Even before the social and economic disruption seen in the wake of COVID-19, customer expectations were shifting – fast.

Intelligent, connected, and personalised experiences were increasingly expected as standard, and were arguably just as important as product and service quality.

COVID-19 has accelerated this shift, leaving Small and Medium-Sized Enterprises (SMEs) in the UAE with little choice but to find innovative ways to transform business operations and drive business growth in an unpredictable new world.

In fact, it is the most pressing issue cited by UAE respondents in our Small and Medium Business Trends report – a survey of opinions and challenges from SME owners across EMEA.

We also learnt that many trailblazing SMEs in the UAE have managed to flourish since the onset of COVID-19. And they did so by first asking themselves this question:

“How can I rise to the challenge of changing customer expectations to drive financial growth?”

Financial growth and customer expectations

Financial growth and customer expectations are inextricably linked, and the pandemic has changed the way our customers behave.

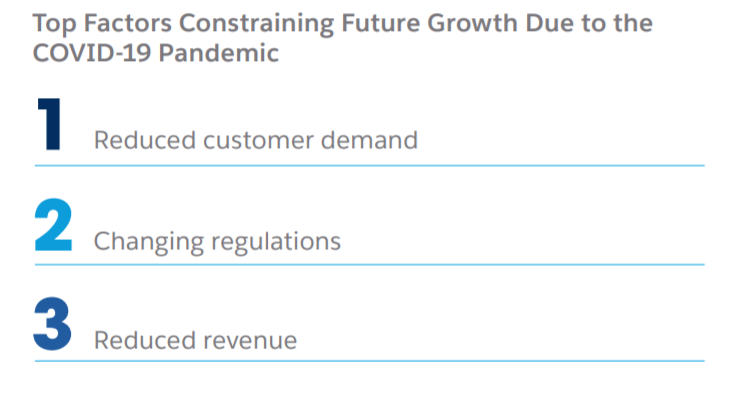

For example, according to our findings, UAE-based SMEs cited a decrease in customer demand as the top factor constraining growth when related to the COVID-19 pandemic.

This means there has never been a more important time to put the customer at the heart of your strategy. Especially as the nature of demand is shifting.

As the world went digital, customers began to expect more from their consumer interactions. ‘Why can’t my banking experience be more like my shopping experience?’, ‘Why can’t my shopping experience be more like my viewing on-demand experience?' and, at a more fundamental level, ‘Can I still feel safe in my consumer interactions?’

SMEs throughout the whole EMEA market who placed the customer journey at the centre of their thinking are optimistic about their future, with a remarkable one in four stating they are very optimistic in our survey.

That’s why we’ve drilled down into the three main challenges identified in our report — and how to tackle them. Not just to help you drive sustainable business growth, but so you too can experience the region’s growing optimism.

Meet customer expectations through innovation

Financial management and access to capital throughout the UAE became increasingly difficult in 2020. This made bringing innovation to the market a daunting and potentially risky prospect.

But inertia combined with lower demand and escalating expectations has led to some SMEs missing out on potential gains.

For example, SMEs in the UAE equipped with a modern CRM system cite being able to achieve:

Faster deal cycles

More sales leads

Better and faster customer service

It’s a growing trend: 64% of SMEs in the UAE now use a CRM system with 38% implementing their CRM during the past year.

By taking advantage of the connected insights enabled by your CRM system, you can accelerate innovation and identify the changes necessary to build resilience and seize new opportunities.

With the right data and insights at hand, you can also start answering once difficult questions like:

- Do our business operations help us meet customer expectations?

- Do our processes give us the data we need to invest in the most effective customer channels and touchpoints?

Ensure safety and sanitation

Throughout the UAE, 55% of SMEs identified safety and sanitation as significant stepping-stones towards meeting customer expectations.

Consumers need to feel safe and understand how your business is taking responsibility for securing their customer experience.

This goes far beyond the fundamentals of sterilising surfaces. Smart SMEs are looking deeply into their operations, at both a physical and digital level, and asking searching questions such as:

Can my store layout be changed to maximise customer safety?

Can I offer digital shopping, mobile ordering, contactless payment, or contactless collection?

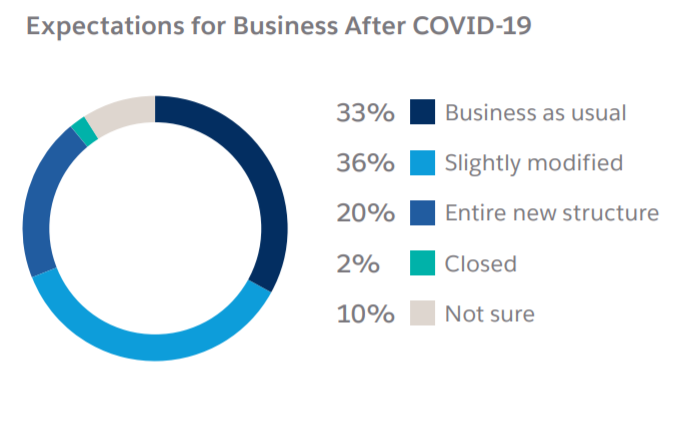

These aren’t quick fixes. They’re lasting changes that will endure past COVID-19, helping improve customer experiences, boost businesses resilience and streamline processes. In fact, only 33% of enterprises expect ‘business as usual’ post-pandemic.

Personalise customer engagements

Customers have come to expect a personalised journey over multiple channels and touchpoints. That means you need a 360-degree view of all their activities no matter where they happen.

Organisations that embrace an end-to-end view of their customer relationships achieve incredible results. For example, our customer success story with music software Trailblazers Propellerhead shows how a small business can successfully deliver the kind of highly personalised end-to-end customer journeys that nurture loyalty and trust.

By equipping your customer-facing teams with the data and insights they need to fully nurture their customers’ relationships, they can deliver a genuinely personalised experience.

SMEs in the UAE realise that tech adoption here is vital, rating it as the top way to drive better customer interactions.

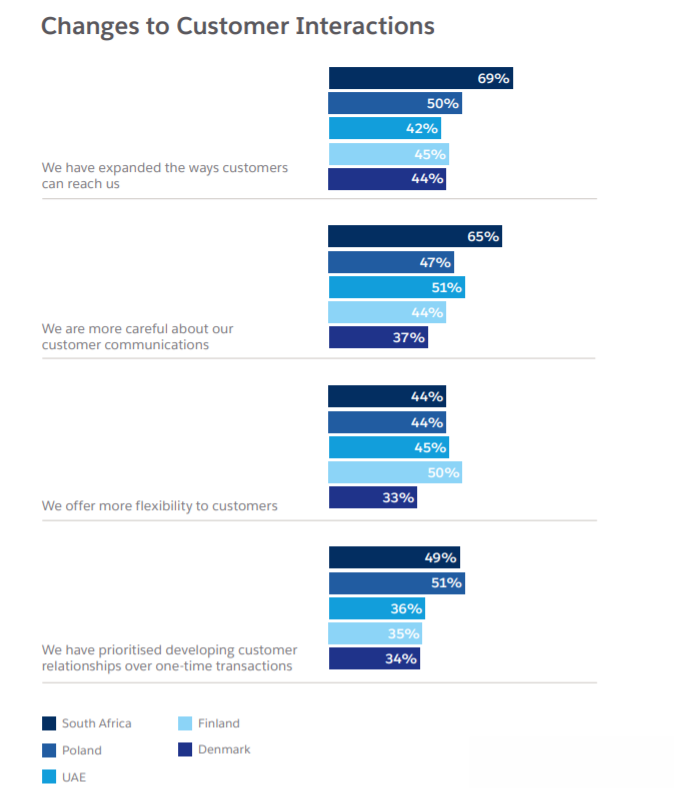

By increasing transparency around your public health initiatives, reviewing your communications strategy, and offering increased flexibility to your customers, you can show the empathy and trustworthiness that consumers need in these uncertain times.

SMEs in the UAE are starting to address this with 50% opting for a more considered communications strategy, and 44% affording their customers more flexibility.

What’s next for SMEs in the UAE?

It’s been a tough year for SMEs, but as our report shows, there is cause for optimism – and many businesses like yours in the UAE agree.

And by taking advantage of a CRM partner like Salesforce, we can help you accelerate the changes needed to meet today’s customer expectations, and unlock the visibility to make faster, more proactive decisions that drive business growth.

Read the Small & Medium Business Trends report to learn more about the challenges facing your peers in the UAE – and how they’re responding.