Get your FREE 30-day trial.

Start by selecting a product:

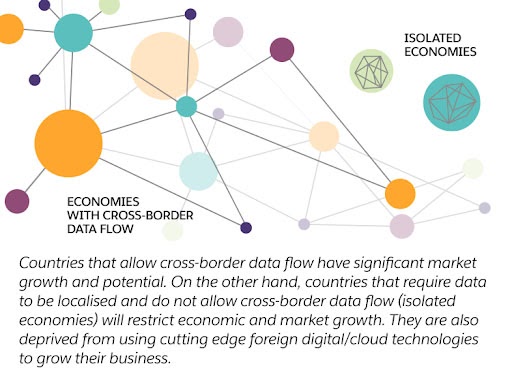

Passing digital information between countries, even though code requires no passport or transportation beyond the internet superhighway, is regulated as if it is a physical commodity. This movement (exchange) of data across borders is typically referred to as cross-border data flow and it has implications for international marketing, banking, and ecommerce in Singapore.

Technologies like artificial intelligence (AI) — which rely on cross-border data flows — are also vital to innovation in business and the growth of the ASEAN economy. McKinsey estimates cross-border data flows account for 3% of global GDP output, the equivalent of SG$3.3 trillion (US$2.3 trillion).

This is why Singapore's recent agreements with the US and Australia to promote cross-border data flow signifies a commitment to open collaboration on policies to protect data privacy. It also enables businesses and consumers to benefit from fewer restrictions on the movement of data.

Many of the business benefits associated with cross-border data flows stem from using global technology at scale and reaching customers in new markets. For example, with cross-border data flow, multinational hotels will be able to collect data from their properties, no matter the geographic location. This is valuable insight they can then use to improve the customer experience. Conversely, restrictions on data can prevent businesses from using affordable technologies, like AI or cloud-based software, that may not have a presence in their market. Antiquated policies regarding cross-border data did not take into account our global and customer-centric world. Without the recent agreements, Singapore-based businesses are vulnerable to negative economic growth.

The recent joint statement on Financial Services Data Connectivity between the Monetary Authority of Singapore (MAS) and the U.S. Department of the Treasury, as well as the Digital Economy Agreement (DEA) between Singapore and Australia have the potential to spur new business opportunities. The DEA is also Singapore’s second economic agreement on cross-border data flows in 2020, after signing the Digital Economy Partnership Agreement (DEPA) with Chile and New Zealand earlier this year.

The recent agreements clarify policy on issues like data localisation.

The joint statement between the Monetary Authority of Singapore (MAS) and the U.S. Department of the Treasury specifically supports cross-border data flows by financial services firms. The agreement recognises the ability to aggregate, store, process, and transmit data across borders is critical to financial sector development. It also makes clear both countries oppose data localisation as long as regulators have access to the data needed for regulatory and supervisory purposes.

The MAS and the U.S. Treasury have also agreed to collaborate and work with other countries to promote a financial services environment that fosters global economy development. In addition, MAS has said it will work with the international community to develop standards to support trust and security for cross-border flows of financial data.

The second agreement was made between Singapore and Australia. The Digital Economy Agreement (DEA) upgrades the digital trade arrangements between the two countries under the Comprehensive and Progressive Trans-Pacific Partnership Agreement (CP-TPP) and the Singapore-Australia Free Trade Agreement (SAFTA).

Similar to the agreement made with the U.S., the DEA will prohibit data localisation requirements to promote the exchange of data and help drive the digital economy. Seven Memoranda of Understandings (MOUs) were signed between the two countries to support the DEA. The MOU on Personal Data Protection recognises and promotes the risk- and accountability-based APEC Cross Border Privacy Rules (CBPR). The APEC CBPR provides a practical, balanced and effective privacy protection mechanism for transferring data across borders.

These agreements and similar policy decisions enacted worldwide not only removes barriers for businesses, but creates new opportunities in the digital economy. This is because cross-border data flow is necessary for businesses who want to access the latest technologies to better serve their customers, reduce costs, improve productivity and scale, and enable digital collaboration around the world. It also catalyses significant economic growth of the country and empowers innovation that can enhance consumers’ lives, from healthcare, finance, education, and social well-being, among others.

Requirements to localise data, erect walls, and draw borders that limit data transfer in the name of data “sovereignty,” “security,” or “privacy,” deprive customers of the benefits of best-in-class technologies to compete in the global market and can impact a country’s overall economic competitiveness. In addition, the high cost of investing in data localisation infrastructure prohibits foreign investments and prevents local technology startups to thrive.

Removing data localisation requirements and allowing cross-border data flow enables businesses to scale using existing infrastructure and trusted suppliers. It also harnesses the benefits of technologies like cloud, Internet of things (IoT), and AI.

It is because of these opportunities for innovation and growth that we are excited about the recent agreements and Singapore’s ongoing negotiations to promote cross-border, fair, interoperable, predictable, and trustworthy digital trade.

Learn more about how we work with governments to unlock innovation.