What investment does an advisor get the highest return on? It's not stocks, mutual funds, or commissions - it's relationships. But strengthening those client relationships is usually easier said than done. Relationships are complicated, and to truly know a client, advisors must link together multiple accounts and financial goals to gain a holistic view of a client’s complete financial lives, including the personal connections they value most.

Despite the challenges advisors have in capturing this information, one thing is clear — uncovering and maintaining client connections across relationship networks has never been more important. With $6 trillion in client assets being transferred between generations in the next 30 years and a 50% average attrition rate across these transfers, advisors have to go deeper in their relationship investments — or risk missing out on growing their books of business. To capitalize on new client opportunities, advisors need to shift from a siloed client view to one that provides optics into complex relationship groups across multiple households, businesses, trusts and more. And they need to be one step ahead, leveraging emerging technologies like AI that enable them to work smarter and surface immediate client opportunities across relationships at the exact point of insight.

That’s why we are excited today to announce Financial Services Cloud Einstein, AI-powered CRM for financial advisors. With Financial Services Cloud Einstein, transforming valuable relationship information into new client opportunities is faster, more visual and smarter than ever before. Firms of all sizes, from Transamerica to Perigon, are already gaining optics into the relationship networks that matter most to their clients.

Today, Salesforce is adding new innovations to Financial Services Cloud that make every advisor smarter, including:

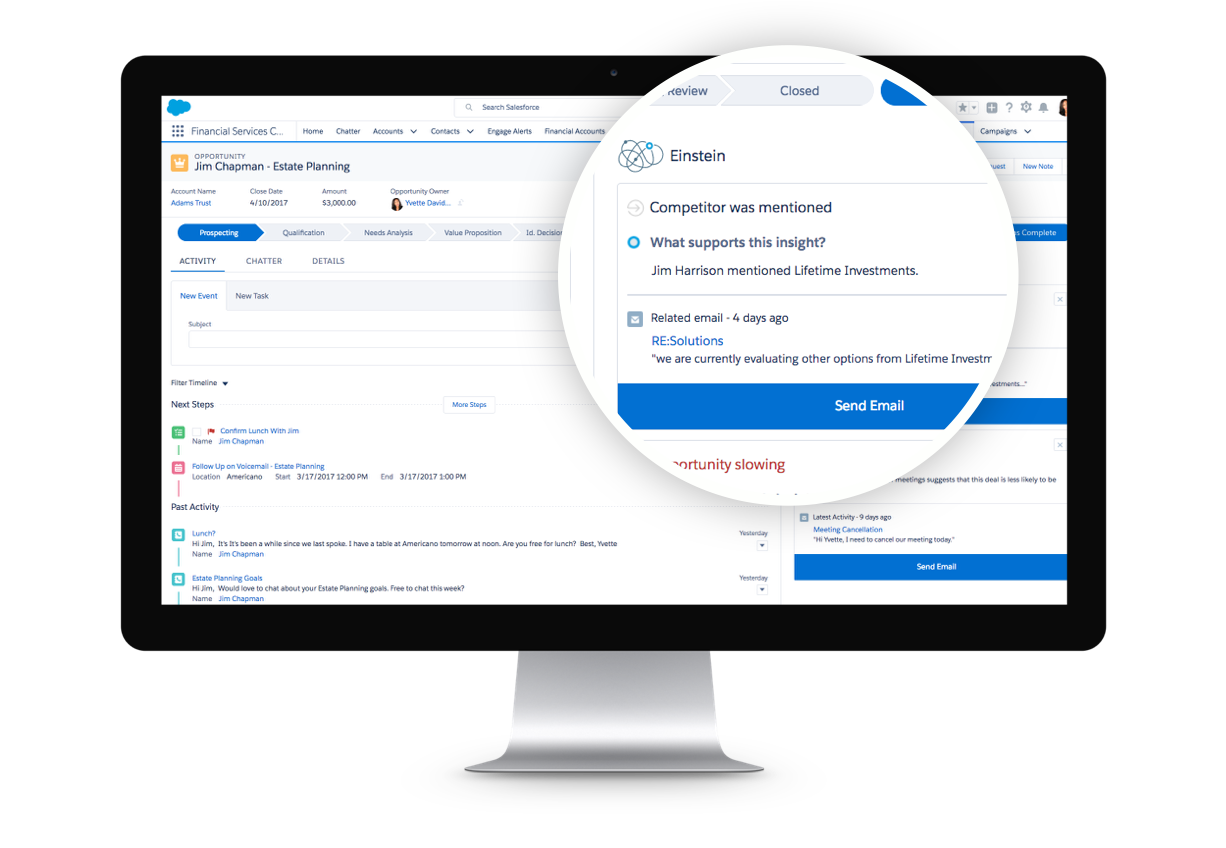

Einstein Opportunity Insights enable advisors to boost productivity and intelligently uncover opportunities based on clients’ sentiments, competitor mentions and overall engagement. For example, advisors can automatically see if a client mentions a competitor in an email thread and — when coupled with a decrease in communications — receive a reminder to reach out and nurture the relationship.

Relationship Builder gives advisors the ability to easily connect information about clients and their households in one place, and edit their existing roles and activities. For example, an advisor can easily add when a client has taken on a new role such as becoming a board member at a company.

Relationship Groups enable advisors to link clients to multiple households, trusts and business groups to ensure they have holistic views of wealth across all accounts and relationships. For example, advisors can track when their clients take on new responsibilities within other households, such as becoming a power of attorney for an aging parent, and then proactively reach out with personalized advice.

With Relationship Map, advisors can visualize a client's family wealth ecosystem and financial accounts in a single snapshot and drill into opportunities to deepen and grow their book of business. For instance, an advisor can discover that a client has become the beneficiary of a trust that is in need of estate-planning services.

See Financial Services Cloud Einstein in action in the GIF below:

About the Author

Rohit Mahna is General Manager of Financial Services at Salesforce, leading the company’s strategy in the Wealth Management, Banking and Insurance sectors. Responsible for the product, marketing and overall go to market strategy, Mahna and his team oversee industry products and customer engagements for the Financial Services industry. He has been at Salesforce for over five years and was instrumental in the vision and development of Salesforce’s Financial Services Cloud, the company’s first industry-specific.

Mahna has over ten years of experience in the Financial Services space, previously leading global development of IBM’s Financial Services industry solutions for business analytics and overseeing the industry marketing team.