Whether you’re an investor, advisor, or entrepreneur seeking investment, Salesforce’s recently published 2016 Connected Investor Report can help you navigate the financial landscape.

Salesforce Research surveyed 7,900 adult investors, 4,944 of whom currently have money invested, in six global markets: Australia, Canada, France, Japan, the U.K., and the U.S. Of the investors surveyed, 1,354 were from Canada, 2,075 from U.S., and other countries are represented by between 1,000 and 1,300 responses. The survey was conducted online by Harris Poll February 24-29.

The purpose of the survey was to learn about investor-advisor relationships, electronic investment platforms, and investor trust during volatile times. As you’ll read in the summary below, we found that investors want to see a zoomed-out picture of their financial lives.

What Investors Want

The world of investment is full of choices. We sought to understand how investors made some of those choices: Surveyed adults were asked where they invest, what systems they use to invest, and how they choose a financial advisor when they want help.

In an ideal world, they prefer using modern tools in collaboration with their financial advisors. Investors don’t meet with their advisors often; however, meetings are usually done over the phone, via email, or in person, as opposed to live chats or texting. The recent economic volatility in the first quarter of 2016 caused many investors to have concerns about their financial futures, and they expressed that they’d like their advisors to be more proactive in managing their relationships with clients.

Where Are Investors Putting Their Money?

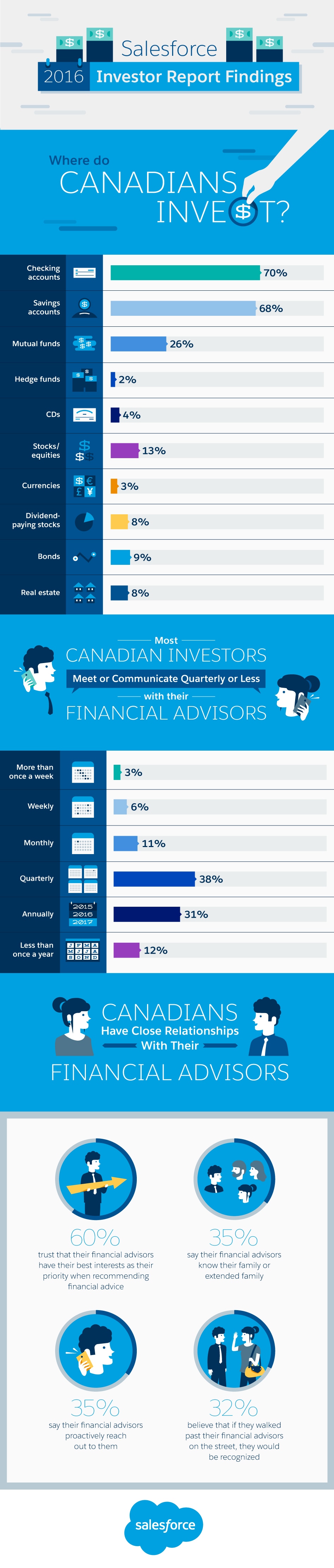

Overwhelmingly, people put at least some of their money in savings accounts: 68 per cent of people surveyed in Canada invest in savings accounts, compared to 71 per cent overall in the survey. In Canada, 70 per cent of people also invest in checking accounts, 13 per cent in stocks and equities, and 26 per cent in mutual funds. Less than 10 per cent each invest in hedge funds, certificates of deposit (CDs), currencies, dividend-paying stocks, bonds, and real estate.

With international investors we saw similar trends, except in checking accounts. Those numbers vary widely, with 66 per cent of people in the U.S. investing in checking accounts, and just 7 per cent in Japan. All the other countries represented—Australia, France, Japan, the U.K., and the U.S.—invest significantly less in mutual funds than Canadians do.

How Are They Investing?

Currently, 38 per cent of surveyed Canadians invest on their own without the help of a financial advisor. Thirty-six per cent collaborate with their advisors, while 26 per cent have advisors who handle all of their investments for them. Nearly half (47 per cent) of Canadians who want to change that want a more collaborative relationship with an advisor. Currently, only 12 per cent of investors use digital advice platforms to manage all or some of their investments. International trends are similar.

How Do Investors Choose an Advisor?

Of all people surveyed, 84 per cent said fee structure was important when choosing an advisor. Eighty-two per cent said convenience was important, while 60 per cent said peer recommendations mattered. Despite the fact that so few investors currently use digital advice platforms like Wealthfront or Betterment to invest, the ability to use modern tools is important to 67 per cent of people surveyed. These platforms tend to provide additional perks, such as a holistic view of one’s finances and online reviews of potential advisors—which 76 per cent and 57 per cent (respectively) of investors want when choosing an advisor.

Advisor-Investor Relationships

When we asked investors about how they interact with their advisors, we got some surprising responses. For example, 8 per cent of investors don’t know the gender of their advisor, suggesting that all communications had been in writing or through an advising platform. While most investors have more interactions with their advisors, they don’t meet very often. Despite that, most investors are happy with their current advisements.

How Often Do Investors Meet or Communicate with Their Advisors?

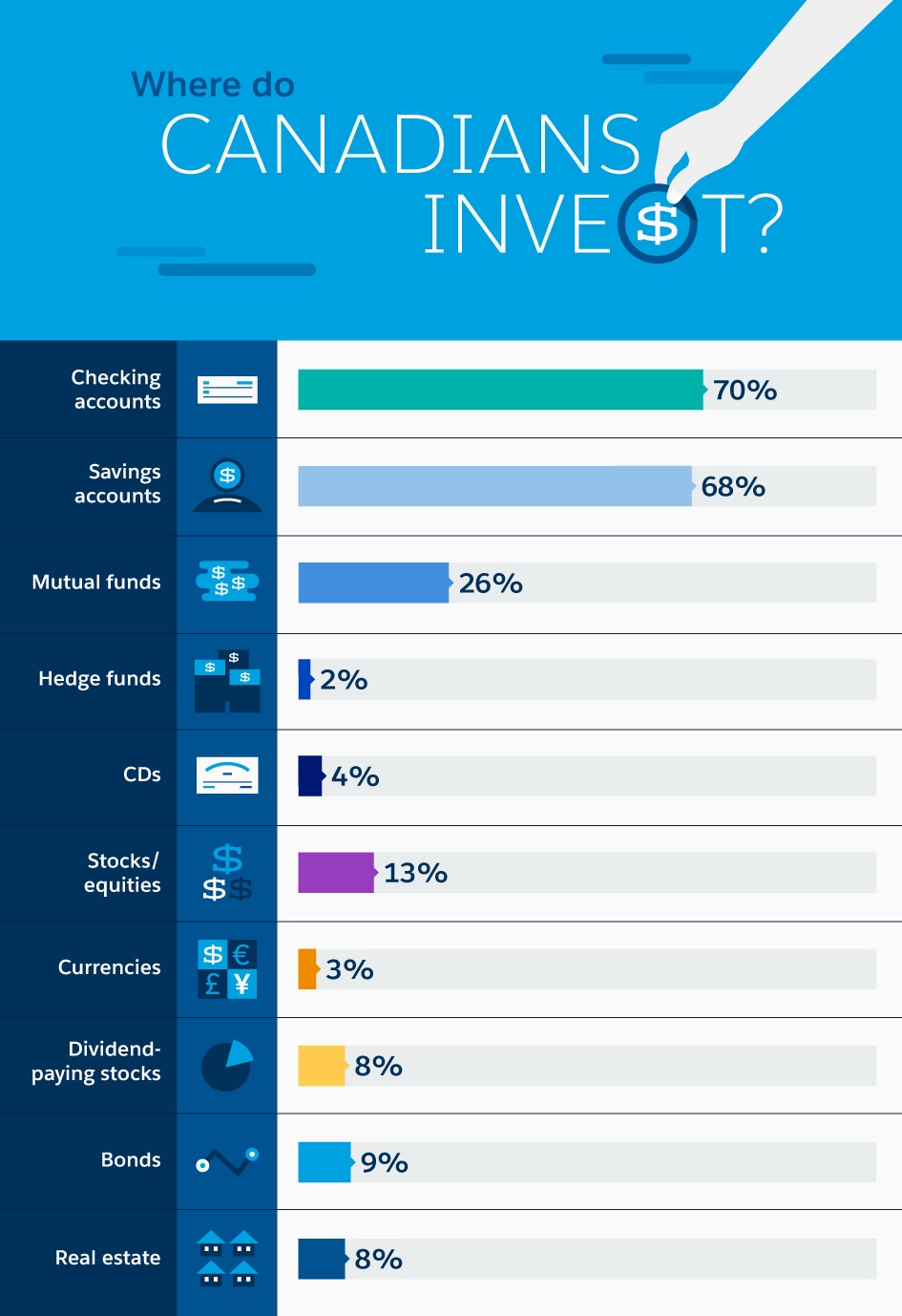

In Canada, 38 per cent of investors meet or communicate with their advisors quarterly, 31 per cent annually, and 12 per cent less once per year. Weekly and monthly meetings are rarer. International trends are similar, with Japan being the outlier. Japanese investors tend to meet with their advisors more regularly; 13 per cent meet more than once a week, 24 per cent said they meet with their advisors weekly, and only 21 per cent said quarterly.

Where Do Canadians Invest?

- 70% - Checking account

- 68% - Savings account

- 26% - Mutual funds

- 2% - Hedge funds

- 4% - CDs

- 13% - Stock/equities

- 3% - Currencies

- 8% - Dividend-paying stocks

- 9% - Bonds

- 8% - Real estate

How Are They Investing?

Currently, 38 per cent of surveyed Canadians invest on their own without the help of a financial advisor. Thirty-six per cent collaborate with their advisors, while 26 per cent have advisors who handle all of their investments for them. Nearly half (47 per cent) of Canadians who want to change that want a more collaborative relationship with an advisor. Currently, only 12 per cent of investors use digital advice platforms to manage all or some of their investments. International trends are similar.

How Do Investors Choose an Advisor?

Of all people surveyed, 84 per cent said fee structure was important when choosing an advisor. Eighty-two per cent said convenience was important, while 60 per cent said peer recommendations mattered. Despite the fact that so few investors currently use digital advice platforms like Wealthfront or Betterment to invest, the ability to use modern tools is important to 67 per cent of people surveyed. These platforms tend to provide additional perks, such as a holistic view of one’s finances and online reviews of potential advisors—which 76 per cent and 57 per cent (respectively) of investors want when choosing an advisor.

Advisor-Investor Relationships

When we asked investors about how they interact with their advisors, we got some surprising responses. For example, 8 per cent of investors don’t know the gender of their advisor, suggesting that all communications had been in writing or through an advising platform. While most investors have more interactions with their advisors, they don’t meet very often. Despite that, most investors are happy with their current advisements.

How Often Do Investors Meet or Communicate with Their Advisors?

In Canada, 38 per cent of investors meet or communicate with their advisors quarterly, 31 per cent annually, and 12 per cent less once per year. Weekly and monthly meetings are rarer. International trends are similar, with Japan being the outlier. Japanese investors tend to meet with their advisors more regularly; 13 per cent meet more than once a week, 24 per cent said they meet with their advisors weekly, and only 21 per cent said quarterly.

Most Canadian Investors Meet or Communicate Quarterly or Less with Their Financial Advisors

- 3% - More than once a week

- 6% - Weekly

- 11% - Monthly

- 38% - Quarterly

- 31% - Annually

- 12% - Less than once a year

How Do Meetings Occur?

The most popular ways to meet with an investor are in person, over the phone, and via email, while text messages, chat systems, and on a website are less popular. Exact numbers vary based on the reason for the meeting. Half of surveyed investors meet in person to make investment decisions, 43 per cent to get investment advice, 40 per cent to communicate account changes, and 39 per cent to share documents. While 24 per cent of investors will use a website to check the performance of their portfolios, a full 37 per cent will still meet in person for that as well.

How Do Investors Store Records?

Digital platforms and many advisors offer records storage services. But are investors taking advantage of them?

Many investors store records in more than one place. Twenty-one per cent say their advisors have physical records, and 25 per cent of surveyed people say their advisors keep digital records. Thirty-seven per cent say they have physical records at home, while 19 per cent have personal digital storage. Meanwhile, some investors use website portals: 25 per cent use a single portal for all of their records while 18 per cent use multiple portals. Surprisingly, a full 15 per cent of investors keep no records at all.

Do Investors Want Personalized Service?

Yes and no. When it comes to goal setting, only 51 per cent of investors say their advisors help them, while 26 per cent set goals themselves. Incredibly, only 37 per cent of investors say their advisors are even aware of their goals. The bigger surprise, however, is that 35 to 56 per cent of investors in all the countries surveyed say they don’t see the point of sharing key life events with their advisors.

Despite the fact that 38 to 50 per cent of investors don’t understand how their advisors make decisions, overall investors are happy with their financial advisors.

Maintaining Trust During Volatile Times

When the economy is in crisis, investors naturally become fearful for their financial futures. Even in times of minimal changes in the market, it’s important to reassure people their money is as safe as possible—and that their investors have their backs. Based on feedback asked during volatile first quarter of 2016, it appears financial advisors have some room for improvement in this area

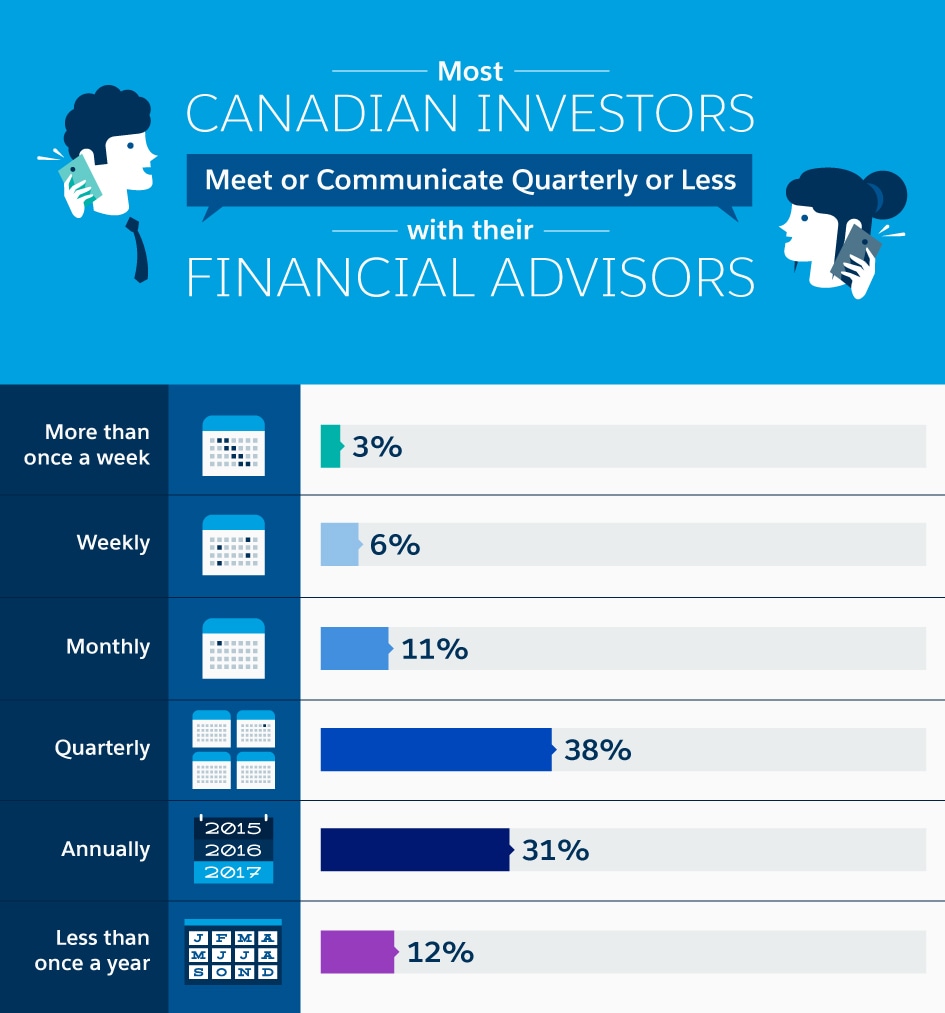

Canadians Have Close Relationships with Their Financial Advisors

- 60% trust that their financial advisor has their best interests as their priority when recommending financial advice

- 35% say their financial advisor knows their family or extended family

- 35% say their financial advisor proactively reaches out to them

- 32% believe that if they walked past their financial advisor on the street, they would be recognized

Why Might You Leave Your Current Financial Advisor?

It’s not surprising that 61 per cent of surveyed investors are scared of the effects a downturn may have on their financial well-being. However, there are ways advisors can avoid losing clients even in tough times. While 40 per cent of investors say they would leave their current advisor due to high fees, a solid 30 per cent say a lack of communication could drive them away. Twenty-nine per cent say they’d leave due to bad advice, 14 per cent if their advisor uses outdated modeling, and 11 per cent for using outdated technology. Only 22 per cent said they’d leave because an advisor was not aligned with their goals.

Is Your Investor Looking Out for You?

The good news is more Canadians feel their financial advisors make their investors’ interests a top priority—60 per cent compared to a total average of 47 per cent. Thirty-five per cent of Canadians say their advisors proactively reach out to them and 32 per cent say their advisors would know them if they met on the street. Internationally, those numbers are lower at 30 and 31 per cent, respectively. Forty-nine per cent of Canadian investors say their advisors would call them immediately if the stock market dropped 5 per cent or more in a day, while 64 per cent say their advisors would contact them if interest rates rose. Of all investors surveyed, 60 per cent want their advisors to be more proactive in recommending changes.

Conclusions

Overall, investors are quite happy with their financial advisors. That doesn’t mean they’re not looking for improvement, especially in volatile times. Advisors could curb any mistrust from their clients by being more communicative and helping investors understand their goals. Using technology and tools to improve clients’ experience, provide proactive service, and give a more holistic view of clients’ financial lives is a necessity.

Advisors should remind investors to keep records and to be more careful about how they store their financial records. Another way advisors can step up their game is to show investors the importance of a mutual understanding of the investor’s goals. Those who are interested in a more holistic view of their finances would do well to include their advisors in their financial goal planning, as well as exploring modern tools for tracking a portfolio.

This report may also be a glimpse into the mind of investors for entrepreneurs looking for funding. With volatile quarter in recent memory, investors and advisors may be more careful with their funds. Entrepreneurs may need to step up their game to get them.

Share "Salesforce 2016 Investor Report Findings" On Your Site