Every VP of sales is under immense pressure to hit his or her numbers consistently; it’s the X factor that drives every decision they make. For sales leaders at start-ups and other new businesses, the issue is magnified due to the lack of company-specific historical metrics that help decide what numbers to target. Lacking data from quarters and years past makes this a difficult task, but there are still several reliable strategies for constructing an accurate forecast in their absence.

Create a thorough representation of your current sales situation

When your goal is to make an accurate prediction of the future, but you don’t have any context from the past to rely on, you only have one place to turn: the present. The more data you gather during this phase, the better positioned you will be to arrive at a sales forecast number that is ambitious, yet achievable. But you have to be just as concerned about the quality of the data as you are about the breadth.

This is a time to be both as comprehensive and as brutally honest as possible. Every possible line item, no matter how small or seemingly insignificant, needs to be added to your data pool. If your unit has had trouble controlling costs in a certain area, now is not the time to assume you will fix it in the next quarter, and therefore avoid incorporating it. When collected and analyzed properly, current sales and financial data tell a powerful story. Listen to it and learn accordingly.

Incorporate as much external information as possible

Although you don’t have specific historical metrics from your company to inform your projections, you can learn from past market performance and take some cues about external forces that may affect your future performance. Global economic developments, changing political situations, and regulatory issues can all significantly affect historical trends. It’s important to always view this data in context in order to avoid becoming bogged down in the past at the expense of the future.

The Benefits of a Powerful CRM Solution

- Close more deals

- Get more leads

- Accelerate productivity

- Make insightful decisions

Take a hint from the competition

There’s no reason why you can’t examine available performance history from your competitors to help illuminate your own position. Of course, for private companies, robust financial data will typically not be available. But you can still examine their company history from a broad perspective, and look at factors such as expansions and contractions, public brand perception shifts over time, and so on.

Mix in some qualitative data along with your numbers

You may have noticed that a data point such as “public brand perception shifts” is not a quantitative input. That’s true, but it’s actually perfectly acceptable to use some qualitative analysis as a part of your forecasting effort, provided that its role is to support, not supplant, the hard data. Surveying your existing customers as well as prospects about subjects such as brand perception, perceived value, product quality, and overall customer experience can be a powerful tool in your forecasting arsenal. There are programs that allow you to create customized questionnaires and organize your results in ways that will maximize their value.

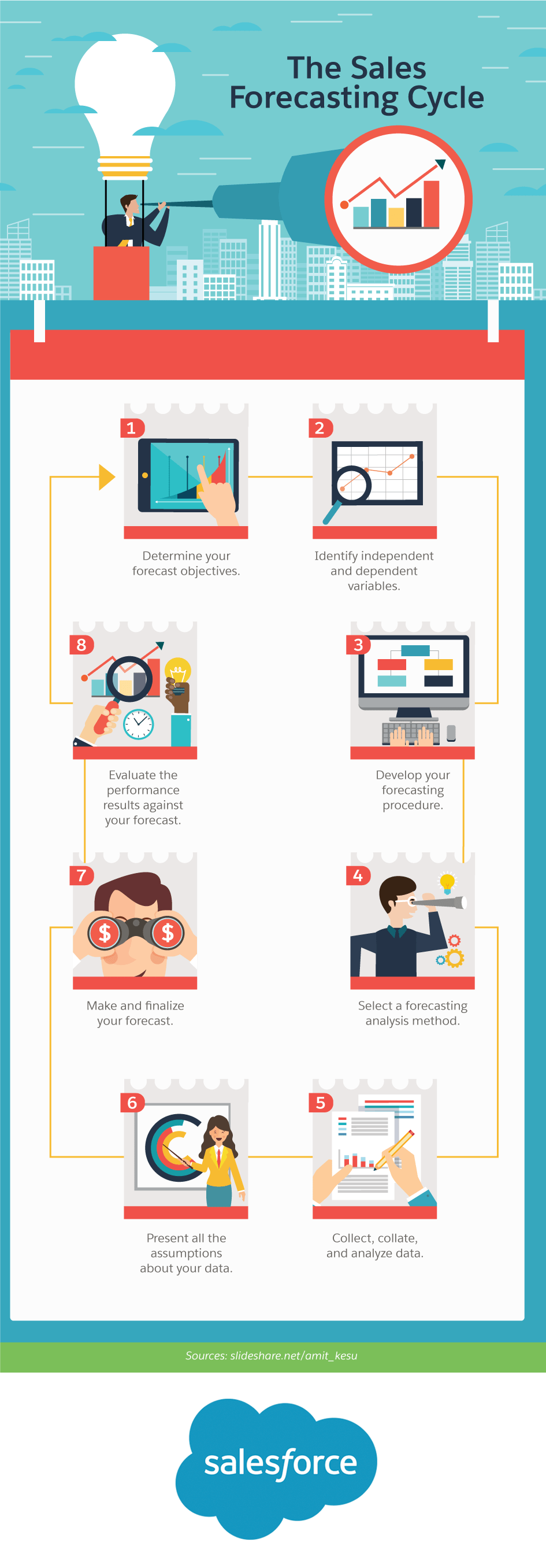

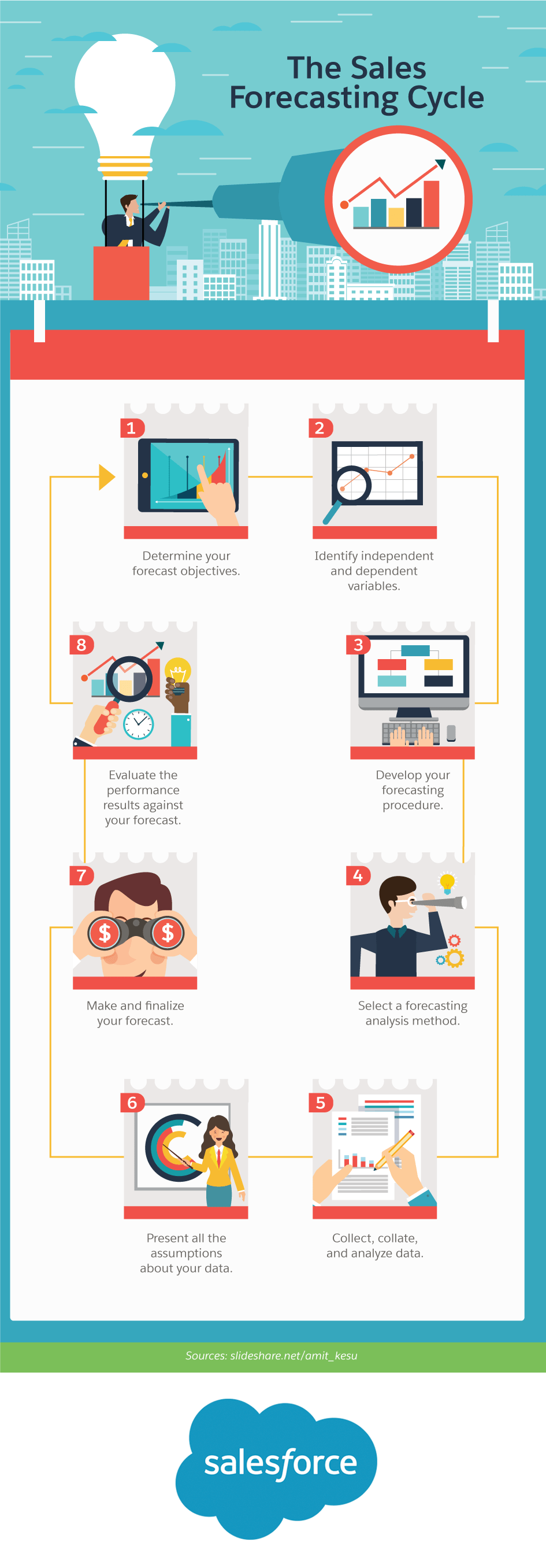

Find forecasting software that fits your needs

Innovative sales forecasting software is now so readily available that you don’t have to settle for a solution that only covers a few of your needs. Because you’re entering into the forecasting process without the aid of historical data, it wouldn’t make sense to use a program that places a premium on past results in order to project accurate results. Take the time to find a solution that can use the information you have access to in order to build a forecast that specifically makes sense for your company and industry.

Build an informed model

Most sales forecasting programs use time-honoured techniques to build a model that works with available data points. In general, models are organized into three broad categories: qualitative techniques, time series analysis and projection, or causal models. Qualitative models are only suitable when there is no quantitative data to be found, such as when you are forecasting a completely new market. The second category uses only historical data in order to make a projection about the future. Causal models, on the other hand, combine historical data with important insights about how systems currently work together to make a market, a company, and a buyer base operate.

Forecast aggressively, forecast conservatively, and forecast in between

Each type of model analyzes different factors in the act of creating a projection. Whether or not the product is wholly new, a refined version, or part of an existing line matters greatly, as does the current and expected state of the pipeline and the point at which rapid growth is expected.

At this point in time you have very little to go on, so it’s best to run projections based on aggressive growth and conservative outlooks. Then look at a range of possibilities in between the two. That will allow you to see what those futures look like specifically in terms of numbers for your company, and that will help you find your footing going forward.

Small businesses need to accurately forecast sales, and they can use the power of Sales Cloud to do it. Learn how to get real-time access to the data you need to hit your sales targets in our demo.

Share "How to Forecast Future Sales for Start-ups" On Your Site