SMEs in South Africa are drastically reshaping their business operations to safely navigate the new normal. It’s a delicate balance of pivoting towards new working practices to stay afloat in a tightening economy. At the same time, SMEs need to handle heightened customer expectations and anxiety at speed and with care.

For small and medium businesses (SMEs) in South Africa, this shift has proven especially challenging. Without the resources enjoyed by larger enterprises, it’s taken a combination of innovation, agility, and determination to weather the crisis.

What is remarkable, though, is that many of the measures and priorities born from this crisis will continue to shape how SMEs operate long after COVID-19 ends. The Small & Medium Business Trends report captures that story. It also highlights the obstacles in the way of small business growth – and the tactics used to overcome them.

SME customer safety remains the priority

Throughout lockdowns, social distancing, and the emergence of vaccines, one aspect of customer service never changed: customer safety.

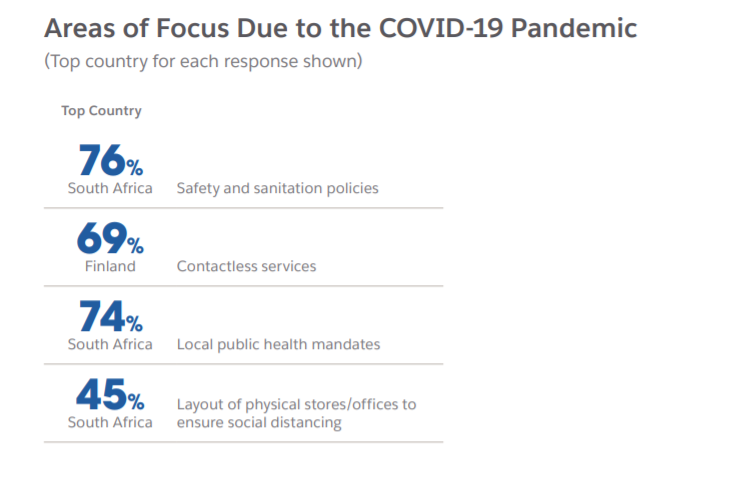

When asked, 76% of SME owners and leaders said this was their top area of focus. Contactless payments have become increasingly important to safe transactions – 54% of SMEs now offer contactless services across the buying journey, from online ordering to curbside pickups.

SMEs in South Africa also led the way in following public health mandates, updating layouts in their stores and offices to ensure social distancing.

With fast-paced and frequent changes to the working/business environment, it’s no surprise that SMEs found new ways to engage with customers. Maintaining relationships while ensuring customer safety is a tricky balance – and SMEs are responding decisively and in numbers.

69% of surveyed South African SMEs have expanded the way customers can reach them, although the effectiveness of these new channels is yet to be seen.

It’s likely that SMEs can improve their customer experiences by interrogating and improving the processes behind their business operations.

Supporting business growth through technology

Technology is a key contributor to the success of SME initiatives – and never has this been more true than during the pandemic.

Of the SMEs we surveyed across EMEA, the benefits to using varying technologies were both internal and external; from developing customer relationships to improving employee productivity.

For many SMEs in South Africa, technology gives an answer to a much more existential question; can we stay open and in business? And considering how quickly many businesses had to adopt digital during the pandemic, this isn’t surprising.

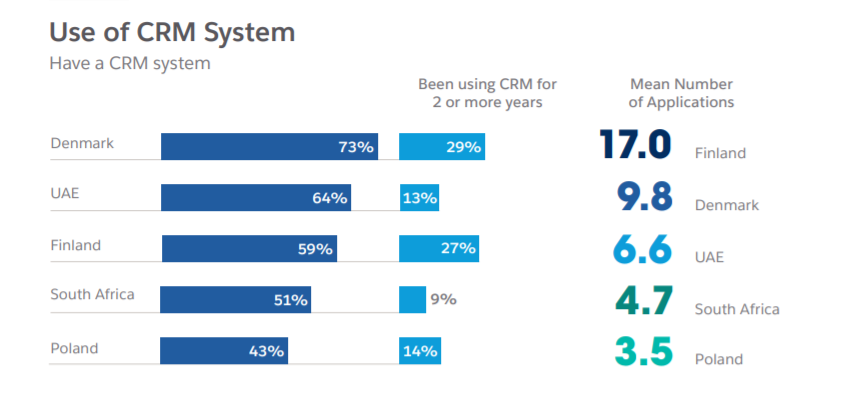

This is best reflected in CRM usage. Over half of SMEs in South Africa have a CRM solution, while only 9% have used one for at least the last two years.

Given the average number of CRM use cases in South Africa (4.7) vs the likes of Finland (17) and even Denmark (9.8), CRM represents a strong area of potential growth for SMEs.

While these companies may not be extracting the maximum potential from their CRM solution, it still serves a key role in supporting their customer experience and growth goals.

With 49% of respondents in South Africa prioritising customer relationships over one-time transactions, it’s clear that further adoption of CRM can only be a positive. It is telling that this subset of EMEA SMEs are putting long-term relationships ahead of short-term gain – despite the obvious appeal of fast income in a time of economic uncertainty.

Access to investment in a pandemic is tough – and long-term relationships look good to potential investors, as well as providing a source of steady and reliable cash flow. Any potential investment could then be used to increase CRM adoption and applications, adding new ways for SMEs in South Africa to enhance their customer experiences.

The impact of COVID-19 on business operations

The tactics and priorities highlighted in the SME Trends report are not just indicative of how small and medium companies are acting today – they’re also a glimpse into the future.

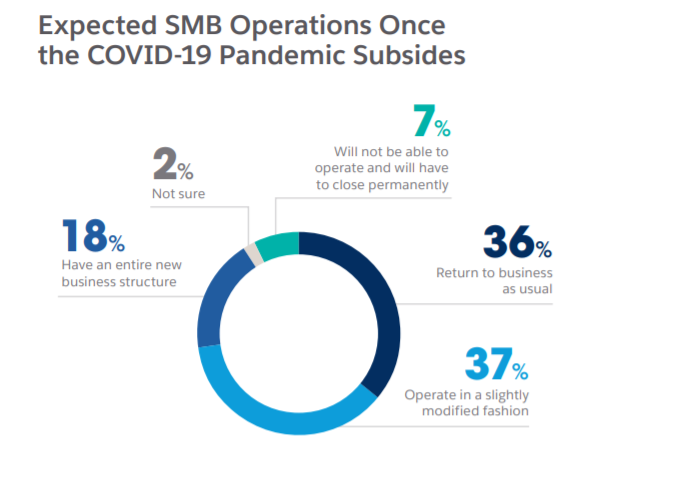

SMEs across EMEA are already planning their re-emergence once the world returns to something resembling normality.

Unsurprisingly, financial constraints are the biggest concerns for SMEs planning for life post-pandemic. 44% fear a reduction in customer demand, while 48% cite reduced revenue as the key obstacle to future growth.

With this in mind, the survey found a mix of attitudes towards future business operations, with 37% expecting to slightly change their business operations. Yet nearly 20% plan to radically overhaul their business structure – a response to the concern of reduced customer demand, yet likely to be hamstrung by a lack of financial resources.

Amid all this, it's no surprise that over half of SME leaders in South Africa (55%) have considered applying for financial assistance.

It seems SMEs across EMEA are in a process of gradual evolution. Financial constraints are likely to persist in the short to medium-term, hampering many small companies’ ability to radically overhaul their business operations to match their new surroundings.

What’s next for SMEs in South Africa?

2020 proved a difficult year for SMEs across the world. Customers expect smarter service through more channels, yet are less likely to provide the same level of revenue as before the pandemic. Economic uncertainty is rife, with SMEs leaning into tech and process evolution to stay afloat.

SMEs can (and are) emerging from COVID-19 intact. Combining innovation, tech and a healthy dose of caution, small businesses can continue to succeed in a post-pandemic world.

Read the Small & Medium Business Trends report to understand the challenges facing your peers in South Africa and across EMEA – and learn how they plan to overcome them.