Unless otherwise stated, all statistics come from the NVCA Yearbook Report and the Canadian Venture Capital & Private Equity Association.

Raising venture capital: Of all the things you do for your business, this one may be the most stressful. It could also be the most powerful. In 2015 alone, venture capital firms raised $28 billion dollars through 263 funds. Think that’s a lot? These firms deployed even more—almost $60 billion across 4,380 deals. Of those deals, 1,400 were with companies receiving their first venture capital funds ever.

The money to fund your startup or project is out there. As an entrepreneur, you need to get your piece of it.

Venture Capital: The Basics

Venture capital is similar to angel investment, but has some important differences. While an angel investor is a single person handling their own investment, venture capitalists depend on many individual investors to supply funding, and those investors want some guarantees that their risk will pay off. A venture capitalist is usually part of an investment firm, so you’ll need to convince the firm to invest. Here’s how to do that.

The Numbers Behind Venture Capital in 2015

- Venture capital firms raised $28 billion dollars through 263 funds

- Deployed almost $60 billion across 4,380 deals

- 1,400 of those deals were companies receiving their first VC funds ever

Step 1: Decide on a Course

Is venture capital (VC) the way to go?

Unfortunately, it’s not as simple as pitching a good idea and spending the check. While there’s a lot of funding out there, venture capitalists don’t decide where to invest lightly. There’s a lengthy due-diligence process, and you need to convince them you’re worth the risk. Allowing them to have a say in your company is one way to do that.

Before you start the long, nuanced process of scoring venture capital funds for your company, make sure this is the path you want to take. Sure, if you seal the deal you’ll have access to the funds you need, but venture capital comes with strings in the form of a seat on your board of directors.

If you don’t want to give up any control, venture capitalism may not be a fit for your company. Many entrepreneurs don’t have a board, don’t think they’ll need one, or aren’t sure who should be on it, and putting one together may not make sense for their company.

With venture capital, you are also often limited in the amount of money you can ask for. Most VCs will want to invest a minimum of $3 million. When all you need to get started are a few software engineers and a small office, that’s overkill. You may need more of an angel investor, who’s usually a single, wealthy person who has less money to invest but will mostly stay out of your way.

Other than lots of zeros in front of that decimal point, there are benefits to choosing venture capital funding. Often, VCs have experience and connections that you simply don’t have access to on your own, and they’re more than happy to employ them toward the goal of their investment paying off.

So what are you most interested in? Large funds that will help you take on the world and make lots of people rich? Or just enough to make yourself comfortable and the freedom to be your own boss? Knowing where your company is going will help you score the right funds to get it off the ground.

Step 2: Do the Research

You can be sure a venture capitalist will dig deep into your personal affairs, your company, your industry, and the market before even considering an investment. And you need to know who you’re pitching to, how much money you could make them, and how likely they are to fund you. If you don’t, you’re wasting your time and theirs.

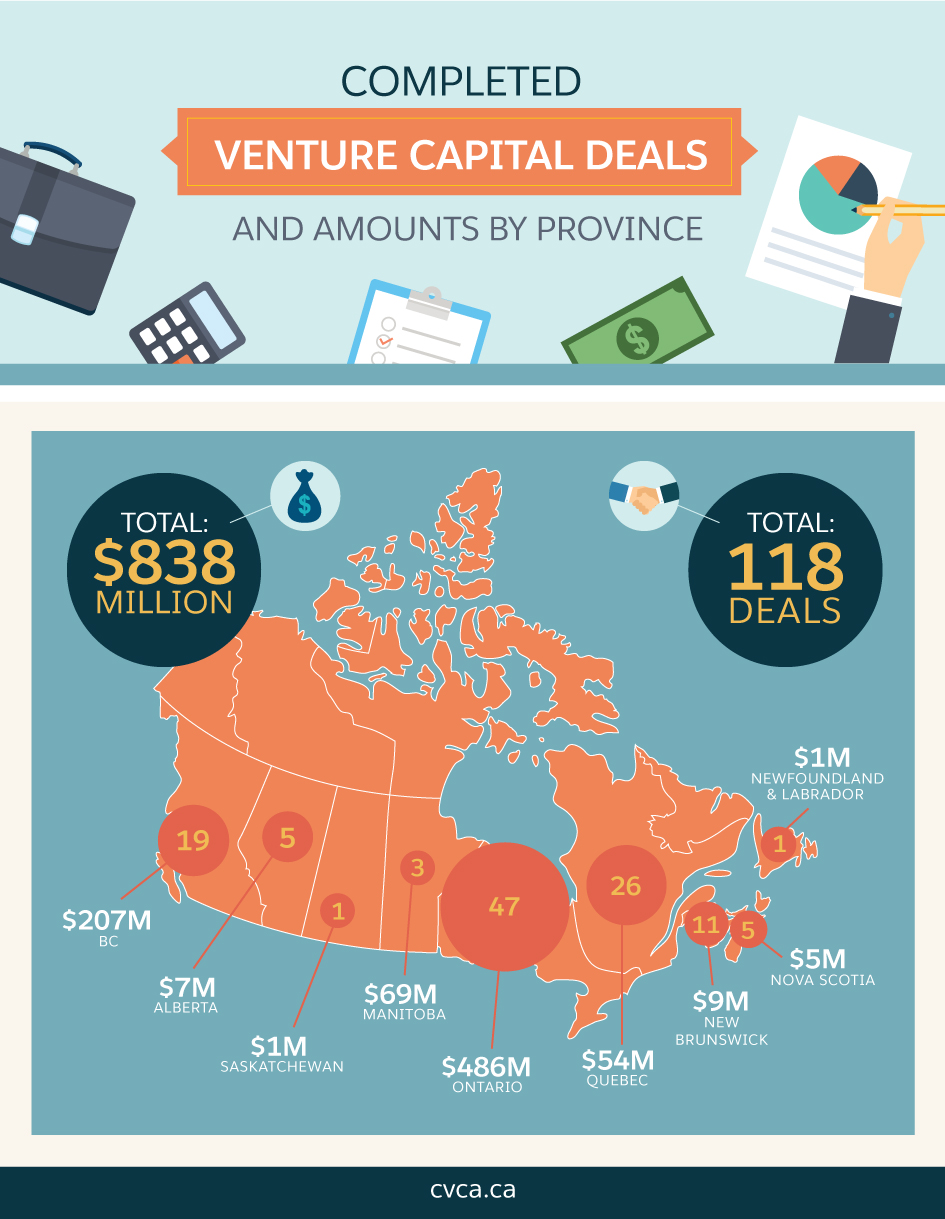

Breakdown of Canadian Venture Capital Deals and Amounts

- BC: $207 M

- Alberta: $7M

- Saskatchewan: $1M

- Manitoba: $69M

- Ontario: $486M

- Quebec: $54M

- New Brunswick: $9M

- Nova Scotia $5M

- Newfoundland & Labrador: $1M

- Total: $838 Millions

- Total: $118 Deals

Know Your Audience

Every venture capital company is different. They have their own guidelines and processes for approving funding. Ask yourself questions like:

- How many deals have they made in the last few years?

- How much funding is currently available to them?

- Have they funded companies like yours before? Firms can only take on so many deals at a time, and they try to diversify to different industries and sectors.

- Is there still room in their portfolio for someone like you?

In 2015, the most active private independent venture capital firms were Real Ventures (78 deals), iNovia Capital Inc. (39), and Relay Ventures (26).

Ultimately, deals are approved or rejected by people: You need to appeal to the individuals at the firm, so include them in your research. Find out what projects each partner has been involved in before, and what concerns they may bring up. Target one or two who may be a champion for your cause and aim to excite. It’s not enough to present a solid case. Often, you’ll need the excitement of one or two partners to push the deal through.

Know Your Business

In order to evaluate how risky investing in your company may be, VCs go through a process called “due diligence.” This is where they learn as much as they can about your company, the people, and the market. The more they know, the better they can evaluate their risk.

And the more you know, the better you’ll look.

When you present in front of the firm’s partners, have answers ready. Showing you’re as thorough as your investors are is critical to convincing them you’re worth investing in.

Know Your Chances

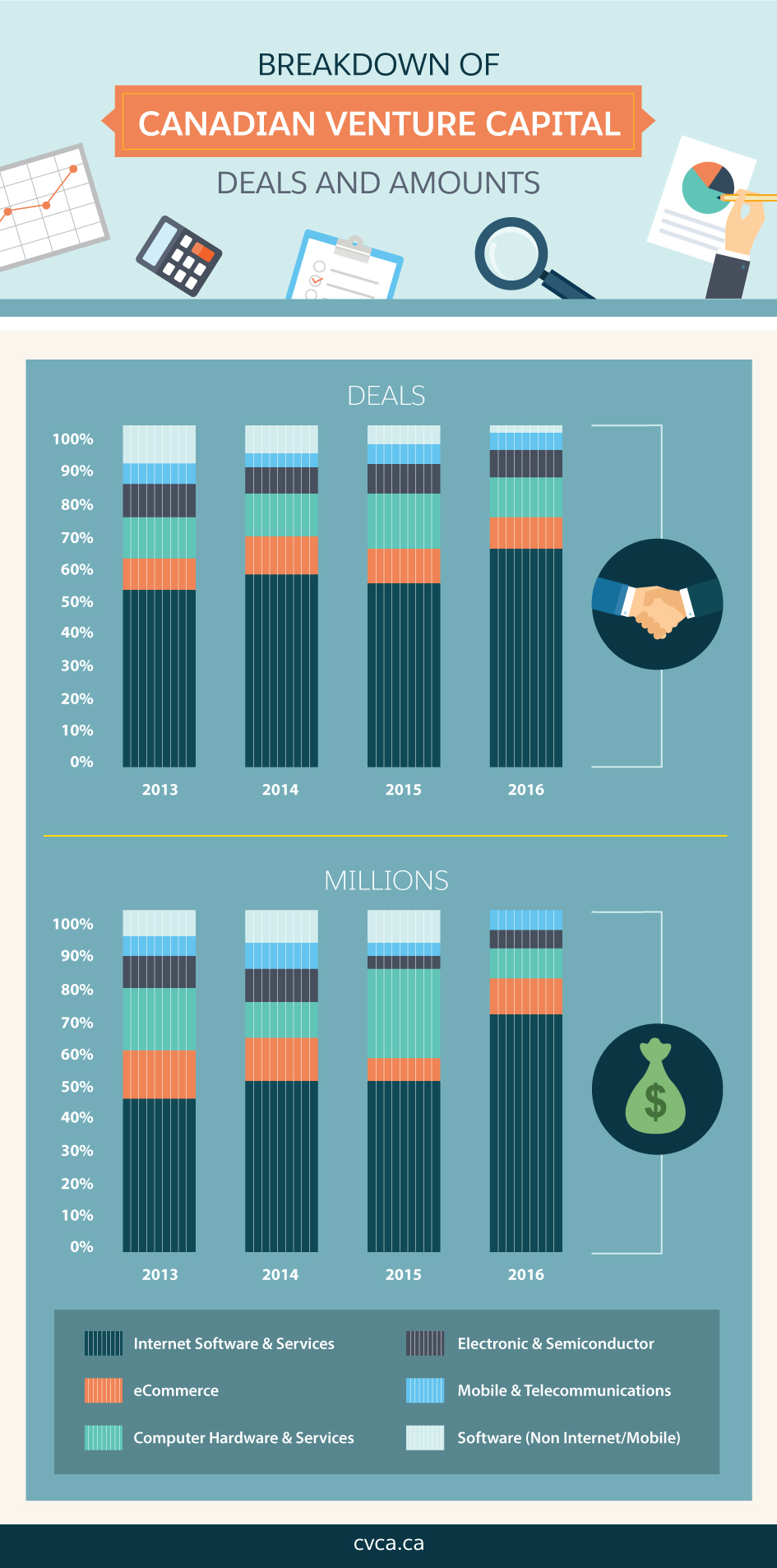

Not all venture capital funds are distributed equally. For example, the number of deals made in 2015 was up 24 per cent compared to 2014, and the amount of funds garnered was up 12 per cent. This suggests a growing trend of small deals over larger ones.

You could make the perfect case for funding, then perfectly execute every step in this guide, and still not get funding. Why? Because in an investor’s experience some deals just pay off better than others. Know where you and your company fit into the landscape.

There are many factors besides your sale pitch that affect your chances of raising funding, including:

- Location: Of the deals that were surveyed in 2015, companies in Ontario scored 42 per cent of all funds. Quebec snagged 31 per cent, British Columbia 20 per cent, and every other province received 5 per cent or less.

- Industry: There were 325 deals in the Information and Communication Technology (ICT) industry, 110 in Life Sciences, 44 in Clean tech, and 20 in Agribusiness.

- Sector: Even within ICT, certain sectors received disproportional amounts: $749 million went to 192 deals in Internet Software and Services, $310 million went to 52 deals in eCommerce, and $102 million went to Electronic and Semiconductor. Other sectors raised less than $100 million each, with 25 or fewer deals brokered.

- Stage: Seed and early stage companies sealed a comparable number of deals, but early stage companies snagged far more dollars—over $1.1 billion versus $154 million. Meanwhile, later stage companies received 78 deals, garnering $530 million in funding.

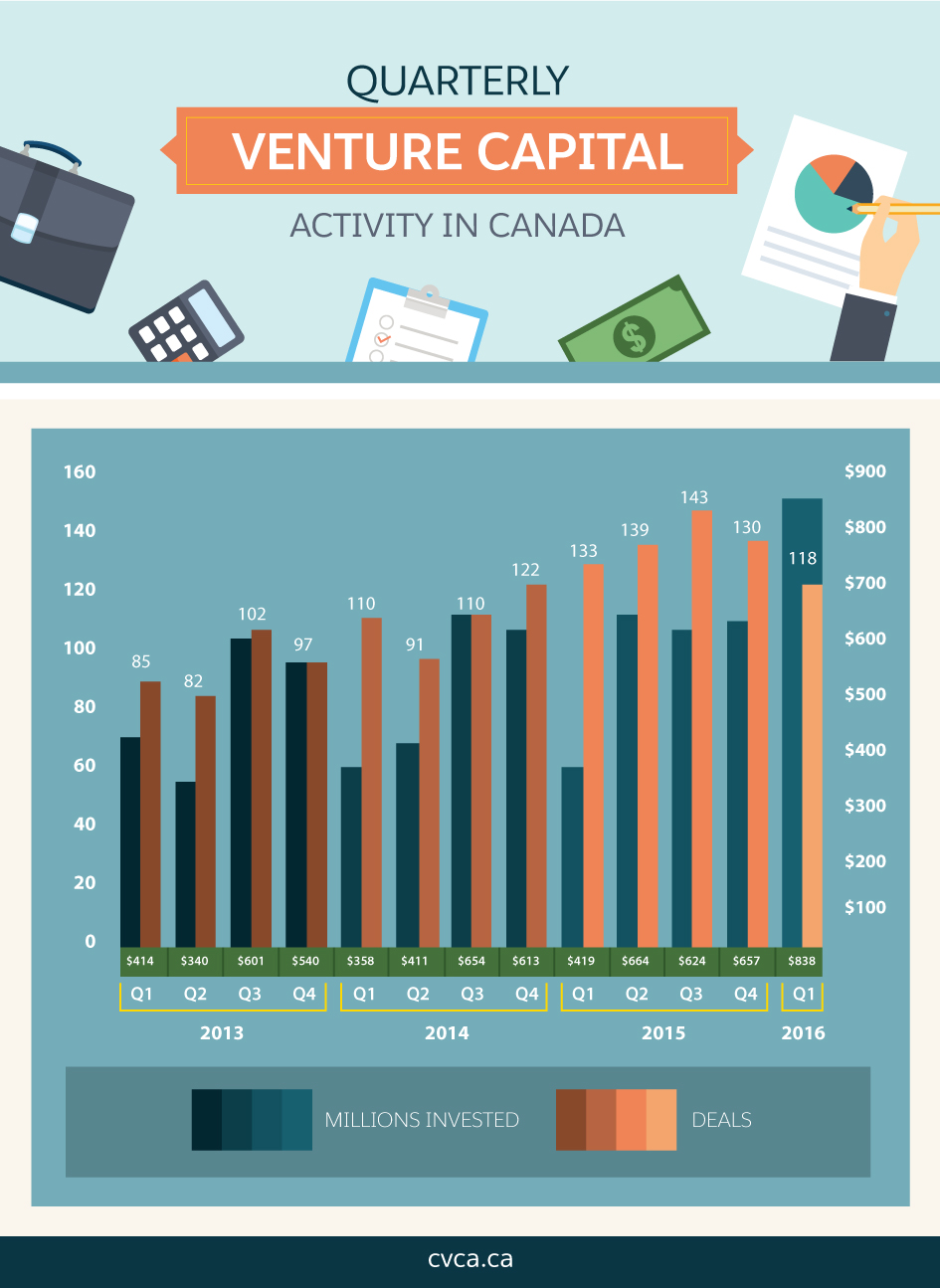

- Timing: In 2015, Q1 saw $419 million in funding, Q2 $651 million, Q3 $615 million, and Q4 $574 million. The year 2014 saw a similar trend.

Breakdown of Canadian Venture Capital Deals and Amounts

Step 3: Play the Game

You know why they say business is all about networking? Because of venture capital. These funds, so critical for so many companies, aren’t won with a good proposal. They’re won with a hard-earned introduction, a good proposal, and spectacular networking.

There will be meetings, lunches, dinners, drinks, golf games, and more—you name it, it’s part of how your investors investigate you. They know that if you pay attention and smooth the way for a deal, you’ll be able to use those skills in the rest of your business endeavors.

The Dating Game

If it feels like you see members of the firm more often than your significant other, you may not be wrong. Raising funds is a lot like dating.

First, you have to find someone you’re interested in. Then it’s time to turn on the charm.

But guess what?

Dating goes both ways.

It’s not just about impressing the firm. The right firm will impress you, too, and not just with the size of its portfolio.

What do they have to offer besides money? The right investor will add crucial industry contacts where you need them most. Don’t have a manufacturer or supplier? Find a firm with connections to both. Do you know your industry, but struggle with other things like marketing or research and development? Your ideal match will have experience developing both.

No Blind Dates!

Just like actual dating, you don’t want to sit through an entire dinner just to find out you two have nothing in common. It’s a waste of your and an investor’s time to surface an opportunity they won’t be remotely interested in.

While it might be tempting to play the odds, don’t go after just any old funding. You’ll gain a reputation for not having anything interesting. Plus, if you’re churning out letters and presentations left and right, you’re stretching yourself too thin. Instead, find the VC firm of your dreams and put everything you have into slam-dunking that campaign.

Step 4: Sealing the Deal

You set your sights on raising venture capital for your company. You’ve pored over the research, knocked the presentation out of the park, and wined and dined partners at your dream firm.

How do you know if it’s working?

The Coveted Term Sheet

Most funds get approved at partner meetings. If the partners vote to move forward with funding, you get a document called a term sheet. When you do, read over it like it’s a contract. It’s not a contract and your funding still isn’t guaranteed, but it’s how you’ll know exactly what you’re getting yourself into. These agreements can be complicated and highly nuanced, so have your lawyer go through yours—thoroughly.

You may want to negotiate pieces of the deal. When (or if) you come to an agreement, you need to sign the term sheet. At this time, funding is still not guaranteed until the actual financing documents are drafted and signed.

Stay Engaged

Just because you’ve gotten a term sheet doesn’t mean it’s a done deal. While you’re in negotiations, continue showing the firm the same attentiveness so they know you’re good with follow-through.

Even after the term sheet is signed, stay with it. Most firms take advantage of the time it takes to draft official documents to conduct another sweep of due diligence. And since you’re a part of that investigation, continue as your wining, dining, meeting-attending self

Quarterly Venture Capital Activity in Canada

Step 5: Get Back Up

Raising venture capital funding is a long and difficult process. It takes a lot of time and resources. The truth is, your efforts may not result in any funding at all.

So what if the unspeakable happens? What if a firm says no? Are you doomed to enter the realm of failed startups, just one more statistic added to the list?

Well, that depends on what you do next. Get back up and try again. Sure, you spent all that time and money going after funding. You lost sleep, you crossed your fingers, you gave it your all. Was it just a waste?

The answer is no—not if you keep going.

When you were doing all that research, did you learn something new about your business or the market? When you delivered your pitch, did you become a better speaker? When you met with investors, did you make a good impression?

Any of these things will help you in your next endeavour, whether that’s seeking funding from another source, changing your strategy, or crumpling up your business plan and starting over. Paul Jones, Chair of the Venture Best group for Michael Best and Friedrich, had this advice for founders:

“One of the great things about being an entrepreneur … you’re supposed to strike out a bunch. You have to be one of those people who realize that if you’re going to hit 714 home runs, you’re probably going to strike out over 1,300 times like Babe Ruth did.”

Share "The Most Important Steps to Take to Raise Venture Capital Funds" On Your Site