As a small business owner, you don’t need us to tell you that across Canada, inflation is on the rise. But you might be surprised to learn just how stark the numbers are.

In May 2022, Canadian consumer prices grew at a faster rate than at any other point in nearly 40 years (since January 1983, to be exact). That month, Canada’s annual inflation rate grew to 7.7 per cent — far more than the Bank of Canada’s forecast of 5.8 per cent. The rate of consumer inflation rose again in June 2022 to a staggering 8.1 per cent.

While the annual inflation rate has slowed slightly since — it was 6.9 per cent in September 2022 — it’s still remarkably high, and small businesses are feeling the squeeze. Canadian businesses aren’t alone in these historical increases; a similar phenomenon is occurring in 60 per cent of advanced economies.

The good news is that a variety of effective strategies can help business owners navigate high inflation with their profit margins intact. Below, we’ll take a closer look at what inflation is and the factors behind it, plus provide a slew of proven tips to help your business survive.

What Is Inflation and What Causes It?

Per the Bank of Canada, in simple terms, inflation occurs when the cost of a variety of consumer goods and services goes up. The goods and services that fall under this umbrella include:

Shelter

Food

Clothing

Transportation

Furniture

Recreation

The changes in costs for these goods and services are determined using monthly consumer price index (CPI) data spanning from 1914 to today. When prices go up over time, that’s inflation.

Inflation is a natural process that’s always occurring, and a low, steady level of inflation is generally considered good for the economy. No one would expect a house or a refrigerator to cost the same in 2022 as it did in 1960, for example. But when inflation increases steeply, consumers tend to scale back their purchasing. This reduction can significantly impact small businesses.

A variety of factors influence the prices of consumer goods and services, including government policy, consumer demand, and production costs. For instance, the current bout of inflation has escalated due to the convergence of several factors:

Gasoline prices rose partly due to an increase in crude oil prices.

The cost of passenger vehicles has increased as a result of high demand outpacing supply.

The prices for a variety of services — including homeowners’ replacement cost, restaurant food, and rent — rose due to a nationwide squeeze.

The costs of travel, including accommodations and air transportation, rose in response to higher demand as pandemic restrictions have eased.

Prices for consumer goods have gone up partly due to supply chain issues resulting from the pandemic.

How Inflation Impacts Small Businesses

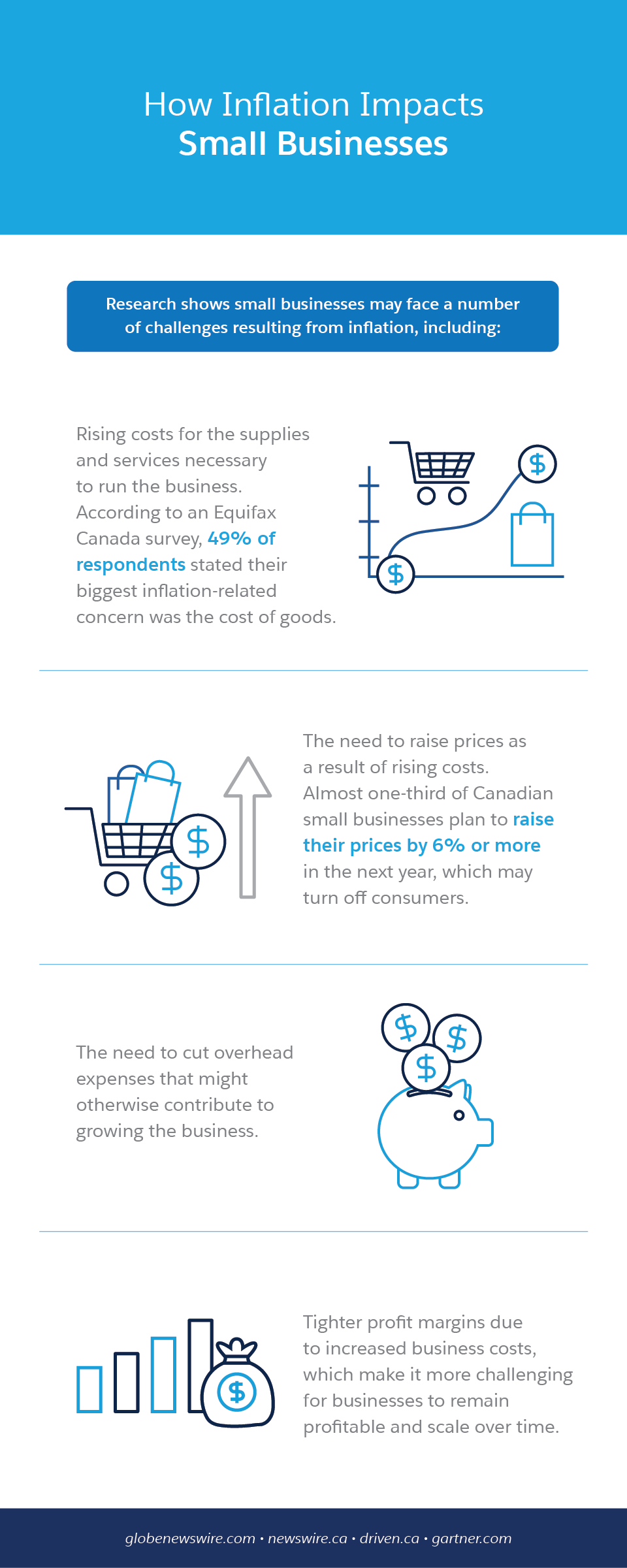

Consumers aren’t the only ones who suffer negative effects in the face of rising inflation. Research shows small businesses may face a number of challenges resulting from inflation, including:

Rising costs for the supplies and services necessary to run the business, such as electricity, rent, raw materials, paper products, shipping, truck transportation, maintenance and repair services, and so on. According to an Equifax Canada survey, 49 per cent of respondents stated their biggest inflation-related concern was the cost of goods.

The need to raise prices (as a result of the rising costs described above), which may turn off some consumers and make a business’s goods or services prohibitively expensive to others. Almost one-third of Canadian small businesses plan to raise their prices by 6 per cent or more in the next year.

The need to cut overhead expenses that might otherwise contribute to growing the business.

Tighter profit margins (resulting from increased business costs), which make it far more challenging for businesses to remain profitable and scale over time.

These are significant obstacles, and for some businesses they will prove fatal. Other companies will stay afloat through a combination of luck and the implementation of savvy strategies. We’ll cover some of these strategies in the next section.

How to Stay Profitable During High Inflation

Here’s some good news: At some point, inflation will level off. Because inflation is always in flux, it’s unlikely that it will continue to rise steeply for an extended period. But in the meantime, your business has bills to pay and profit margins to consider. So here are some practical tips to help you survive high inflation — for however long it lasts.

Identify opportunities to cut costs

Get creative when it comes to reducing expenditures. Here are some ideas to get you started:

If you rent your office space, talk to your landlord about a potential rent decrease. It might be helpful to wait until your lease is almost up so you have more leverage.

Consider ditching your office entirely. Many businesses are enjoying huge cost savings by switching to remote work. Just make sure you don’t pass along the costs to your employees; it’s still the business’s responsibility to provide team members with the tools and services necessary to do their jobs.

Talk with your merchant card provider and see if they will lower your rate for credit processing fees. If they won’t budge, shop around to see if you can find a lower-cost alternative.

Ask your team to reduce printing whenever possible. You’d be amazed at how much you can save on paper and ink.

Review all of the company’s subscriptions and services and consider whether they’re necessary. Make sure you aren’t paying for anything the team doesn’t use on a regular basis.

Automate and improve processes to maximize productivity

Revisit your processes and identify ways to streamline or automate tasks. This will free up your team members’ time and energy to focus on initiatives that could make a bigger impact on the company’s bottom line.

For instance, consider using software to automate tasks such as taking orders, scheduling, and billing; get rid of unnecessary reports that create busy work for your team; reduce the number of meetings or non-work-related activities that employees are required to attend; and so on.

Manage cash flow carefully

When profit margins are tight, there’s no room for error. According to the same Equifax Canada survey mentioned previously, 60 per cent of Canadian small businesses struggle to manage cash flows, so it’s vital to stay on top of yours. Several strategies may help:

Require prompt payments. For costly goods or services, require a deposit up front and/or full payment immediately upon invoice receipt.

Make it as easy as possible for customers to pay you. Accept various forms of payment, from cash to credit cards to digital payment apps.

Monitor accounts receivable. Don’t offer additional goods or services to clients with unpaid invoices. Promptly follow up on outstanding balances.

Incentivize immediate payment. Consider offering discounts to clients or customers who pay their balances early.

Take advantage of business tools and trainings

Effective business tools can help you better predict and manage your income and expenses. For instance, Salesforce’s holiday sales forecasting tools and Ebook, “The 2022 Holiday Planning Guide for Retailers” can help you make sense of consumer trends so you can manage inventory effectively with minimal waste.

You could also take advantage of educational tools such as Salesforce’s on-demand webinar, “The Future of the Post-Pandemic Customer,” which explores (among other topics) how to deliver great business outcomes in the face of tight margins.

Prioritize profitability

As mentioned before, an obvious way to combat inflation is to increase your prices as a means to offset higher costs. Many companies have chosen to bump up prices in response to current inflation rates. Of course, this decision can cause some customers to look elsewhere for cheaper goods or services. Aim to raise prices slowly to minimize sticker shock.

It’s also helpful to prioritize your business’s most profitable products or services by reviewing your offerings and making sure you’re doing everything you can to support sales. Reconsider whether to continue offering less profitable items or services.

Take care of your team members

Employee turnover is extremely costly. Minimize the chance of incurring these costs by investing in your team. Raises are appropriate given that team members will feel the effects of inflation in their daily lives. You can also offer attractive benefits such as remote work, flexible scheduling, stipends for child care or home insurance, and more.

Stock up on supplies when the price is right

If you use certain (nonperishable) supplies on an ongoing basis, take advantage of sales or discounts and buy those items in bulk. As long as you have the storage space to stash supplies that won’t be used for a bit, you’ll enjoy noticeable savings over the long-term. Now might also be a good time to renegotiate prices with your suppliers.

Stay ahead of inflation

While many of these strategies emphasize scaling back costs during inflation, some businesses may choose to take the preventative approach and go all-in on growth ahead of inflation. This might mean increasing the marketing budget to attract new leads, targeting new customer segments who have greater spending power, improving the business’s website to maximize transactions, or investing in other areas of the business that could lead to greater profitability. From there, that greater profitability can serve as a safety net when hard times strike.

Conclusion

High inflation is a real threat to small businesses. But with a little know-how, some careful accounting, and a lot of creativity, it’s possible to weather the storm and come out stronger on the other side.