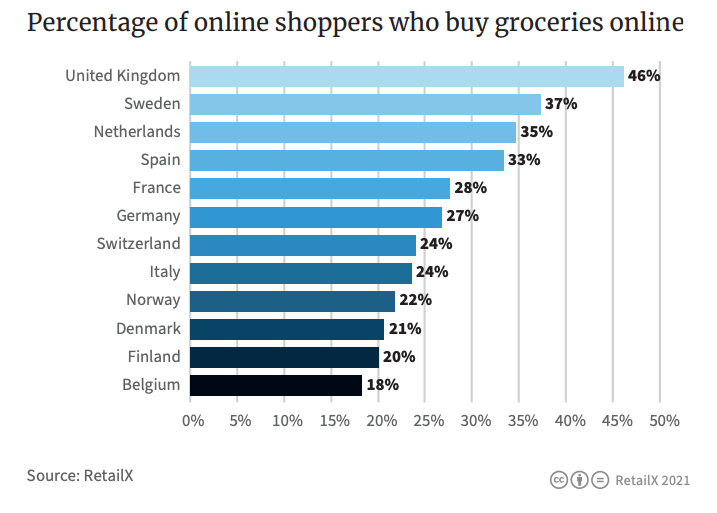

Digital adoption has accelerated rapidly over the past couple of years. This has improved the relationship between retail stores and their customers in many ways. We’ve seen more brands going directly to the end customer with their online offerings, using data insight as a tool to help them do this.

It’s crucial to use data to understand more about the consumer, particularly when they’re shopping online. By doing so, brands and stores can drive future growth. What’s apparent is that the majority of consumers (60%) prefer to shop with retailers rather than directly from the brand.

With the shift to online, brands have more of an opportunity to sell directly to the end customer, skipping retailers. Consider bulky, regularly purchased products like long-life plant milk, nappies, or toilet roll. They’re the ideal way of strengthening brand/customer relationships. Brands are able to better capture market share by using the right strategy.

We know that digital experience is key for any business, and it’s no different for European grocers and brands. As consumers continue to head online to shop, driven by the ease and connected experience they’ve come to rely on, retailers have to keep up to retain market share.

Brick-and-mortar stores remain king

Despite an online presence being crucial to success, many consumers still prefer to shop in brick-and-mortar stores for their groceries. We found that 34% of Spanish consumers, 32% of Italian consumers, and 26% of Swedish consumers say their preference is to only shop in brick-and-mortar stores.

It may be that it takes too long for their groceries to get delivered (14% of the surveyed consumers), or that the shop itself takes longer online (15%). Whatever the reason, brick-and-mortar stores offer factors like product availability, product range, and convenience that mean many consumers remain loyal to them.

It’s clear that today’s European shopper is looking for the right combination of digital service, convenience, and price. Grocery brands and stores now need to listen to consumer demand and use this insight to thrive and grow in the year ahead.

Learn more about the challenges and opportunities facing retailers and brands in the European grocery market.